ComEd 2013 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

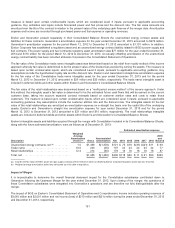

(a) PECO’s gasPOR programbecameeffectiveonJanuary1,2012 andincludesa1% discount on purchasedreceivablesinorder to recover theimplementation costs

ofthe program. If thecostsare not fullyrecoveredwhen PECO filesitsnextgas distribution rate case, PECO will proposeamechanism to recover theremaining

implementation costsasadistribution chargetolowvolume transportation customersor applyfuture discountson purchasedreceivablesfromnatural gassuppliers

servingthosecustomers.

(b) For ComEd and BGE, reflectstheincremental allowancefor uncollectible accountsrecorded, which is inaddition to the purchasediscount.For ComEd, the

incremental uncollectible accountsexpenseis recoveredthrough itsPurchaseofReceivableswithConsolidatedBilling (PORCB) tariff.

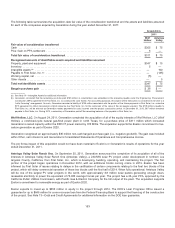

4. Merger and Acquisitions

Merger with Constellation

Description of Transaction

OnMarch 12,2012,Exelon completedthemerger contemplatedbytheMerger Agreement amongExelon,Bolt Acquisition

Corporation,awhollyownedsubsidiaryofExelon (Merger Sub), andConstellation.Asaresult ofthat merger,Merger Subwas

mergedinto Constellation (theInitial Merger)andConstellation becameawhollyownedsubsidiaryofExelon.Followingthe

completion oftheInitial Merger,Exelon andConstellation completedaseriesofinternal corporate organizational restructuring

transactions. Constellation mergedwithandinto Exelon,withExelon continuingasthesurvivingcorporation (theUpstreamMerger).

SimultaneouslywiththeUpstreamMerger,Constellation’s interestinRFHoldCoLLC, which holds Constellation’s interestinBGE,

wastransferredto Exelon Energy DeliveryCompany, LLC, awhollyownedsubsidiaryofExelon that alsoownsExelon’s interestsin

ComEd and PECO. FollowingtheUpstreamMerger andthe transfer ofRFHoldCoLLC, Exelon contributedto Generation certain

subsidiaries, includingthosewithgeneration andcustomer supplyoperationsthat were acquiredfromConstellation asaresult ofthe

Initial Merger andtheUpstreamMerger.

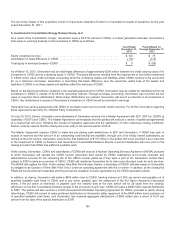

Regulatory Matters

InFebruary2012,theMDPSC issuedan Order approvingtheExelon andConstellation merger.Aspart oftheMDPSC Order,

Exelon agreedto provideapackageofbenefitsto BGE customers, theCityofB

altimore andtheState ofMaryland, resultinginan

estimateddirectinvestment intheState ofMarylandofapproximately$1billion.

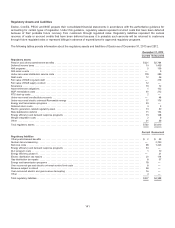

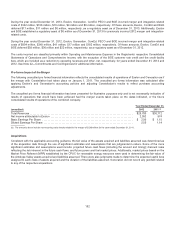

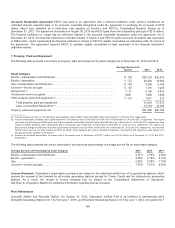

Thefollowingcostswere recognizedafter theclosingofthemerger andare includedinExelon’s ConsolidatedStatementsof

OperationsandComprehensiveIncomefor theyear endedDecember 31,2012.

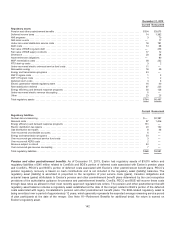

Description

Payment

Period Exelon

Statement of Operations

Location

BGE rate creditof$100 per residential customer (a)...................... Q2 2012 $113 Revenues

Customer investment fundto investin energy efficiency andlow-income

energy assistancetoBGE customers ................................ 2012 to 2014113.5 O&M Expense

Contribution for renewable energy, energy efficiency or relatedprojectsin

Baltimore ....................................................... 2012 to 20142O&M Expense

Charitable contributionsat $7 million per year for 10 years ................ 2012 to 2021 70O&M Expense

State fundingfor offshore winddevelopment projects..................... Q2 2012 32 O&M Expense

Miscellaneoustaxbenefits........................................... Q2 2012 (2)TaxesOther Than Income

Total $328.5

(a)Exelon madea$66 million equitycontribution to BGE inthesecondquarter of2012 to fundtheafter-taxamount ofthe rate creditasdirectedintheMDPSC order

approvingthemerger transaction.

Thedirectinvestment estimate includes $95 million to $120 million relatingto theconstruction ofaheadquartersbuildingin

Baltimore for Generation’s competitive energy businesses. OnMarch 20,2013,Generation signeda20year leaseagreement that is

contingent upon thedeveloper obtainingall requiredapprovals, permitsandfinancingfor theconstruction ofthebuilding. Once

requiredapprovalsare receivedandfinancingconditionsare met,construction will commenceandthebuildingisexpectedto be

ready for occupancy in approximately2yearsafter buildingconstruction commences.

Thedirectinvestment estimate alsoincludes$600 million to $650million for Exelon’s andGeneration’s commitment to develop or

assistindevelopment of285—300 MWs ofnewgeneration inMaryland, expectedto becompletedover a periodof10 years. The

MDPSC Order contemplatesvariousoptionsfor complyingwiththenewgeneration development commitments, includingbuildingor

148