ComEd 2013 Annual Report Download - page 64

Download and view the complete annual report

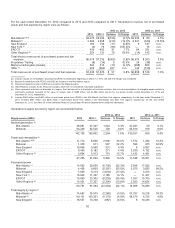

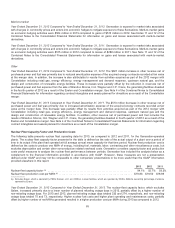

Please find page 64 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Actual incometaxescouldvaryfromestimatedamountsdue to thefuture impactsofvariousitems, includingchangesinincometax

laws, theRegistrants’ forecastedfinancial condition andresultsofoperations, failure to successfullyimplement taxplanning

strategies, aswell asresultsofauditsandexaminationsoffiledtaxreturnsbytaxingauthorities. While theRegistrantsbelievethe

resultingtaxbalancesasofDecember 31,2013 and2012 are appropriatelyaccountedfor inaccordancewiththe applicable

authoritativeguidance,the ultimate outcomeoftaxmatterscouldresult infavorable or unfavorable adjustmentsto theirconsolidated

financial statementsandsuch adjustmentscouldbematerial.See Note 14oftheCombinedNotesto ConsolidatedFinancial

Statementsfor additional information regardingtaxes.

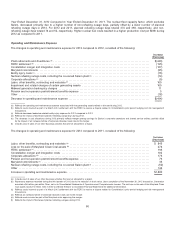

Accounting for Loss Contingencies

Inthe preparation oftheirfinancial statements, theRegistrantsmakejudgmentsregardingthefuture outcomeofcontingent events

andrecordliabilitiesfor loss contingenciesthat are probable andcan be reasonablyestimatedbasedupon available information.

Theamountsrecordedmay differ fromtheactual expenseincurredwhen theuncertaintyisresolved. Theestimatesthat the

Registrantsmakeinaccountingfor loss contingenciesandtheactual resultsthat theyrecordupon the ultimate resolution ofthese

uncertaintiescouldhaveasignificant effectontheirconsolidatedfinancial statements.

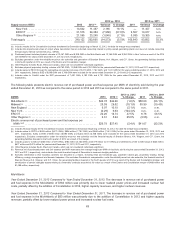

Environmental Costs. Environmental investigation andremediation liabilitiesare basedupon estimateswithrespecttothenumber

ofsitesfor which theRegistrantswill beresponsible,thescope andcostofworkto be performedat each site,the portion ofcosts

that will besharedwithother parties, thetimingoftheremediation work, changesintechnology, regulationsandtherequirementsof

local governmental authorities. Periodic studiesare conductedat ComEd, PECO and BGE to determine future remediation

requirementsandestimatesare adjustedaccordingly. Inaddition,periodic reviews are performedat Generation to assess the

adequacy ofitsenvironmental reserves. Thesematters, if resolvedinamanner different fromtheestimate,couldhaveasignificant

effectontheRegistrants’ resultsofoperations, financial position andcash flows. See Note 22 oftheCombinedNotesto

ConsolidatedFinancial Statementsfor further information.

Other, Including Personal Injury Claims. TheRegistrantsare self-insuredfor general liability, automotiveliability, workers’

compensation,andpersonal injuryclaims to theextent that lossesare within policy deductiblesor exceedtheamount ofinsurance

maintained. TheRegistrantshavereservesfor bothopen claims assertedandan estimate ofclaims incurredbut not reported

(IBNR). TheIBNRreserveis estimatedbasedon actuarial assumptionsandanalysis andisupdatedannually. Future events, such

asthenumber ofnewclaims to befiledeach year,theaveragecostof disposingofclaims, aswell asthenumerousuncertainties

surroundinglitigation andpossible state andnational legislativemeasurescouldcausetheactual coststo behigher or lower than

estimated. Accordingly, theseclaims, if resolvedinamanner different fromtheestimate,couldhaveamaterial effectonthe

Registrants’ resultsofoperations, financial position andcash flows.

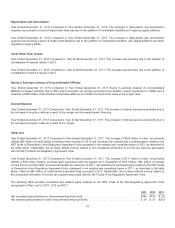

Revenue Recognition

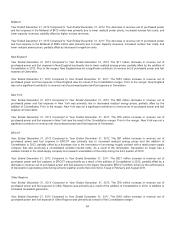

Sources of Revenue and Selection of Accounting Treatment. TheRegistrantsearn revenuesfromvariousbusiness activities

including: thesale ofenergy andenergy-relatedproducts, such asnatural gas, capacity, andother commoditiesin non-regulated

markets (wholesale andretail);thesale anddeliveryofelectricityandnatural gasinregulatedmarkets; andthe provision ofother

energy-relatednon-regulatedproductsandservices.

The appropriate accountingtreatment for revenue recognition is basedon the nature oftheunderlyingtransaction andapplicable

accountingstandards. TheRegistrantsprimarilyuseaccrual andmark-to-market accountingas discussedinmore detailbelow.

Accrual Accounting. Under accrual accounting, theRegistrantsrecordrevenuesinthe periodwhen servicesare renderedor

energy is deliveredto customers. TheRegistrantsgenerallyuseaccrual accountingto recognizerevenuesfor salesofelectricity,

natural gas, andother commoditiesaspart oftheirphysical deliveryactivities. TheRegistrantsenter into thesesalestransactions

usingavarietyofinstruments, includingnon-derivativeagreements, derivativesthat qualify for andare designatedasnormal

purchasesandnormal sales (NPNS) ofcommoditiesthat will bephysicallydelivered, salesto utilitycustomersunder regulated

service tariffs, andspot-market sales, includingsettlementswithindependent systemoperators.

Mark-to-Market Accounting. TheRegistrantsrecordrevenuesusingthemark-to-market methodofaccountingfor transactionsthat

meet thedefinition ofaderivativefor which theyare not permitted, or have not elected, theNPNS exception.Thesemark-to-market

transactionsprimarilyrelate to risk management activitiesandeconomic hedgesofother accrual activities. Mark-to-market revenues

include:inception gainsor losseson newtransactionswhere thefairvalue is observable andrealized; andunrealizedgainsand

lossesfromchangesinthefairvalue ofopen contracts.

58