ComEd 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.not segregatedproprietarytradingactivitywithinthefollowing discussion becauseofthe relativesizeofthe proprietarytrading

portfolioincomparison to Generation’s total gross marginfromcontinuingoperationsfor theyear endedDecember 31,2013 of

$7,433 million.

Fuel Procurement.Generation procurescoal andnatural gasthrough long-termandshort-termcontracts, andspot-market

purchases. Nuclear fuel assembliesare obtainedprimarilythrough long-termcontractsfor uraniumconcentrates, andlong-term

contractsfor conversion services, enrichment servicesandfuel fabrication services. Thesupplymarketsfor coal,natural gas,

uraniumconcentratesandcertainnuclear fuel servicesare subjecttopricefluctuationsandavailabilityrestrictions. Supplymarket

conditionsmaymakeGeneration’s procurement contractssubjecttocreditrisk relatedto the potential non-performanceof

counterpartiesto deliver thecontractedcommodityor serviceatthecontractedprices. Approximately60%ofGeneration’s uranium

concentrate requirementsfrom2014through 2018are suppliedbythree producers. Intheevent ofnon-performanceby theseor

other suppliers, Generation believesthat replacement uraniumconcentratescan beobtained, although at pricesthat maybe

unfavorable when comparedto thepricesunder thecurrent supplyagreements. Non-performanceby thesecounterpartiescould

haveamaterial impactonExelon’s andGeneration’s resultsofoperations, cash flows andfinancial positions. See Note 22 ofthe

CombinedNotesto ConsolidatedFinancial Statementsfor additional information regardinguraniumandcoal supplyagreement

matters.

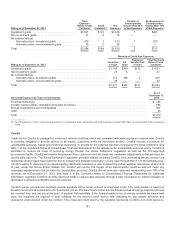

ComEd

Thefinancial swap contractbetween Generation andComEd wasdeemedprudent by theIllinois Settlement Legislation,thereby

ensuringthat ComEd wouldbe entitledto receivefull costrecoveryin rates. Thechangeinfairvalue each periodwasrecordedby

ComEd withan offset to a regulatoryasset or liability. This financial swap contractbetween Generation andComEd expiredon

May31,2013.All realizedimpactshavebeen includedinGeneration’s andComEd’s resultsofoperations.

ComEd enteredinto 20-year contractsfor renewable energy andRECs beginninginJune 2012.ComEd is permittedto recover its

renewable energy andREC costsfromretailcustomerswithno mark-up.The annual commitmentsrepresent themaximum

settlementswithsuppliersfor renewable energy andRECs under theexistingcontract terms. Pursuant to theICC’s Order on

December 19, 2012,ComEd’s commitmentsunder theexistinglong-termcontractswere reducedfor theJune 2013 through May

2014procurement period. TheICC’s December 18, 2013 order approvedthereduction ofComEd’s commitmentsunder the long-

termcontractsfor theJune 2014through May2015procurement period, however theamount ofthereduction will not befinalized

andapprovedbytheICC untilMarch 2014. See Notes3and12 oftheCombinedNotesto ConsolidatedFinancial Statementsfor

additional information regardingenergy procurement andderivatives.

PECO

PECO hascontractsto procure electric supplythat were executedthrough thecompetitive procurement process outlinedinits

PAPUC-approved DSP Programs, which are further discussedinNote 3 oftheCombinedNotesto theConsolidatedFinancial

Statements. PECO’s full requirementscontractsandblock contracts, which are consideredderivatives, qualify for the normal

purchasesandnormal salesscope exception under current derivative authoritativeguidanceandasaresult,are accountedfor on

an accrual basis ofaccounting. Under theDSP Programs, PECO is permittedto recover itselectric supplyprocurement costsfrom

retailcustomerswithno mark-up.

PECO hasalso enteredinto derivative natural gascontracts, which either qualify for the normal purchasesandnormal sales

exception or havenomark-to-market balancesbecausethederivativesare indexpriced, to hedgeitslong-termpricerisk inthe

natural gasmarket. PECO’s hedgingprogramfor natural gasprocurement hasno directimpactonitsfinancial position or resultsof

operationsasnatural gascostsare fullyrecoveredfromcustomersunder thePGC.

PECO doesnot enter into derivativesfor speculative or proprietarytradingpurposes. For additional information on thesecontracts,

see Note 12 oftheCombinedNotesto ConsolidatedFinancial Statements.

BGE

BGE procureselectric supplyfor default servicecustomersthrough full requirementsc

ontractspursuant to BGE’s MDPSC-approved

SOS program. BGE’s full requirementscontractsthat are consideredderivativesqualify for the normal purchasesandnormal sales

scope exception under current derivative authoritativeguidanceandasaresult,are accountedfor on an accrual basis ofaccounting.

Under theSOS program, BGE is permittedto recover itselectricityprocurement costsfromretailcustomers, plusan administrative

98