HSBC 2010 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Report of the Directors: Operating and Financial Review

Financial summary > Reconciliation of profit before tax

14

Financial summary

Page

Reconciliation of reported and underlying profit

before tax .................................................................. 14

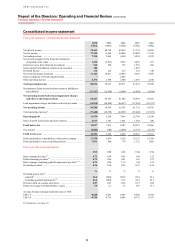

Consolidated income statement .................................... 16

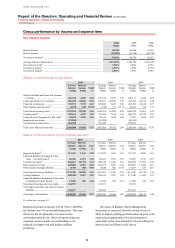

Group performance by income and expense item ........ 18

Net interest income ................................................... 18

Net fee income .......................................................... 19

Net trading income ................................................... 20

Net income from financial instruments designated

at fair value .......................................................... 21

Gains less losses from financial investments ........... 22

Net earned insurance premiums .............................. 22

Other operating income ........................................... 23

Page

Net insurance claims incurred and movement in

liabilities to policyholders .................................... 24

Loan impairment charges and other credit risk

provisions ............................................................. 24

Operating expenses .................................................. 26

Share of profit in associates and joint ventures ....... 28

Tax expense .............................................................. 28

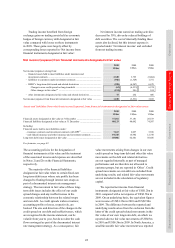

Consolidated balance sheet ........................................... 29

Movement in 2010 .................................................... 30

Economic profit ............................................................ 32

Critical accounting policies .......................................... 33

The management commentary included in the Report of the Directors: ‘Overview’ and ‘Operating and Financial Review’, together with the

‘Employees’ and ‘Corporate sustainability’ sections of ‘Governance’ and the ‘Directors’ Remuneration Report’ is presented in compliance

with the IFRS Practice Statement Management Commentary issued by the IASB.

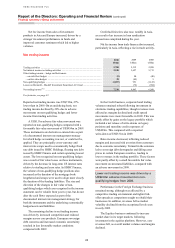

Reconciliation of reported and

underlying profit before tax

We measure our performance internally on a like-

for-like basis by eliminating the effects of foreign

currency translation differences, acquisitions and

disposals of subsidiaries and businesses, and fair

value movements on own debt attributable to credit

spread where the net result of such movements will

be zero upon maturity of the debt; all of which

distort year-on-year comparisons. We refer to this

as our underlying performance.

Reported results include the effects of the above

items. They are excluded when monitoring progress

against operating plans and past results because

management believes that the underlying basis more

accurately reflects operating performance.

Constant currency

Constant currency comparatives for 2009 referred to in the

commentaries are computed by retranslating into US dollars

for non-US dollar branches, subsidiaries, joint ventures and

associates:

• the income statements for 2009 at the average rates of

exchange for 2010; and

• the balance sheet at 31 December 2009 at the prevailing

rates of exchange on 31 December 2010.

No adjustment has been made to the exchange rates used to

translate foreign currency denominated assets and liabilities

into the functional currencies of any HSBC branches,

subsidiaries, joint ventures or associates. When reference is

made to ‘constant currency’ in tables or commentaries,

comparative data reported in the functional currencies of

HSBC’s operations have been translated at the appropriate

exchange rates applied in the current period on the basis

described above.

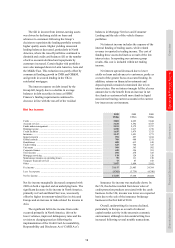

Underlying performance

The tables below compare our underlying

performance in 2010 and 2009 with reported profits

in those years.

The foreign currency translation differences

reflect the relative strengthening of the US dollar

against the euro and sterling, which offset its relative

weakness against currencies in Asia, Mexico and

Brazil during 2010.

The following acquisitions and disposals

affected both comparisons:

• the acquisition of PT Bank Ekonomi Raharja

Tbk (‘Bank Ekonomi’) in May 2009;

• the gain on sale of our 49% interest in a joint

venture for a UK merchant acquiring business in

June 2009 of US$280m;

• the gain of US$62m on reclassification of Bao

Viet Holdings (‘Bao Viet’) from an available-

for-sale asset to an associate in January 2010;

• the gain on sale of our stake in Wells Fargo

HSBC Trade Bank in March 2010 of US$66m;

• the gain on disposal of HSBC Insurance Brokers

Limited of US$107m in April 2010;

• the dilution gain of US$188m which arose

on our holding in Ping An Insurance (Group)

Company of China, Limited (‘Ping An

Insurance’) following the issue of shares by the

company in May 2010;

• the loss of US$42m on the completion of the

sale of our investment in British Arab

Commercial Bank plc in October 2010;

• the gain on sale of Eversholt Rail Group of

US$255m in December 2010; and

• the gain of US$74m on the deconsolidation of

private equity funds following the management

buy-out of Headland Capital Partners Ltd

(formally known as HSBC Private Equity (Asia)

Ltd) in November 2010.