HSBC 2010 Annual Report Download - page 242

Download and view the complete annual report

Please find page 242 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Statements (continued)

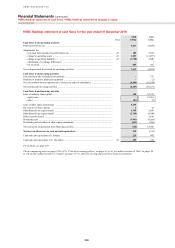

Consolidated balance sheet / Consolidated statement of cash flows

240

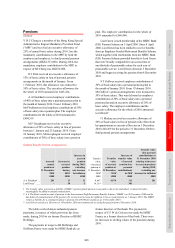

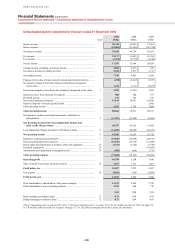

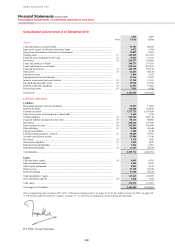

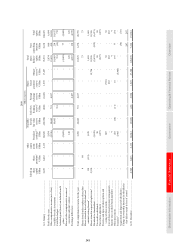

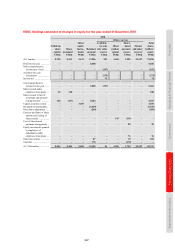

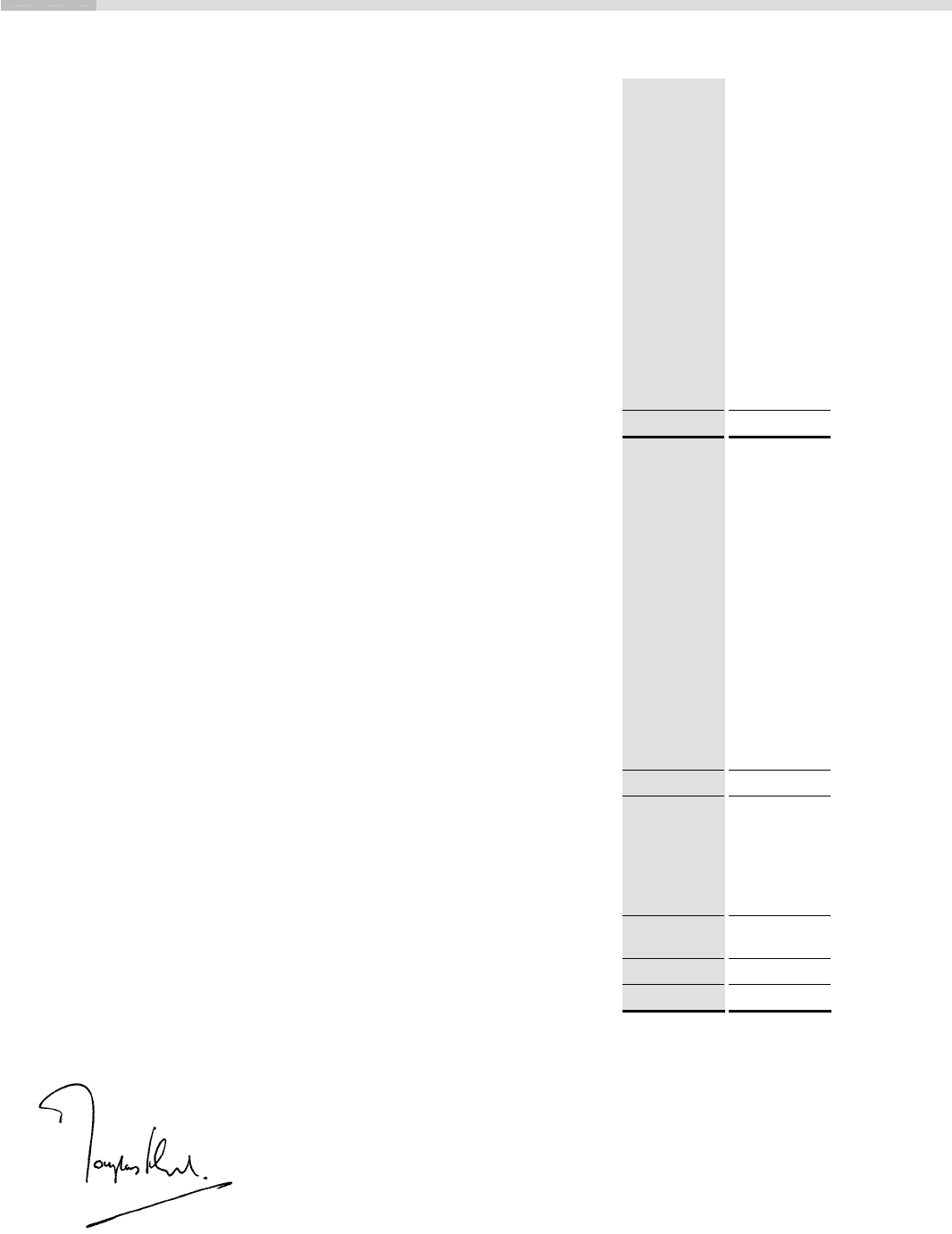

Consolidated balance sheet at 31 December 2010

2010 2009

Notes US$m US$m

Assets

Cash and balances at central banks ............................................................................................... 57,383 60,655

Items in the course of collection from other banks ....................................................................... 6,072 6,395

Hong Kong Government certificates of indebtedness .................................................................. 19,057 17,463

Trading assets ................................................................................................................................ 15 385,052 421,381

Financial assets designated at fair value ....................................................................................... 19 37,011 37,181

Derivatives ..................................................................................................................................... 20 260,757 250,886

Loans and advances to banks ........................................................................................................ 208,271 179,781

Loans and advances to customers ................................................................................................. 958,366 896,231

Financial investments .................................................................................................................... 21 400,755 369,158

Other assets .................................................................................................................................... 27 43,251 44,534

Current tax assets ........................................................................................................................... 1,096 2,937

Prepayments and accrued income ................................................................................................. 11,966 12,423

Interests in associates and joint ventures ...................................................................................... 23 17,198 13,011

Goodwill and intangible assets ...................................................................................................... 24 29,922 29,994

Property, plant and equipment ....................................................................................................... 25 11,521 13,802

Deferred tax assets ......................................................................................................................... 10 7,011 8,620

Total assets .................................................................................................................................... 2,454,689 2,364,452

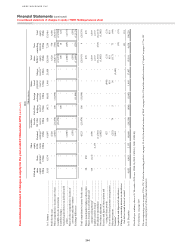

Liabilities and equity

Liabilities

Hong Kong currency notes in circulation ..................................................................................... 19,057 17,463

Deposits by banks .......................................................................................................................... 110,584 124,872

Customer accounts ......................................................................................................................... 1,227,725 1,159,034

Items in the course of transmission to other banks ....................................................................... 6,663 5,734

