HSBC 2010 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Directors’ Remuneration Report (continued)

Remuneration Committee – members and advisers / Overall principles / Executive Directors’ remuneration

222

Remuneration Committee –

members and advisers

The Committee meets regularly to consider human

resource issues relating to terms and conditions of

employment, remuneration and retirement benefits.

Within the authority delegated by the Board, the

Committee is responsible for approving

remuneration policy and in doing so takes into

account the pay and conditions across our Group.

This includes the terms of bonus plans, share plans,

other long-term incentive plans and the individual

remuneration packages of executive Directors and

other senior Group employees, including all in

positions of significant influence and those having

an impact on our risk profile. No Directors are

involved in deciding their own remuneration.

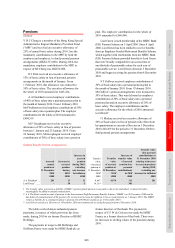

The members of the Committee during 2010

were J D Coombe, W S H Laidlaw, G Morgan and

J L Thornton. Sir Mark Moody-Stuart retired as a

Director of HSBC Holdings and ceased to be a

member and chairman of the Committee on 28 May

2010. J L Thornton was appointed chairman on

28 May 2010.

There were nine meetings of the Committee

during 2010. The table on page 190 gives details of

Directors’ attendance at these meetings. Following

each meeting the Committee reports to the Board on

its activities. The terms of reference of the

Committee are available at

www.hsbc.com/boardcommittees.

The Committee received independent advice on

executive remuneration issues from Deloitte LLP

and remuneration data from Towers Watson. Each of

these firms also provided other consulting services to

various parts of the Group. Other consultants are

used from time to time to advise on specific issues.

Going forward, the Committee has agreed to use

advisers only as and when required and that these

would be separate from the Company’s advisers.

During the year, the Group Chief Executive provided

regular briefings to the Committee and the

Committee received advice from the Group

Managing Director, Human Resources, A Almeida,

the Head of Group Performance and Reward,

T Roberts and B Robertson, then the Group Chief

Risk Officer.

Overall principles

Our global reward strategy provides a framework for

the Committee to carry out its responsibilities during

the year.

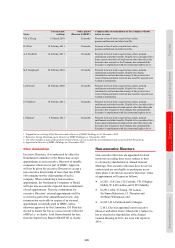

HSBC reward strategy How achieved

A rounded approach to

measuring performance

• We assess performance with reference to clear and relevant objectives set within a holistic balanced

scorecard framework. Under this framework, objectives are set under four categories – financial, process

(including risk mitigation), customer and people. Significant importance is given to the achievement of

efficiency and risk objectives as well as financial objectives. Objectives relating to customer development

and the productivity of our human capital are key to sustained financial performance and the development

of the Group over the short and medium term.

A focus on total

remuneration with variable

pay differentiated by

performance

• Reward is delivered through a combination of fixed and variable pay (salary, bonus, other long-term

incentives). The variable pay element is differentiated by performance over both the short and long-term.

The performance-related elements of pay comprise a material proportion of the total remuneration package

for executive Directors, whilst maintaining an appropriate balance between fixed and variable elements.

Remuneration is structured to provide an opportunity for market top quartile total remuneration for higher

levels of market referenced performance.

Aligning individual rewards

with Group performance and

shareholders

• A significant proportion of variable pay is deferred into, predominantly, awards of HSBC Holdings

Restricted Shares to align recipients to the future performance of the Group and to retain key talent. For

Code Staff (as defined under FSA rules) 50% of deferred variable pay is delivered in the form of deferred

cash.

• Executive Directors and other senior executives are subject to share ownership guidelines.

Competitive and cost

effective packages to attract

and retain staff

• A total remuneration package (salary, bonus, long-term incentives and other benefits) which is competitive

in relation to comparable organisations in each of the markets in which we operate.

Effective management of

risk

• Discretion is used in order to assess the extent to which performance has been achieved, rather than

applying a formulaic approach which, by its nature, may encourage inappropriate risk taking.

• Performance is assessed taking risk into account using a combination of quantitative and qualitative

measures as informed by the risk appetite framework.

• Affordability is assessed (including the cost and quantity of capital and liquidity considerations).

• All Restricted Share awards made from 2010 onwards are, prior to vesting, subject to clawback as are

deferred cash awards made from 2011 onwards.

Stakeholder interest • Consideration of shareholder interests together with consideration of the wider environment and societal

aspects.

• Consideration of the pay and employment conditions of the Group’s employees compared to its Directors

and senior executives.