ComEd 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

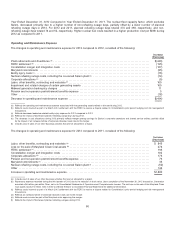

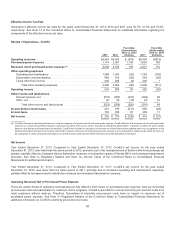

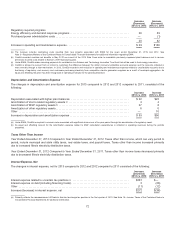

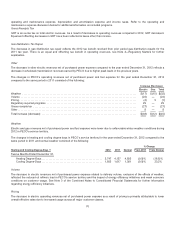

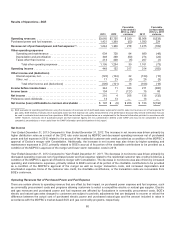

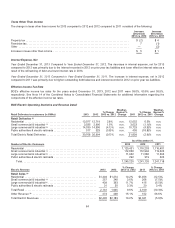

Results of Operations—PECO

2013 2012

Favorable

(unfavorable)

2013 vs. 2012

variance 2011

Favorable

(unfavorable)

2012 vs. 2011

variance

Operating revenues ........................................... $3,100 $3,186 $(86) $3,720 $(534)

Purchasedpower andfuel ....................................... 1,300 1,375 75 1,864 489

Revenues net of purchased power and fuel expense (a) ............ 1,800 1,811 (11)1,856 (45)

Other operating expenses

Operatingandmaintenance.................................. 748 80961794 (15)

Depreciation andamortization ................................ 228217(11)202 (15)

Taxesother than income..................................... 158 162420543

Total other operatingexpenses............................ 1,1341,188 54 1,201 13

Operating income ............................................. 666 623 43655 (32)

Other income and (deductions)

Interestexpense,net ........................................ (115) (123)8(134) 11

Other,net ................................................. 6 8 (2)14 (6)

Total other incomeand(deductions) ....................... (109) (115) 6 (120)5

Income before income taxes .................................... 557 50849 535(27)

Income taxes ................................................. 162127(35) 146 19

Net income ................................................... 395 38114389 (8)

Preferredsecurity dividends ...................................... 7 4 34—

Net income on common stock .................................. $ 388 $ 377 $ 11 $385 $ (8)

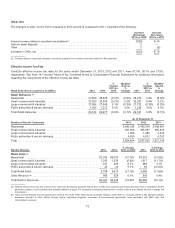

(a) PECO evaluatesitsoperatingperformanceusingthemeasuresofrevenuesnet ofpurchasedpower expensefor electric salesandrevenue net offuel expensefor

gassales. PECO believesrevenuesnet ofpurchasedpower expenseandrevenuesnet offuel expense are useful measurementsofitsperformancebecausethey

provideinformation that can beusedto evaluate itsnet revenuesfromoperations. PECO hasincludedthe analysis belowasacomplement to thefinancial

information providedinaccordancewithGAAP. However,revenuesnet ofpurchasedpower expenseandrevenue net offuel expensefiguresare not a presentation

definedunder GAAPandmaynot becomparable to other companies’ presentationsor more useful than theGAAPinformation providedelsewhere inthis report.

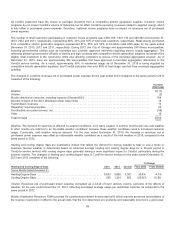

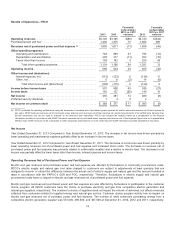

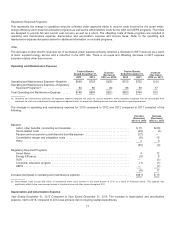

Net Income

Year Ended December 31, 2013 Compared to Year Ended December 31, 2012. Theincreasein net incomewasdriven primarilyby

lower operatingandmaintenanceexpense partiallyoffset by an increaseinincometaxes.

Year Ended December 31, 2012 Compared to Year Ended December 31, 2011. Thedecreasein net incomewasdriven primarilyby

lower operatingrevenuesnet ofpurchasedpower andfuel expenseandincreasedstormcosts. Thedecreaseinrevenuesnet of

purchasedpower andfuel expensewasprimarilyrelatedto unfavorable weather andadecline in electric load. Thedecrease to net

incomewaspartiallyoffset by lower taxesother than income,interestexpenseandincometaxes.

Operating Revenues Net of Purchased Power and Fuel Expense

Electric andgasrevenuesandpurchasedpower andfuel expense are affectedbyfluctuationsincommodityprocurement costs.

PECO’s electric supplyandnatural gascost rateschargedto customersare subjecttoadjustmentsat leastquarterlythat are

designedto recover or refundthedifferencebetween theactual costofelectric supplyandnatural gasandtheamount includedin

ratesinaccordancewiththePAPUC’s GSAand PGC, respectively. Therefore,fluctuationsin electric supplyandnatural gas

procurement costshavenoimpact on electric andgasrevenuesnet ofpurchasedpower andfuel expense.

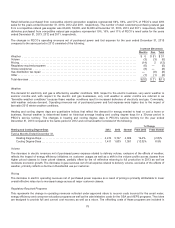

Electric andgasrevenuesandpurchasedpower andfuel expense are alsoaffectedbyfluctuationsin participation inthecustomer

choice program. All PECO customershavethechoice to purchase electricityandgasfromcompetitive electric generation and

natural gassuppliers, respectively. Thecustomer’s choiceofsuppliersdoesnot impactthevolumeofdeliveries, but affectsrevenues

collectedfromcustomersrelatedto suppliedenergy andnatural gasservice.Customer choice programactivityhasno impacton

electric andgasrevenuesnet ofpurchasepower andfuel expense.Thenumber ofretailcustomerspurchasingenergy froma

competitive electric generation supplier was531,500, 496,500,and387,600 at December 31,2013,2012 and2011,respectively.

74