HSBC 2010 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

153

Overview Operating & Financial Review Governance Financial Statements Shareholder Information

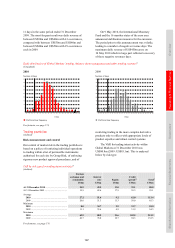

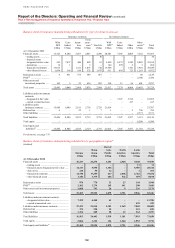

The interest rate sensitivities tabulated above

are illustrative only and are based on simplified

scenarios. The figures represent the effect of pro

forma movements in net interest income based on our

projected yield curve scenarios, HSBC Holdings’

current interest rate risk profile and assumed changes

to that profile during the next five years. Changes to

assumptions concerning the risk profile over the next

five years can have a significant impact on the net

interest income sensitivity for that period. The figures

do not take into account the effect of actions that could

be taken to mitigate this interest rate risk, however.

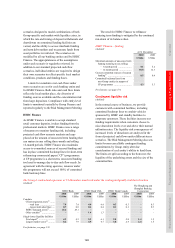

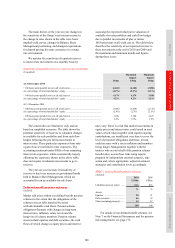

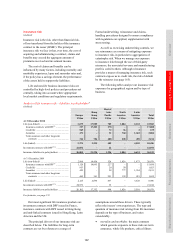

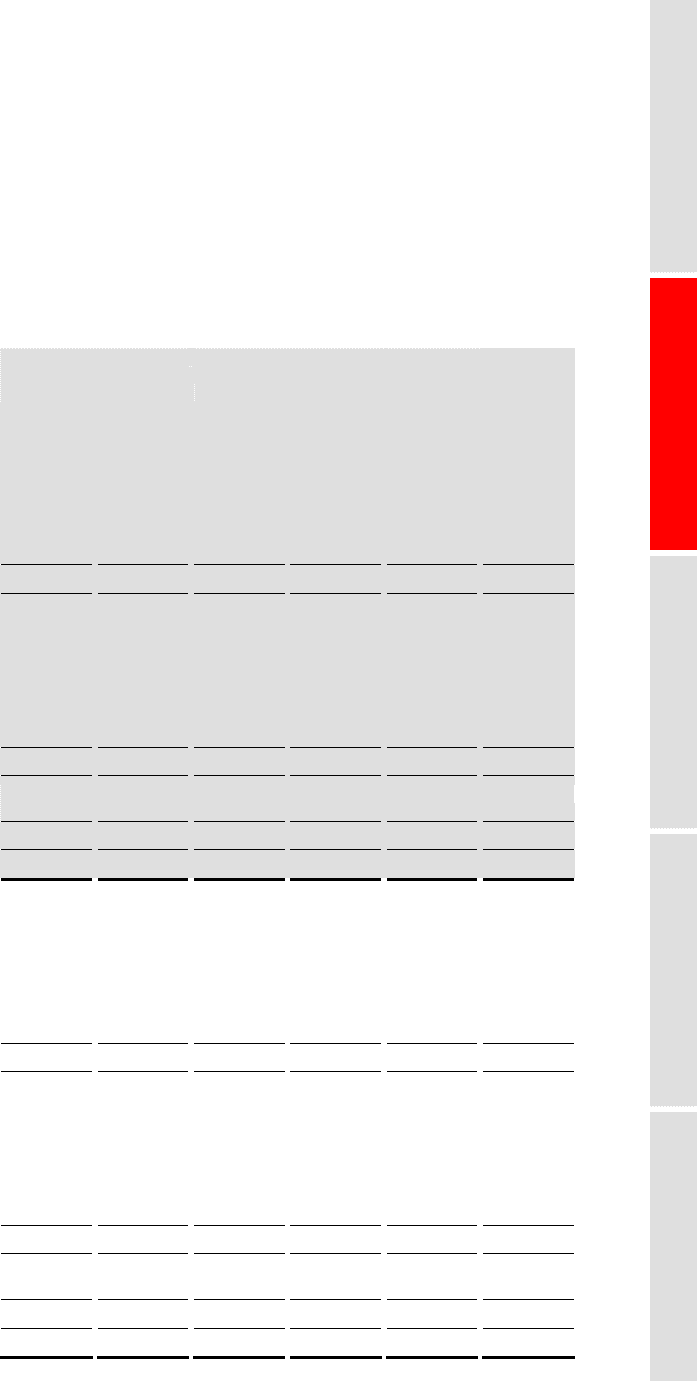

Interest repricing gap table

The interest rate risk on the fixed-rate securities

issued by HSBC Holdings is not included within the

Group VAR but is managed on a repricing gap basis.

