ComEd 2013 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

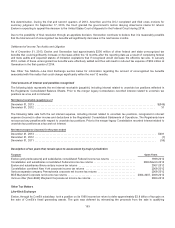

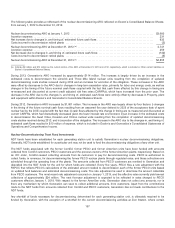

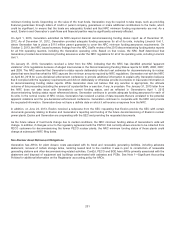

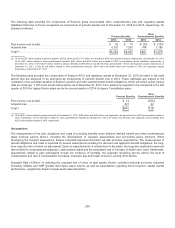

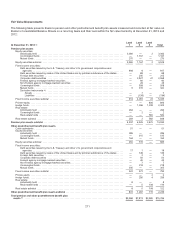

Thefollowingtable providesa rollforwardofthe non-nuclear AROs reflectedon Exelon’s ConsolidatedBalanceSheetsfrom

January1,2012 to December 31,2013:

Non-nuclear AROs at January1,2012 ........................................................................ $209

Net increasedue to changesin,andtimingof, estimatedfuture cash flows (a)........................................ 27

Development projects ...................................................................................... 47

Accretion expense(b) ....................................................................................... 13

Merger withConstellation (c) ................................................................................. 58

Payments ................................................................................................ (11)

Non-nuclear AROs at December 31,2012 ..................................................................... 343

Net increasedue to changesin,andtimingof, estimatedfuture cash flows (a)........................................ 1

Development projects ...................................................................................... 2

Accretion expense(b) ....................................................................................... 18

Payments ................................................................................................ (13)

Non-nuclear AROs at December 31,2013 (d) ................................................................... $351

(a)Duringtheyear endedDecember 31,2013,Generation recordedan increasein operatingandmaintenanceexpenseof$13 million.ComEd and PECO did not record

anyadjustmentsin operatingandmaintenanceexpensefor theyear endedDecember 31,2013.Duringtheyear endedDecember 31,2012,Generation recordeda

reduction in operatingandmaintenanceexpenseof$8million.ComEd, PECO, and BGE did not recordanyreductionsin operatingandmaintenanceexpensefor the

year endedDecember 31,2012.

(b) For ComEd, PECO, and BGE, themajorityoftheaccretion is recordedasan increasetoaregulatoryasset due to theassociatedregulatorytreatment.

(c) Exelon’s AROincludes$8million of BGE costsincurredprior to theclosingofExelon’s merger withConstellation.Refer to Note 4—Merger andAcquisitionsfor

additional information.

(d) Includes$2million,$1million,and$0million asthecurrent portion oftheAROat December 31,2013 for ComEd, PECO, and BGE, respectively, which is includedin

other current liabilitieson Exelon’s andeach oftherespectiveutilities’ ConsolidatedBalanceSheets.

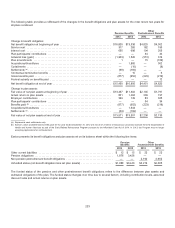

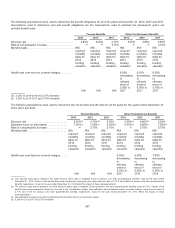

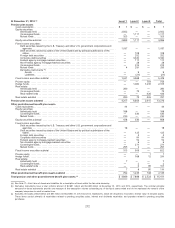

16. Retirement Benefits

AsofDecember 31,2013,Exelon sponsoreddefinedbenefit pension plansandother postretirement benefit plansfor essentiallyall

Generation,ComEd, PECO, BGE and BSC employees. Inconnection withtheacquisition ofConstellation inMarch 2012,Exelon

assumedConstellation’s benefit plansanditsrelatedassets. Exelon’s traditional andcash balance pension plansare intendedto be

tax-qualifieddefinedbenefit plans. Substantiallyall non-union employeesandelectingunion employeeshiredon or after January1,

2001 participate incash balance pension plans. EffectiveJanuary1,2009, substantiallyall newly-hiredunion-represented

employeesparticipate incash balance pension plans. Exelon haselectedthat the trustsunderlyingthese plansbe treatedunder the

IRCasqualifiedtrusts. If certainconditionsare met,Exelon can deductpaymentsmadetothequalifiedtrusts, subjecttocertainIRC

limitations.

Benefit Obligations, Plan Assets and Funded Status

Exelon recognizestheoverfundedor underfundedstatusofdefinedbenefit pension andother postretirement benefit plansasan

asset or liabilityon itsbalancesheet,withoffsettingentriesto AccumulatedOther ComprehensiveIncome(AOCI) andregulatory

assets(liabilities), inaccordancewiththe applicable authoritativeguidance.Themeasurement date for the plansisDecember 31.

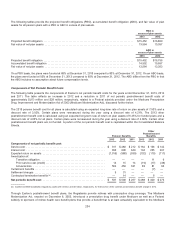

Duringthefirstquarter of2013,Exelon receivedan updatedvaluation ofitslegacy pension andother postretirement benefit

obligationsto reflectactual censusdata asofJanuary1,2013. This valuation resultedinanincreasetothe pension obligation of$8

million andadecreasetotheother postretirement benefitobligation of$39million.Additionally, accumulatedother comprehensive

loss decreasedbyapproximately $75 million (after tax) andregulatoryassetsincreasedbyapproximately$93million.Duringthe

secondquarter of2013,Exelon receivedtheupdatedvaluation for thelegacy Constellation pension andother postretirement

obligationsto reflectactual censusdata asofJanuary1,2013. This valuation resultedinanincreasetothe pension obligation of$23

million andadecreasetotheother postretirement benefitobligation of$12 million.Additionally, accumulatedother comprehensive

loss increasedbyapproximately$2million (after tax) andregulatoryassetsincreasedbyapproximately$14million.

202