HSBC 2010 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Report of the Directors: Operating and Financial Review (continued)

Risk > Credit risk > Credit exposure / Areas of special interest > Wholesale lending

102

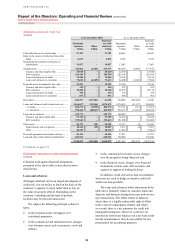

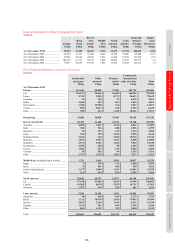

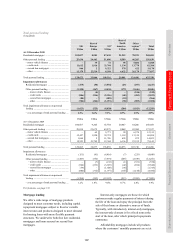

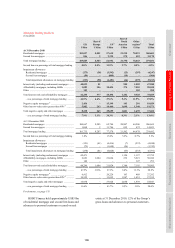

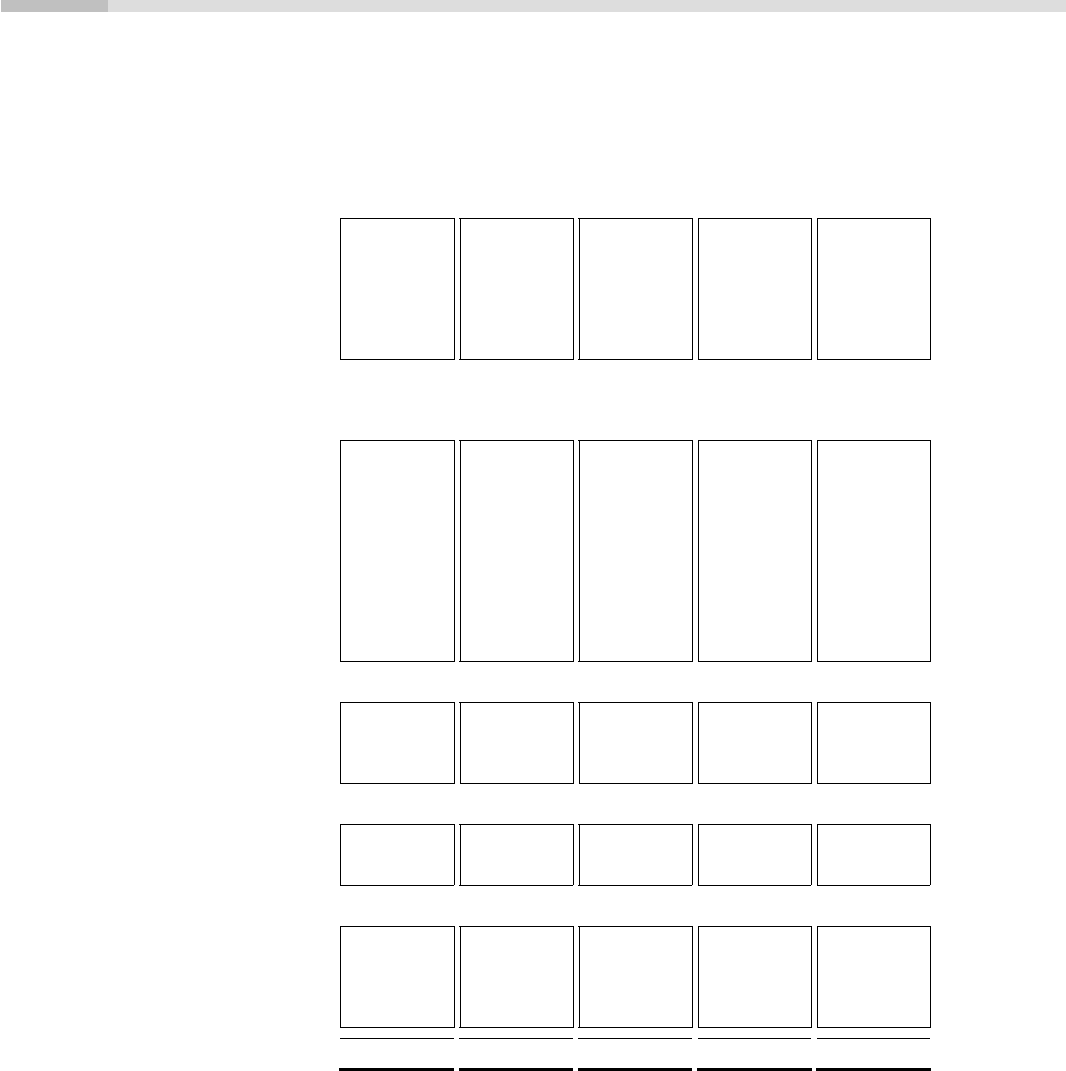

Gross loans and advances to customers by country (continued)

