ComEd 2013 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

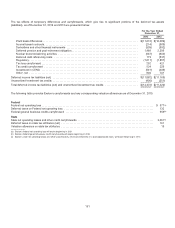

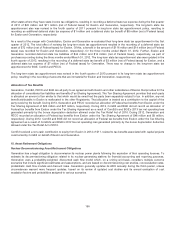

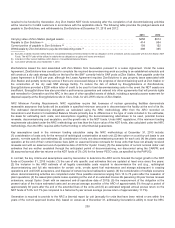

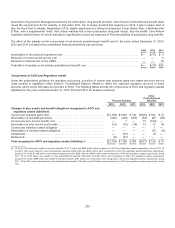

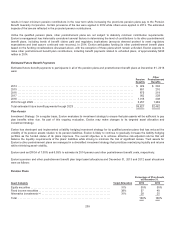

requiredto befundedbyGeneration.AnyZion Station NDT funds remainingafter thecompletion ofall decommissioningactivities

will be returnedto ComEd customersinaccordancewiththe applicable orders. Thefollowingtable providesthe pledgedassetsand

payable to ZionSolutions, andwithdrawalsbyZionSolutionsat December 31,2013 and2012:

2013 2012

Carryingvalue ofZion Station pledgedassets.................................................. $458 $614

Payable to Zion Solutions(a)................................................................ 414 564

Current portion ofpayable to Zion Solutions(b) ................................................. 109132

WithdrawalsbyZion Solutionsto paydecommissioningcosts(c) ................................... 498 335

(a) ExcludesaliabilityrecordedwithinExelon’s ConsolidatedBalanceSheetsrelatedto thetaxobligation on the unrealizedactivityassociatedwiththeZion Station NDT

Funds. TheNDT Funds will beutilizedto satisfy thetaxobligationsasgainsandlossesare realized.

(b) IncludedinOther current liabilitieswithinExelon’s ConsolidatedBalanceSheets.

(c) CumulativewithdrawalssinceSeptember 1,2010.

ZionSolutionsleasedthe landassociatedwithZion Station fromGeneration pursuant to a LeaseAgreement.Under theLease

Agreement,ZionSolutionshascommittedto complete therequireddecommissioningworkaccordingto an established schedule and

will constructadrycask storagefacilityon the landfor theSNF currentlyheldinSNF poolsat Zion Station.Rent payable under the

LeaseAgreement is $1.00 per year,although theLeaseAgreement requiresZionSolutionsto paypropertytaxesassociatedwith

Zion Station andpenaltyrentsmayaccrue if there are unexcuseddelays inthe progress ofdecommissioningworkat Zion Station or

theconstruction ofthedrycask SNF storagefacility. Toreducetherisk ofdefault by EnergySolutionsor ZionSolutions,

EnergySolutionsprovideda$200 million letter ofcredittobeusedto funddecommissioningcostsintheevent theNDT assetsare

insufficient.EnergySolutionshasalso provideda performanceguarantee andenteredinto other agreementsthat will providerights

andremediesfor Generation andtheNRCinthecaseofother specifiedeventsofdefault,includingaspecial purposeeasement for

disposal capacityat theEnergySolutionssite inClive,Utah, for all LLRWvolumeofZion Station.

NRC Minimum Funding Requirements.NRCregulationsrequire that licenseesofnuclear generatingfacilitiesdemonstrate

reasonable assurancethat funds will beavailable inspecifiedminimumamountsto decommission thefacilityat theendofitslife.

TheestimateddecommissioningobligationsascalculatedusingtheNRCmethodology differ fromtheAROrecordedon

Generation’s andExelon’s ConsolidatedBalanceSheetsprimarilydue to differencesinthetype ofcostsincludedintheestimates,

thebasis for estimatingsuch costs, andassumptionsregardingthedecommissioningalternativesto beused, potential license

renewals, decommissioningcostescalation,andthegrowthrate intheNDT funds. Under NRCregulations, if theminimumfunding

requirementscalculatedunder theNRCmethodology are less than thefuture value oftheNDT funds, alsocalculatedunder theNRC

methodology, then theNRCrequireseither further fundingor other financial guarantees.

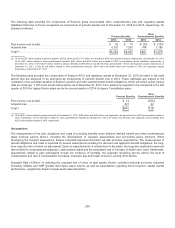

Keyassumptionsusedintheminimumfundingcalculation usingtheNRCmethodology at December 31,2013 include:

(1)consideration ofcostsonlyfor theremoval ofradiological contamination at each unit;(2)the option on a unit-by-unitbasis to use

generic, non-site specific costestimates; (3)consideration ofonlyone decommissioningscenariofor each unit; (4) the plantscease

operation at theendoftheircurrent licenselives (withno assumedlicense renewalsfor thoseunitsthat have not already received

renewalsandwithan assumedend-of-operationsdate of2019for Oyster Creek); (5) theassumption ofcurrent nominal dollar cost

estimatesthat are neither escalatedthrough the anticipatedperiodofdecommissioning, nor discountedusingtheCARFR;and

(6) assumedannual after-taxreturnson theNDT funds of2%(3%for theformer PECO units, asspecifiedbythePAPUC).

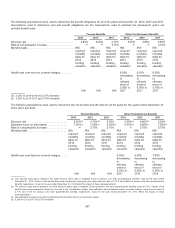

Incontrast,thekeycriteriaandassumptionsusedbyGeneration to determine theAROandto forecastthe target growthintheNDT

funds at December 31,2013 include:(1)theuseofsite specific costestimatesthat are updatedat leastonceevery fiveyears;

(2)theinclusion intheAROestimate ofall legallyunavoidable costsrequiredto decommission theunit(e.g., radiological

decommissioningandfull site restoration for certainunits, on-site spent fuel maintenanceandstoragesubsequent to ceasing

operationsanduntilDOE acceptance,and disposal ofcertainlow-level radioactivewaste); (3)theconsideration ofmultiple scenarios

where decommissioningactivitiesare completedunder three possible scenariosrangingfrom10 to 70yearsafter thecessation of

plant operations; (4) theassumption plantscease operatingat theendofan extendedlicenselife(assuming20-year license renewal

extensions, except Oyster Creekwithan assumedend-of-operationsdate of2019); (5) themeasurement oftheobligation at the

present value ofthefuture estimatedcostsandan annual averageaccretion oftheAROofapproximately5%through a periodof

approximately30 yearsafter theendoftheextendedlivesoftheunits; and (6) an estimatedtargetedannual pre-taxreturn on the

NDT funds of 5.9% to 6.7% (ascomparedto a historical 5-year annual average pre-taxreturn ofapproximately11.7%).

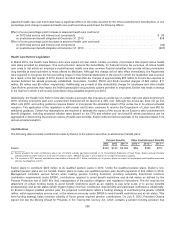

Generation is requiredto providetotheNRCabiennial report by unit(annuallyfor unitsthat havebeen retiredor are withinfive

yearsofthecurrent approvedlicenselife), basedon valuesasofDecember 31,addressingGeneration’s abilityto meet theNRC

200