ComEd 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

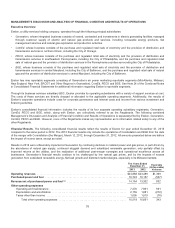

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Executive Overview

Exelon,autilityservicesholdingcompany, operatesthrough thefollowingprincipal subsidiaries:

•Generation, whoseintegratedbusiness consistsofowned, contractedandinvestmentsin electric generatingfacilitiesmanaged

through customer supplyofelectric andnatural gasproductsandservices, includingrenewable energy products, risk

management servicesandnatural gasexploration andproduction activities.

•ComEd, whosebusiness consistsofthe purchaseandregulatedretailsale ofelectricityandthe provision of distribution and

transmission servicesin northern Illinois, includingtheCityof Chicago.

•PECO, whosebusiness consistsofthe purchaseandregulatedretailsale ofelectricityandthe provision of distribution and

transmission servicesinsoutheastern Pennsylvania,includingtheCityof Philadelphia,andthe purchaseandregulatedretail

sale ofnatural gasandthe provision of distribution servicesinthePennsylvaniacountiessurroundingtheCityof Philadelphia.

•BGE, whosebusiness consistsofthe purchaseandregulatedretailsale ofelectricityandthe provision of distribution and

transmission servicesincentral Maryland, includingtheCityofBaltimore,andthe purchaseandregulatedretailsale ofnatural

gasandthe provision of distribution servicesincentral Maryland, includingtheCityofBaltimore.

Exelon hasnine reportable segmentsconsistingofGeneration’s six power marketingreportable segments (Mid-Atlantic, Midwest,

NewEngland, NewYork, ERCOT andOther RegionsinGeneration), ComEd, PECO and BGE. See Note 24oftheCombinedNotes

to ConsolidatedFinancial Statementsfor additional information regardingExelon’s reportable segments.

Through itsbusiness servicessubsidiary BSC, Exelon providesitsoperatingsubsidiarieswithavarietyofsupport servicesat cost.

Thecostsoftheseservicesare directlychargedor allocatedto the applicable operatingsegments. Additionally, theresultsof

Exelon’s corporate operationsincludecostsfor corporate governanceandinterestcostsandincomefromvariousinvestment and

financingactivities.

Exelon’s consolidatedfinancial information includestheresultsofitsfour separate operatingsubsidiaryregistrants, Generation,

ComEd, PECO and BGE, which, alongwithExelon,are collectivelyreferredto astheRegistrants. Thefollowingcombined

Management’s Discussion andAnalysis ofFinancial Condition andResultsofOperationsisseparatelyfiledbyExelon,Generation,

ComEd, PECO and BGE. However,none oftheRegistrantsmakesanyrepresentation asto information relatedsolelyto anyofthe

other Registrants.

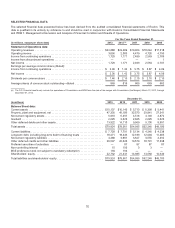

Financial Results. Thefollowingconsolidatedfinancial resultsreflecttheresultsofExelon for year endedDecember 31,2013

comparedto thesame periodin 2012.The 2012 financial resultsonlyincludethe operationsofConstellation and BGE fromthedate

ofthemerger withConstellation (theMerger), March 12,2012,through December 31,2012.All amountspresentedbeloware before

theimpactofincometaxes, except asnoted.

Resultsin 2013 were unfavorablyimpactedat Generation by continuingdeclinesin realizedpower andgasprices, in part driven by

theabundanceofnatural gassupply, continuedsluggish demandandsubsidizedrenewable generation;onlypartiallyoffset by

improvedreturnsat theutilities, andthe realization ofadditional post-merger synergiesandoperational excellenceacross all

businesses. Generation’s financial resultscontinue to bechallengedbylownatural gasprices, andbytheimpactsofexcess

generation fromsubsidizedrenewable energy, flat loadgrowthand distortedmarket designs, especiallyinits Midwestmarkets.

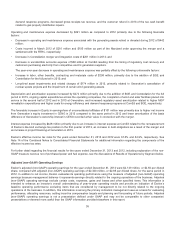

The Years Ended

December 31, Favorable

(Unfavorable)

Variance2013 2012

Operating revenues ................................................................. $24,888 $23,489 $1,399

Purchased power and fuel ........................................................... 10,72410,157 (567)

Revenue net of purchased power and fuel (a) ........................................... 14,164 13,332 832

Other operating expenses

Operatingandmaintenance........................................................ 7,2707,961691

Depreciation andamortization ...................................................... 2,1531,881(272)

Taxesother than income.......................................................... 1,095 1,019 (76)

Total other operatingexpenses ................................................. 10,51810,861343

33