HSBC 2010 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2010 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

Overview Operating & Financial Review Governance Financial Statements Shareholder Information

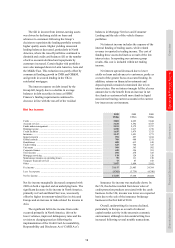

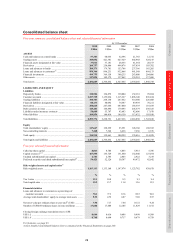

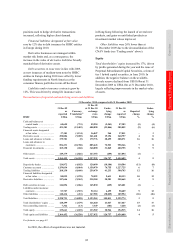

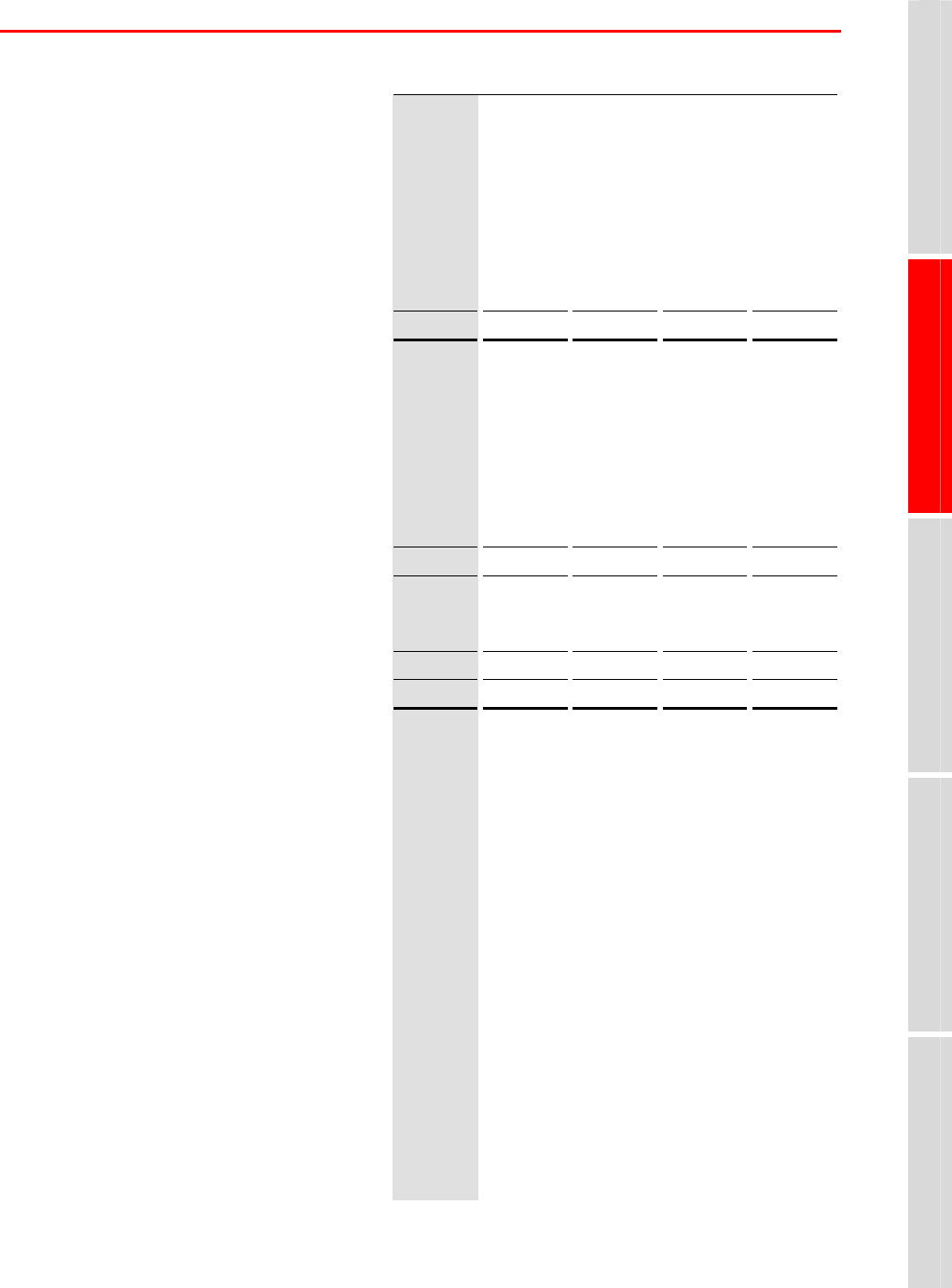

Consolidated balance sheet

Five-year summary consolidated balance sheet and selected financial information

At 31 December

2010

US$m

2009

US$m

2008

US$m

2007

US$m

2006

US$m

ASSETS

Cash and balances at central banks ............................................. 57,383 60,655 52,396 21,765 12,732

Trading assets .............................................................................. 385,052 421,381 427,329 445,968 328,147

Financial assets designated at fair value ..................................... 37,011 37,181 28,533 41,564 20,573

Derivatives ................................................................................... 260,757 250,886 494,876 187,854 103,702

Loans and advances to banks ...................................................... 208,271 179,781 153,766 237,366 185,205

Loans and advances to customers35 ............................................. 958,366 896,231 932,868 981,548 868,133

Financial investments .................................................................. 400,755 369,158 300,235 283,000 204,806

Other assets .................................................................................. 147,094 149,179 137,462 155,201 137,460

Total assets .................................................................................. 2,454,689 2,364,452 2,527,465 2,354,266 1,860,758

LIABILITIES AND EQUITY

Liabilities

Deposits by banks ........................................................................ 110,584 124,872 130,084 132,181 99,694

Customer accounts ....................................................................... 1,227,725 1,159,034 1,115,327 1,096,140 896,834

Trading liabilities ......................................................................... 300,703 268,130 247,652 314,580 226,608

Financial liabilities designated at fair value ................................ 88,133 80,092 74,587 89,939 70,211

Derivatives ................................................................................... 258,665 247,646 487,060 183,393 101,478

Debt securities in issue ................................................................ 145,401 146,896 179,693 246,579 230,325

Liabilities under insurance contracts ........................................... 58,609 53,707 43,683 42,606 17,670

