ComEd 2013 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

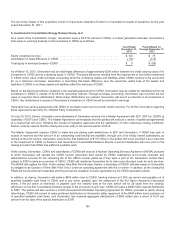

value,includinggoodwill,indicatedno impairment ofgoodwill;therefore,thesecondstep wasnot required. ComEd performeda

qualitativeassessment asofNovember 1,2012,for its2012 annual goodwill impairment assessment anddeterminedthat itsfair

value wasnot more likelythan not less than itscarryingvalue.Therefore,ComEd did not performaquantitativeassessment.Aspart

ofitsqualitativeassessment,ComEd evaluated, amongother things, management’s bestestimate ofprojectedoperatingandcapital

cash flows for ComEd’s business (includingtheimpactsoftheMay2012 Order)aswell aschangesincertainother market

conditions, such asthediscount rate and EBITDAmultiples.

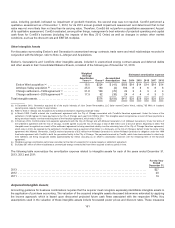

Other Intangible Assets

For discussion surroundingExelon’s andGeneration’s unamortizedenergy contracts, tradenameandretail relationshipsrecordedin

conjunction withtheMerger,refer to Note 4—Merger andAcquisitions.

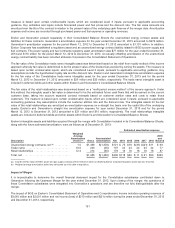

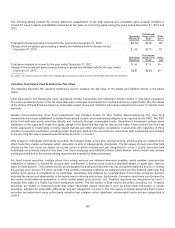

Exelon’s, Generation’s andComEd’s other intangible assets, includedin unamortizedenergy contractassetsanddeferreddebits

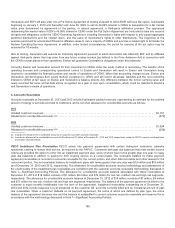

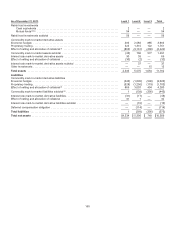

andother assetsintheirConsolidatedBalanceSheets, consistedofthefollowingasofDecember 31,2013:

Weighted

Average

Amortization

Years (e)

Estimated amortization expense

Gross (f)

Accumulated

Amortization Net 2014 2015 2016 2017 2018

Exelon Windacquisition (a)...................... 18.0$224$(41)$183$14$14$14$14$14

Antelope Valleyacquisition (b) .................... 25.0190(4) 18688888

Chicagosettlement—1999 agreement (c) ........... 21.8 100 (76) 2433344

Chicagosettlement—2003 agreement (d) ........... 17.9 62(38) 2444433

Total intangible assets.............................. $576 $(159) $417$29$29$29$29$29

(a)InDecember 2010,Generation acquiredall oftheequityinterestsofJohnDeere Renewables, LLC (later namedExelon Wind), adding735 MWs ofinstalled,

operatingwindcapacitylocatedineightstates.

(b) Refer to Note 4—Merger andAcquisitionsfor additional information regardingAntelope Valley.

(c) InMarch 1999, ComEd enteredinto a settlement agreement withtheCityof ChicagoassociatedwithComEd’s franchiseagreement.Under the terms ofthe

settlement,ComEd agreedto makepaymentsto theCityof Chicagoeach year from1999 to 2002.Theintangible asset recognizedasaresult ofthesepaymentsis

beingamortizedratablyover theremainingtermofthefranchiseagreement, which ends in 2020.

(d) InFebruary2003,ComEd enteredinto separate agreementswiththeCityof Chicagoandwith MidwestGeneration, LLC (MidwestGeneration). Under the terms of

thesettlement agreement withtheCityof Chicago,ComEd agreedto paytheCityof Chicago a total of$60million over a ten-year period, beginningin 2003.The

intangible asset recognizedasaresult ofthesettlement agreement is beingamortizedratablyover theremainingtermoftheCityof Chicagofranchiseagreement,

which ends in 2020.Asrequiredbythesettlement,ComEd alsomadeapayment of$2million to a third-partyon theCityof Chicago’s behalf. Under the terms ofthe

agreement with MidwestGeneration,ComEd receivedpaymentsof$32 million from MidwestGeneration to relieveMidwestGeneration’s obligation under the1999

fossilsale agreement withComEd to buildthegeneration facilityintheCityof Chicago.ThepaymentsreceivedbyComEd, which havebeen recordedinother long-

termliabilities, are beingrecognizedratably(approximately$2million annually) asan offset to amortization expenseover theremainingtermofthefranchise

agreement.

(e)Weighted-averageamortization periodwascalculatedat thedate ofacquisition for acquiredassetsor settlement agreement.

(f) Excludes $67 million ofother miscellaneousunamortizedenergy contractsthat havebeen acquiredat variouspointsintime.

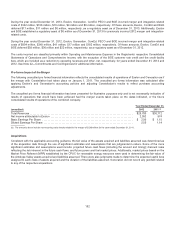

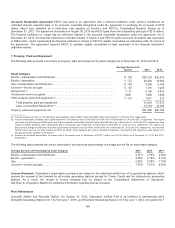

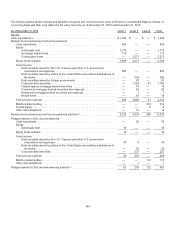

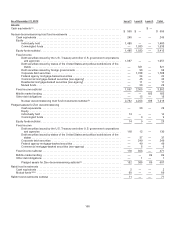

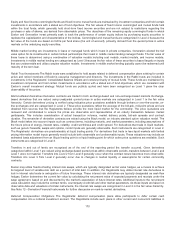

Thefollowingtable summarizestheamortization expense relatedto intangible assetsfor each oftheyearsendedDecember 31,

2013,2012 and2011:

For the Year

Ended

December 31,

2013 ............................................................................................. $27

2012 ............................................................................................. 20

2011 ............................................................................................. 19

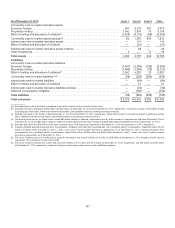

Acquired Intangible Assets

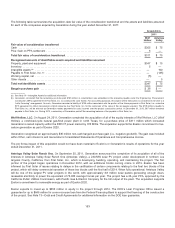

Accountingguidancefor business combinationsrequiresthat theacquirer mustrecognizeseparatelyidentifiable intangible assetsin

the application ofpurchaseaccounting. Thevaluation oftheacquiredintangible assets discussedbelowwere estimatedbyapplying

theincome approach, which is basedupon discountedprojectedfuture cash flows associatedwiththerespectivePPAs. Key

assumptionsusedinthevaluation oftheseintangible assetsincludeforecastedpower pricesand discount rates. Thosemeasures

161