Residential

mortgages

US$m

Other

personal

US$m

Property-

related

US$m

Commercial,

international

trade and other

US$m

Total

US$m

At 31 December 2009

Europe ............................................................. 109,872 52,690 40,084 242,970 445,616

UK ................................................................... 100,667 29,018 28,339 175,513 333,537

France ............................................................. 4,326 10,224 9,429 48,570 72,549

Germany ......................................................... 10 404 90 3,689 4,193

Malta ............................................................... 1,730 612 660 1,689 4,691

Switzerland ..................................................... 1,301 9,197 175 1,413 12,086

Turkey ............................................................. 843 2,778 150 2,490 6,261

Other ............................................................... 995 457 1,241 9,606 12,299

Hong Kong ..................................................... 35,292 12,654 23,844 28,395 100,185

Rest of Asia-Pacific ........................................ 21,983 10,531 10,338 38,187 81,039

Australia .......................................................... 5,919 993 1,785 3,496 12,193

India ................................................................ 883 864 458 3,002 5,207

Indonesia ......................................................... 59 571 71 2,114 2,815

Japan ............................................................... 109 149 796 1,444 2,498

Mainland China .............................................. 1,503 319 2,633 8,915 13,370

Malaysia .......................................................... 2,925 1,717 1,085 3,548 9,275

Singapore ........................................................ 5,149 3,041 2,407 4,251 14,848

South Korea .................................................... 2,093 407 30 1,932 4,462

Taiwan ............................................................ 2,205 503 53 1,578 4,339

Vietnam ........................................................... 23 132 51 1,042 1,248

Other ............................................................... 1,115 1,835 969 6,865 10,784

Middle East (excluding Saudi Arabia) ........... 1,898 4,507 2,666 15,151 24,222

Egypt ............................................................... 4 326 126 2,132 2,588

Qatar ............................................................... 9 624 416 841 1,890

United Arab Emirates ..................................... 1,650 2,881 1,395 8,848 14,774

Other ............................................................... 235 676 729 3,330 4,970

North America ................................................ 86,591 77,343 19,979 36,616 220,529

US ................................................................... 65,784 69,275 8,922 25,747 169,728

Canada ............................................................ 19,228 7,526 10,641 10,339 47,734

Bermuda .......................................................... 1,579 542 416 530 3,067

Latin America ................................................. 5,033 15,812 2,998 26,339 50,182

Argentina ........................................................ 31 628 49 1,689 2,397

Brazil ............................................................... 717 10,494 1,076 12,111 24,398

Mexico ............................................................ 2,259 2,702 995 6,762 12,718

Panama ............................................................ 1,151 973 475 3,464 6,063

Other ............................................................... 875 1,015 403 2,313 4,606

Total ................................................................ 260,669 173,537 99,909 387,658 921,773

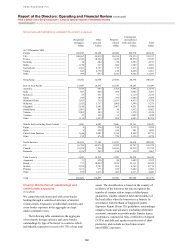

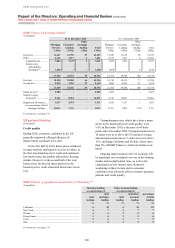

Country distribution of outstandings and

cross-border exposures

(Unaudited)

We control the risk associated with cross-border

lending through a centralised structure of internal

country limits. Exposures to individual countries and

cross-border exposure in the aggregate are kept

under continual review.

The following table summarises the aggregate

of in-country foreign currency and cross-border

outstandings by type of borrower to countries which

individually represent in excess of 0.75% of our total

assets. The classification is based on the country of

residence of the borrower but also recognises the

transfer of country risk in respect of third-party

guarantees, eligible collateral held and residence of

the head office when the borrower is a branch. In

accordance with the Bank of England Country

Exposure Report (Form CE) guidelines, outstandings

comprise loans and advances (excluding settlement

accounts), amounts receivable under finance leases,

acceptances, commercial bills, certificates of deposit

(‘CD’s) and debt and equity securities (net of short

positions), and exclude accrued interest and

intra-HSBC exposures.