HSBC 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

Overview Operating & Financial Review Corporate Governance Financial Statements Shareholder Information

Accounting for deferred bonus arrangements

Recent regulatory and best practice guidance has

clarified the required structure and terms of deferred

bonus arrangements awarded to employees, who

now have a better understanding of the likely nature

of awards to be granted in respect of a particular

financial year. As a result, the vesting period in

respect of deferred awards expected to be granted in

March 2012 is therefore determined to have started

on 1 January 2011. An additional expense of

US$163m in respect of these deferred awards was

recognised in ‘Operating expenses’ during 2011.

Footnotes to pages 2 to 93

Financial highlights

1 Dividends recorded in the financial statements are dividends per ordinary share declared in a year and are not dividends in respect of,

or for, that year. The third interim dividend for 2010 of US$0.08 was paid on 12 January 2011. The fourth interim dividend for 2010 of

US$0.12 was paid on 5 May 2011. First, second and third interim dividends for 2011, each of US$0.09 per ordinary share, were paid on

6 July 2011, 6 October 2011 and 18 January 2012, respectively. Note 11 on the Financial Statements provides more information on the

dividends declared in 2011. On 27 February 2012 the Directors declared a fourth interim dividend for 2011 of US$0.14 per ordinary

share in lieu of a final dividend, which will be payable to ordinary shareholders on 2 May 2012 in cash in US dollars, or in pounds

sterling or Hong Kong dollars at exchange rates to be determined on 23 April 2012, with a scrip dividend alternative. The reserves

available for distribution at 31 December 2011 were US$34,621m.

Quarterly dividends of US$15.50 per 6.2% non-cumulative Series A US dollar preference share, equivalent to a dividend of US$0.3875

per Series A ADS, each of which represents one-fortieth of a Series A US dollar preference share, were paid on 15 March 2011, 15 June

2011, 15 September 2011 and 15 December 2011.

Quarterly coupons of US$0.508 per security were paid with respect to 8.125% capital securities on 18 January 2011, 15 April 2011,

15 July 2011 and 15 October 2011.

Quarterly coupons of US$0.50 per security were paid with respect to 8% capital securities on 15 March, 15 June, 15 September and

15 December 2011.

2 Return on average invested capital is based on the profit attributable to ordinary shareholders. Average invested capital is measured

as average total shareholders’ equity after adding back goodwill previously amortised or written-off directly to reserves, deducting

average equity preference shares issued by HSBC Holdings and deducting/(adding) average reserves for unrealised gains/(losses) on

effective cash flow hedges and available-for-sale securities and property revaluation reserves. This measure reflects capital initially

invested and subsequent profit.

3 The return on average ordinary shareholders’ equity is defined as profit attributable to shareholders of the parent company divided by

average ordinary shareholders’ equity.

4 The cost efficiency ratio is defined as total operating expenses divided by net operating income before loan impairment charges and

other credit risk provisions.

5 Each American Depositary Share represents five ordinary shares.

6 Total shareholder return is defined as the growth in share value and declared dividend income during the relevant period.

7 The Financial Times Stock Exchange 100 Index, the Morgan Stanley Capital International World Index and the Morgan Stanley Capital

International World Bank Index.

8 The core tier 1 capital ratio in 2011 includes the effect of the Basel 2.5 rules.

9 HBEU is HSBC Bank plc; HBAP is The Hongkong and Shanghai Banking Corporation; and HBUS is HSBC Bank USA. Figures

provided for HSBC Bank plc and The Hongkong and Shanghai Banking Corporation incorporate the major overseas branches of these

entities. Subsidiaries of these entities are not included unless there is unrestricted transferability of liquidity between the subsidiaries

and the parent. ‘Other entities’ comprise our other main banking subsidiaries and, as such, includes businesses spread across a range

of locations, in many of which we may require a higher ratio of net liquid assets to customer liabilities to reflect local market

conditions.

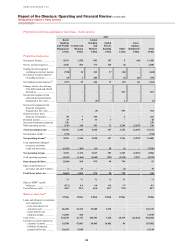

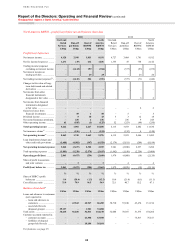

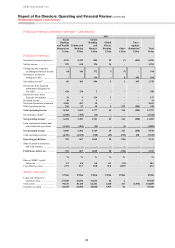

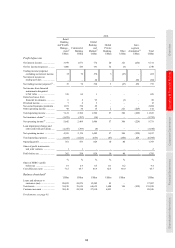

Reconciliations of reported and underlying profit/(loss) before tax

10 These columns comprise the net increments or decrements in profits in the current year compared with the previous year which are

attributable to acquisitions or disposals gains on the dilution of interests in associates and/or movements in fair value of own debt

attributable to credit spread. The inclusion of acquisitions and disposals is determined in the light of events each year.

11 ‘Currency translation’ is the effect of translating the results of subsidiaries and associates for the previous year at the average rates of

exchange applicable in the current year.

12 Excluding adjustments in 2010.

13 Positive numbers are favourable: negative numbers are unfavourable.

14 Changes in fair value due to movements in own credit spread on long-term debt issued. This does not include the fair value changes due

to own credit spread on structured notes issued and other hybrid instruments included within trading liabilities.

15 Other income in this context comprises net trading income, net income/(expense) from other financial instruments designated at fair

value, gains less losses from financial investments, dividend income, net earned insurance premiums and other operating income less

net insurance claims incurred and movement in liabilities to policyholders.

16 Net operating income before loan impairment charges and other credit risk provisions.

17 With effect from 1 March 2011, our Global Asset Management business was moved from GB&M to RBWM. Comparative data have

been adjusted accordingly.

18 Excluding adjustments in 2009.