The interest rate repricing gap table below analyses

the full term structure of interest rate mismatches

within HSBC Holdings’ balance sheet. The year-on-

year movement in the repricing gap was mainly due

to the refinancing of maturing interest bearing

capital liabilities with perpetual fixed rate issues.

Repricing gap analysis of HSBC Holdings

(Audited)

Total

Up to

1 year 1-5 years 5-10 years

More than

10 years

Non-

interest

bearing

US$m US$m US$m US$m US$m US$m

At 31 December 2010

Cash at bank and in hand:

– balances with HSBC undertakings .............. 459 339 – – – 120

Derivatives .......................................................... 2,327 – – – – 2,327

Loans and advances to HSBC undertakings ...... 21,238 19,351 – 290 605 992

Financial investments ......................................... 2,025 – 300 900 731 94

Investments in subsidiaries ................................. 92,899 1,785 875 1,164 – 89,075

Other assets ......................................................... 393 – – – – 393

Total assets .......................................................... 119,341 21,475 1,175 2,354 1,336 93,001

Amounts owed to HSBC undertakings .............. (2,932) (2,266) – – – (666)

Financial liabilities designated at fair values ..... (16,288) – (7,184) (4,740) (3,509) (855)

Derivatives .......................................................... (827) – – – – (827)

Debt securities in issue ....................................... (2,668) – (1,664) – (1,004) –

Other liabilities ................................................... (1,232) – – – – (1,232)

Subordinated liabilities ....................................... (13,313) (750) (1,579) (2,140) (8,680) (164)

Total equity ......................................................... (81,331) – – (7,450) – (73,881)

Other non-interest bearing liabilities .................. (750) – – – – (750)

Total liabilities and equity .................................. (119,341) (3,016) (10,427) (14,330) (13,193) (78,375)

Off-balance sheet items attracting interest rate

sensitivity ........................................................ – (15,302) 7,221 4,403 3,409 269

Net interest rate risk gap ..................................... – 3,157 (2,031) (7,573) (8,448) 14,895

Cumulative interest rate gap ............................... – 3,157 1,126 (6,447) (14,895) –

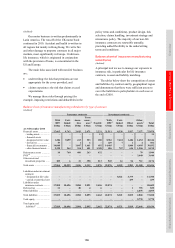

At 31 December 2009

Cash at bank and in hand:

– balances with HSBC undertakings .............. 224 224 – – – –

Derivatives .......................................................... 2,981 – – – – 2,981

Loans and advances to HSBC undertakings ...... 23,212 16,980 3,084 – 1,896 1,252

Financial investments ......................................... 2,455 – – 300 1,610 545

Investments in subsidiaries ................................. 86,247 1,866 1,217 – 875 82,289

Other assets ......................................................... 674 – – – – 674

Total assets .......................................................... 115,793 19,070 4,301 300 4,381 87,741

Amounts owed to HSBC undertakings .............. (3,711) (2,898) – – – (813)

Financial liabilities designated at fair values ..... (16,909) – (6,108) (5,017) (5,015) (769)

Derivatives .......................................................... (362) – – – – (362)

Debt securities in issue ....................................... (2,839) – (1,784) – (1,055) –

Other liabilities ................................................... (1,257) – – – – (1,257)

Subordinated liabilities ....................................... (14,406) (2,850) (865) (3,117) (7,382) (192)

Total equity ......................................................... (75,876) – – – (3,650) (72,226)

Other non-interest bearing liabilities .................. (433) – – – – (433)

Total liabilities and equity .................................. (115,793) (5,748) (8,757) (8,134) (17,102) (76,052)

Off-balance sheet items attracting interest rate

sensitivity ........................................................ – (15,302) 6,275 6,306 4,051 (1,330)

Net interest rate risk gap ..................................... – (1,980) 1,819 (1,528) (8,670) 10,359

Cumulative interest rate gap ............................... – (1,980) (161) (1,689) (10,359) –