HSBC 2011 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2011 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396 -

397

397 -

398

398 -

399

399 -

400

400 -

401

401 -

402

402 -

403

403 -

404

404 -

405

405 -

406

406 -

407

407 -

408

408 -

409

409 -

410

410 -

411

411 -

412

412 -

413

413 -

414

414 -

415

415 -

416

416 -

417

417 -

418

418 -

419

419 -

420

420 -

421

421 -

422

422 -

423

423 -

424

424 -

425

425 -

426

426 -

427

427 -

428

428 -

429

429 -

430

430 -

431

431 -

432

432 -

433

433 -

434

434 -

435

435 -

436

436 -

437

437 -

438

438 -

439

439 -

440

440

|

|

113

Overview Operating & Financial Review Corporate Governance Financial Statements Shareholder Information

officials. This process enabled us to form a view of

the credit standing and the level of exposure that

the counterparties have to peripheral eurozone

sovereigns and banks. The majority of these

counterparties are located in France, Germany and

the Netherlands, where the exposures are disclosed

in aggregate below. Vulnerable counterparties were

identified, subject to enhanced monitoring and our

exposure was managed in a way similar to the

monitoring and management of direct exposures to

the peripheral eurozone countries.

The overall quality of the portfolio was strong

with most in-country and cross-border limits

extended to countries with high-grade internal credit

risk ratings. We regularly update our assessment of

higher risk countries and adjust our risk appetite

accordingly.

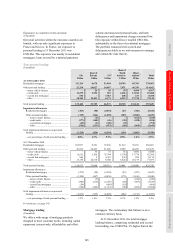

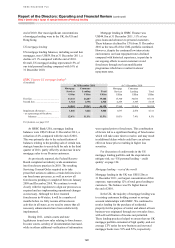

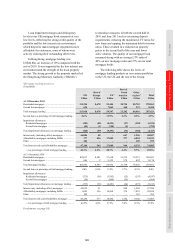

Exposures to countries in the eurozone

(Unaudited)

2011 was a turbulent year for the global markets,

dominated by the continuing eurozone debt crisis that

started with the global financial crisis in 2007 and,

by 2011, had developed into a severe sovereign debt

crisis. The measures taken by governments during

that period to avoid a financial collapse resulted in

higher debt levels, large fiscal deficits and, in certain

cases, social and political disruption. During 2011, a

number of eurozone countries came under severe

financial pressure and their ability to raise, refinance

and service their debt was put into question by

markets, as demonstrated by the record high spreads

during most of the year. Greece, Ireland and Portugal

were forced to seek support packages from the

European Central Bank (‘ECB’) and the International

Monetary Fund (‘IMF’) under strict conditions, while

fear of contagion to other eurozone countries forced

governments to reduce debt levels through austerity

measures that, at least in the short term, were seen

as the cause of slow growth for some countries and

stagnation in others.

Despite a number of high profile summits and

meetings the EU was unable to agree and implement

a strong coherent policy response to the crisis,

prompting fear of default or the exit from the euro of

one or more members. Under pressure during most of

2011, EU members showed an increasing willingness

to agree a structured common approach, but they also

demonstrated divergent opinions on the way forward

and on the measures to be taken. This resulted in the

three major rating agencies either downgrading, or

putting on the watch list for possible downgrade, a

number of sovereigns which intensified the pressure,

even on the stronger eurozone countries.

The ongoing sovereign debt crisis, slow

economic growth, dearth of market financing for

banks and private sector deleveraging severely

affected the eurozone financial system, increasing

the possibility of further banking stress in the region.

The banking sector within the peripheral eurozone

countries was particularly under threat as the credit

risk of domestic and cross-border exposures

increased significantly. This prompted calls from the

European Banking Authority (‘EBA’) and the IMF

for funding and liquidity support and/or the

recapitalisation of certain European banks.

The ratings downgrade of a number of eurozone

countries by major rating agencies in 2011 and

January 2012 was generally anticipated and was, in

most cases, not as large as feared, with the exception

of Portugal which is now rated below investment

grade. The downgrades are likely to have

implications for the ratings of European banks and

government guaranteed securities, as evidenced by

the downgrade of the European Financial Stability

Fund (‘EFSF’).

We continue to closely monitor events and have

stress-tested our capital position for potential

scenarios.

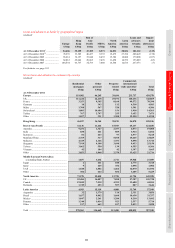

The tables below summarise our exposures to

selected eurozone countries, including:

• governments and central banks of selected

eurozone countries along with near/quasi

government agencies;

• banks; and

• other financial institutions and other corporates.

Exposures to banks, other financial institutions

and other corporates are based on the country of

domicile of the counterparty.

The following analysis of our exposures to

selected European countries is made voluntarily to

reflect developments in best practice disclosure.

Whilst certain analysis is subject to audit and

incorporated into the Group’s risk management

disclosure, it is not required for the purposes of

compliance with IFRSs.

Basis of preparation

(Audited)

The countries presented were selected as they

exhibited levels of market volatility during 2011

which exceeded other eurozone countries and

demonstrated fiscal or political uncertainty. Certain

of these countries also have high sovereign debt to

GDP ratios and a short to medium-term maturity

concentration of those liabilities.