ComEd 2013 Annual Report Download - page 41

Download and view the complete annual report

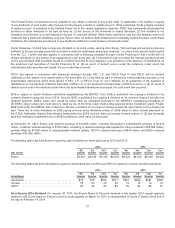

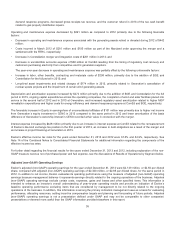

Please find page 41 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.demandresponse programs, decreasedgross receiptstaxrevenue,andthecustomer refundin 2013 ofthetaxcash benefit

relatedto gasproperty distribution repairs.

Operatingandmaintenanceexpensedecreased by $691million ascomparedto 2012 primarilydue to thefollowingfavorable

factors:

•Decreasein operatingandmaintenanceexpenseassociatedwiththegeneratingassetsretiredor divestedduring2012 of $442

million;

•CostsincurredinMarch 2012 of$216million and$195 million aspart oftheMarylandorder approvingthemerger anda

settlement withtheFERC, respectively;

•DecreaseinConstellation merger andintegration costsof$201 million in 2013;and

•Decreaseinuncollectible accountsexpenseof $58 million at ComEd resultingfromthetimingofregulatorycostrecoveryand

customerspurchasingelectricityfromcompetitive electric generation suppliers.

Theyear-over-year decreasein operatingandmaintenanceexpensewaspartiallyoffset by thefollowingunfavorable factors:

•Increaseinlabor,other benefits, contractingandmaterialscostsof$298 million,primarilydue to theaddition of BGE and

Constellation for thefull periodin 2013;and

•Long-livedasset impairmentsandrelatedchargesof$174 million in 2013,primarilyrelatedto Generation’s cancellation of

nuclear uprate projectsandtheimpairment ofcertainwindgeneratingassets.

Depreciation andamortization expenseincreasedby$272million primarilydue to theaddition of BGE andConstellation for thefull

periodin 2013,ongoingcapital expendituresacross the operatingcompanies, thecompletion ofwindandsolar facilitiesplacedinto

serviceinthesecondhalfof2012 andin 2013 at Generation,andincreasedregulatoryasset amortization relatedto higher MGP

remediation expendituresand higher costsfor energy efficiency anddemandresponse programs at ComEd and BGE, respectively.

Thefavorable increaseinEquityin earnings/loss ofunconsolidatedaffiliatesof$101 million wasprimarilydue to higher net income

fromGeneration’s equityinvestment inCENG in 2013 comparedto thesame periodin 2012 andlower amortization ofthebasis

differenceofGeneration’s ownershipinterestinCENG recordedat fairvalue inconnection withthemerger.

Interestexpenseincreasedby$428million primarilydue to an increaseininterestexpenseatComEd relatedto theremeasurement

ofExelon’s like-kindexchangetaxposition inthefirstquarter of2013,an increaseindebtobligationsasaresult ofthemerger and

an increasein projectfinancingat Generation in 2013.

Exelon’s effectiveincometaxratesfor theyearsendedDecember 31,2013 and2012 were 37.6% and34.9%, respectively. See

Note 14oftheCombinedNotesto ConsolidatedFinancial Statementsfor additional information regardingthecomponentsofthe

effectiveincometaxrates.

For further detailregardingthefinancial resultsfor theyearsendedDecember 31,2013 and2012,includingexplanation ofthe non-

GAAPmeasure revenue net ofpurchasedpower andfuel expense,see thediscussionsofResultsofOperationsbySegment below.

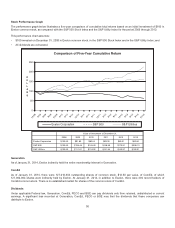

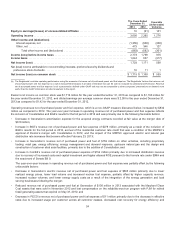

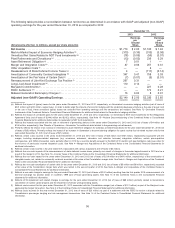

Adjusted (non-GAAP) Operating Earnings

Exelon’s adjusted(non-GAAP) operatingearnings for theyear endedDecember 31,2013 were $2,149 million,or $2.50 per diluted

share,comparedwithadjusted(non-GAAP) operatingearnings of$2,330 million,or $2.85 per dilutedshare,for thesame periodin

2012.Inaddition to net income,Exelon evaluatesitsoperatingperformanceusingthemeasure ofadjusted(non-GAAP) operating

earnings becausemanagement believesit representsearnings directlyrelatedto theongoingoperationsofthebusiness. Adjusted

(non-GAAP) operatingearnings excludecertaincosts, expenses, gainsandlossesandother specifieditems. This information is

intendedto enhanceaninvestor’s overall understandingofyear-to-year operatingresultsandprovideanindication ofExelon’s

baseline operatingperformanceexcludingitems that are consideredbymanagement to be not directlyrelatedto theongoing

operationsofthebusiness. Inaddition,this information is amongtheprimaryindicatorsmanagement usesasabasis for evaluating

performance,allocatingresources, settingincentivecompensation targetsandplanningandforecastingoffuture periods. Adjusted

(non-GAAP) operatingearnings is not a presentation definedunder GAAPandmaynot becomparable to other companies’

presentationsor deemedmore useful than theGAAPinformation providedelsewhere inthis report.

35