Trading liabilities ........................................................................................................................... 28 300,703 268,130

Financial liabilities designated at fair value .................................................................................. 29 88,133 80,092

Derivatives ..................................................................................................................................... 20 258,665 247,646

Debt securities in issue .................................................................................................................. 30 145,401 146,896

Other liabilities .............................................................................................................................. 31 28,050 68,640

Current tax liabilities ..................................................................................................................... 1,804 2,140

Liabilities under insurance contracts ............................................................................................. 32 58,609 53,707

Accruals and deferred income ....................................................................................................... 13,906 13,190

Provisions ...................................................................................................................................... 33 2,138 1,965

Deferred tax liabilities ................................................................................................................... 10 1,093 1,837

Retirement benefit liabilities ......................................................................................................... 7 3,856 6,967

Subordinated liabilities .................................................................................................................. 34 33,387 30,478

Total liabilities ............................................................................................................................... 2,299,774 2,228,791

Equity

Called up share capital ................................................................................................................... 39 8,843 8,705

Share premium account ................................................................................................................. 8,454 8,413

Other equity instruments ............................................................................................................... 5,851 2,133

Other reserves ................................................................................................................................ 27,169 22,236

Retained earnings .......................................................................................................................... 97,350 86,812

Total shareholders’ equity ............................................................................................................. 147,667 128,299

Non-controlling interests ............................................................................................................... 38 7,248 7,362

Total equity .................................................................................................................................... 154,915 135,661

Total equity and liabilities ............................................................................................................. 2,454,689 2,364,452

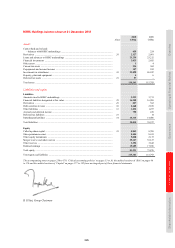

The accompanying notes on pages 250 to 370, ‘Critical accounting policies’ on pages 33 to 36, the audited sections of ‘Risk’ on pages 86

to 176 and the audited sections of ‘Capital’ on pages 177 to 182 form an integral part of these financial statements.

D J Flint, Group Chairman