HSBC 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396 -

397

397 -

398

398 -

399

399 -

400

400 -

401

401 -

402

402 -

403

403 -

404

404 -

405

405 -

406

406 -

407

407 -

408

408 -

409

409 -

410

410 -

411

411 -

412

412 -

413

413 -

414

414 -

415

415 -

416

416 -

417

417 -

418

418 -

419

419 -

420

420 -

421

421 -

422

422 -

423

423 -

424

424 -

425

425 -

426

426 -

427

427 -

428

428 -

429

429 -

430

430 -

431

431 -

432

432 -

433

433 -

434

434 -

435

435 -

436

436 -

437

437 -

438

438 -

439

439 -

440

440

|

|

101

Overview Operating & Financial Review Corporate Governance Financial Statements Shareholder Information

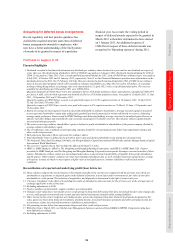

ratio after an observation and review period

in 2018.

In addition, the Basel Committee on

Banking Supervision will monitor a

leverage ratio based on a minimum 3%

tier 1 capital ratio over the period beginning

in 2013.

UK Independent Commission on Banking: the

forthcoming legislation in relation to the report of

the Independent Commission on Banking (‘ICB’) is

likely to require us to make major changes to our

corporate structure and the business activities we

conduct in the UK through our major banking

subsidiary, HSBC Bank, arising from:

– the likelihood that the retail banking activities

currently carried out within that entity may have

to be spun-off into a ring-fenced retail bank.

These changes would take an extended period to

implement with a significant effect on costs to

both implement the changes and run the ongoing

operations as restructured;

– the call for banks to hold a specified level of

primary loss-absorbing capital (‘PLAC’) up to

20% of their respective risk-weighted loans and

investment assets. Many of the areas which

could affect our business are precisely those

areas where changes to the proposals appear

likely or where consultation is being undertaken

by the UK government. The government

has indicated that it may modify the

recommendations in the report and is proposing

to undertake extensive consultation in two

stages during 2012;

– introduction of a non-risk based leverage ratio,

not as a binding prudential requirement but as

an instrument for supervisory review (pillar 2).

Bank levy: legislation in respect of the UK bank

levy was enacted on 19 July 2011. A charge of

US$570m for the UK bank levy has been recognised

in operating expenses in 2011. The UK levy is based

on the consolidated balance sheet at the year-end.

Bank levies have also been introduced, most notably

in France, Germany and South Korea. The overall

cost in 2011 was US$587m.

The ‘Volcker Rule’: while we do not have

segregated proprietary trading desks, the so called

Volcker Rule proposed under the Dodd-Frank Wall

Street Reform & Consumer Protection Act (the

‘Dodd-Frank Act’) could affect HSBC in North

America and across the Group. On 11 October 2011,

a proposed rule was published which generated

extensive public comment. A number of foreign

governments and other bodies have made public

submissions to the US authorities on, inter alia, the

overall scope and extra-territorial effects of the

proposed rule. However, rulemaking to implement

the provisions of the Volcker Rule has not been

completed.

G-SIBs: the capital impact of being designated a

Global systemically important bank (‘G-SIB’) is

discussed on page 213.

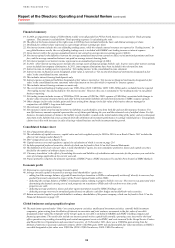

Potential impact on HSBC

• The proposals relating to capital and liquidity

will affect the capital adequacy and liquidity

frameworks under which financial institutions

operate and result in increased capital and

liquidity requirements, although the nature,

timing and effect of many of the changes remain

unclear. Increases in capital and liquidity

requirements could have a material effect on our

future financial condition or the results of our

operations. There is also the risk of second and

third order impacts of regulation which could

constrain the flow of credit within the economy.

• The proposed leverage ratio could cause HSBC,

as an institution with a relatively low-risk

portfolio overall, to constrain business activity

in areas which are well collateralised or possess

sufficient risk mitigants.

• For a further description of the possible effects

of the new Basel III/CRD IV rules on HSBC see

page 213. If either the quality or amount of the

Group’s capital were to fall outside the proposed

regulations, we could be required to raise more

capital or reduce our level of RWAs to meet the

requirements. Such actions and any resulting

transactions may not be within our operating

plans and may not be conducted on the most

favourable terms. This could lead to lower

returns on equity and cause some business

activities and products to be less profitable and,

in some instances, to fail to cover their cost of

equity.

• The proposed changes relating to remuneration,

bank levies and other taxes could increase the

Group’s cost of doing business in the regulatory

regimes in which these changes are

implemented, reducing future profitability.

Proposed changes in regulations such as the

rules relating to derivatives and central

counterparties regulation, the UK ICB ring-

fencing proposals, recovery and resolution plans

and the Volcker Rule may affect the manner in

which we conduct our activities and structure

ourselves, with the potential to both increase the

costs of doing business and curtail the types of