Other liabilities ............................................................................ 109,954 148,414 149,150 113,432 103,010

Total liabilities ............................................................................. 2,299,774 2,228,791 2,427,236 2,218,850 1,745,830

Equity

Total shareholders’ equity ........................................................... 147,667 128,299 93,591 128,160 108,352

Non-controlling interests ............................................................. 7,248 7,362 6,638 7,256 6,576

Total equity .................................................................................. 154,915 135,661 100,229 135,416 114,928

Total equity and liabilities ........................................................... 2,454,689 2,364,452 2,527,465 2,354,266 1,860,758

Five-year selected financial information

Called up share capital ................................................................. 8,843 8,705 6,053 5,915 5,786

Capital resources36,37 .................................................................... 167,555 155,729 131,460 152,640 127,074

Undated subordinated loan capital .............................................. 2,781 2,785 2,843 2,922 3,219

Preferred securities and dated subordinated loan capital38 ......... 54,421 52,126 50,307 49,472 42,642

Risk weighted assets and capital ratios36

Risk weighted assets .................................................................... 1,103,113 1,133,168 1,147,974 1,123,782 938,678

% % % % %

Tier 1 ratio ................................................................................... 12.1 10.8 8.3 9.3 9.4

Total capital ratio ......................................................................... 15.2 13.7 11.4 13.6 13.5

Financial statistics

Loans and advances to customers as a percentage of

customer accounts ................................................................... 78.1 77.3 83.6

89.5 96.8

Average total shareholders’ equity to average total assets ......... 5.53 4.72 4.87 5.69 5.97

Net asset value per ordinary share at year-end39 (US$) .............. 7.94 7.17 7.44 10.72 9.24

Number of US$0.50 ordinary shares in issue (millions) ............. 17,686 17,408 12,105 11,829 11,572

Closing foreign exchange translation rates to US$:

US$1: £ ........................................................................................ 0.644 0.616 0.686 0.498 0.509

US$1: € ........................................................................................ 0.748 0.694 0.717 0.679 0.759

For footnotes, see page 83.

A more detailed consolidated balance sheet is contained in the Financial Statements on page 240.