HSBC 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

Overview Operating & Financial Review Governance Financial Statements Shareholder Information

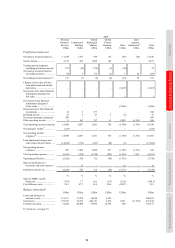

39 The definition of net asset value per share is total shareholders’ equity, less non-cumulative preference shares and capital securities,

divided by the number of ordinary shares in issue.

40 ‘Currency translation’ is the effect of translating the assets and liabilities of subsidiaries and associates for the previous year-end at the

rates of exchange applicable at the current year-end.

Economic profit

41 Expressed as a percentage of average invested capital.

42 Average invested capital is measured as average total shareholders’ equity after:

– adding back the average balance of goodwill amortised pre-transition to IFRSs or subsequently written-off, directly to reserves (less

goodwill previously amortised in respect of the French regional banks sold in 2008);

– deducting the average balance of HSBC’s revaluation surplus relating to property held for own use. This reserve was generated when

determining the deemed carrying cost of such properties on transition to IFRSs and will run down over time as the

properties are sold;

– deducting average preference shares and other equity instruments issued by HSBC Holdings; and

– deducting average reserves for unrealised gains/(losses) on effective cash flow hedges and available-for-sale securities.

43 Return on invested capital is profit attributable to ordinary shareholders of the parent company, which can be found in Note 12 on the

Financial Statements on page 296.

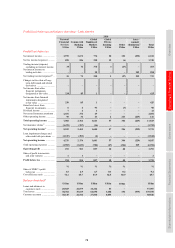

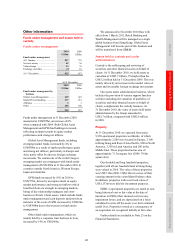

Customer groups and global businesses and Geographical regions

44 The main items reported under ‘Other’ are certain property activities, unallocated investment activities, centrally held investment

companies, gains arising from the dilution of interests in associates, movements in the fair value of own debt designated at fair value

(the remainder of the Group’s gain on own debt is included in GB&M) and HSBC’s holding company and financing operations. The

results also include net interest earned on free capital held centrally, operating costs incurred by the head office operations in providing

stewardship and central management services to HSBC, and costs incurred by the Group Service Centres and Shared Service

Organisations and associated recoveries. At 31 December 2010, there was a US$188m gain arising from the dilution of interests in

associates (2009: nil; 2008: nil) and adverse fair value movements on HSBC’s own debt designated at fair value were US$0.1bn (2009:

US$6.5bn adverse; 2008: US$6.6bn favourable).

45 Assets by geographical region and customer group include intra-HSBC items. These items are eliminated, where appropriate, under the

heading ‘Intra-HSBC items’.

46 Net operating income before loan impairment charges and other credit risk provisions.

47 Loan impairment charges and other credit risk provisions.

48 Share of profit in associates and joint ventures.

49 In the analyses of customer groups and global businesses, net trading income comprises all gains and losses from changes in the fair

value of financial assets and financial liabilities classified as held for trading, together with related external and internal interest

income and interest expense, and dividends received; in the statutory presentation internal interest income and expense are eliminated.

50 In 2010, Global Markets included a favourable fair value movement of US$23m on the widening of credit spreads on structured

liabilities (2009: adverse fair value movement of US$444m; 2008: favourable fair value movement of US$529m).

51 Total income earned on securities services products in the Group amounted to US$1.5bn (2009: US$1.4bn; 2008: US$2.2bn), of which

US$1.5bn was in GB&M (2009: US$1.4bn; 2008: US$2.1bn) and US$29m was in CMB (2009: US$19m; 2008: US$45m).

52 Total income earned on payments and cash management products in the Group amounted to US$4.4bn (2009: US$4.1bn; 2008:

US$5.8bn), of which US$3.3bn was in CMB (2009: US$3.1bn; 2008: US$4.1bn) and US$1.1bn was in GB&M (2009: US$1.1bn; 2008:

US$1.7bn).

53 Total income earned on other transaction services in the Group amounted to US$2.3bn (2009: US$1.8bn; 2008: US$1.8bn), of which

US$1.6bn was in CMB relating to trade and supply chain (2009: US$1.3bn; 2008: US$1.3bn) and US$636m was in GB&M of which

US$523m related to trade and supply chain (2009: US$382m; 2008: US$355m) and US$113m related to banknotes and other (2009:

US$125m; 2008: US$126m).

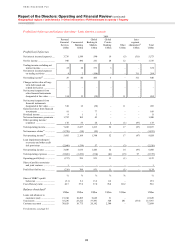

54 In each Group entity, Balance Sheet Management is responsible for managing liquidity and funding under the supervision of the local

ALCO. Balance Sheet Management also manages the structural interest rate position of the entity within a Global Markets limit

structure.

55 ‘Other’ in GB&M includes net interest earned on free capital held in the global business not assigned to products.

56 Inter-segment elimination comprises (i) the costs of shared services and Group Service Centres included within ‘Other’ which are

recovered from customer groups, and (ii) the intra-segment funding costs of trading activities undertaken within GB&M. HSBC’s

Balance Sheet Management business, reported within GB&M, provides funding to the trading businesses. To report GB&M’s ‘Net

trading income’ on a fully funded basis, ‘Net interest income’ and ‘Net interest income/(expense) on trading activities’ are grossed up to

reflect internal funding transactions prior to their elimination in the inter-segment column.

57 Net insurance claims incurred and movement in liabilities to policyholders.

58 ‘Employee expenses’ comprises costs directly incurred by each customer group. The reallocation and recharging of employee and other

expenses directly incurred in the ‘Other’ customer group is shown in ‘Other operating expenses’.

59 RWAs are non-additive across geographical regions due to market risk diversification effects within the Group.

60 France primarily comprises the domestic operations of HSBC France, HSBC Assurances Vie and the Paris branch of HSBC Bank plc.

61 Hong Kong Government certificates of indebtedness were reclassified from PFS to ‘Other’ at 1 January 2010.

62 US includes the impairment of goodwill in respect of PFS – North America.