ComEd 2013 Annual Report Download - page 177

Download and view the complete annual report

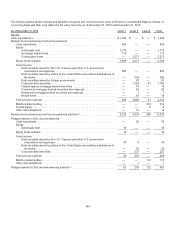

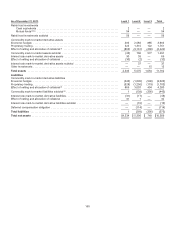

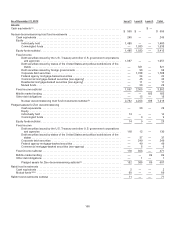

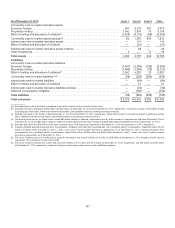

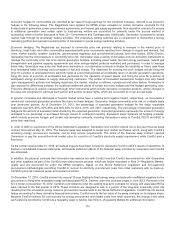

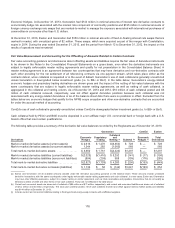

Please find page 177 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.theirConsolidatedBalanceSheets. Thevalue oftheRegistrants’ deferredcompensation obligationsisbasedon themarket value of

the participants’ notional investment accounts. The notional investmentsare comprisedprimarilyofmutual funds, which are based

on observable market prices. However,sincethedeferredcompensation obligationsthemselvesare not exchangedinanactive

market,theyare categorizedasLevel 2 inthefairvalue hierarchy.

Additional Information Regarding Level 3 Fair Value Measurements

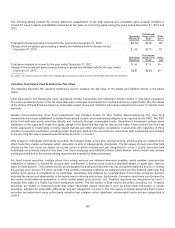

Mark-to-Market Derivatives. For valuationsthat includebothobservable andunobservable inputs, if the unobservable input is

determinedto besignificant to theoverall inputs, the entire valuation is categorizedinLevel 3. This includesderivativesvaluedusing

indicativepricequotationswhosecontract tenure extends into unobservable periods. Ininstanceswhere observable data is

unavailable,consideration is given to theassumptionsthat market participantswoulduseinvaluingtheasset or liability. This

includesassumptionsabout market risks such asliquidity, volatilityandcontractduration.Such instrumentsare categorizedinLevel

3asthemodel inputsgenerallyare not observable.Exelon’s RMC approvesrisk management policiesandobjectivesfor risk

assessment,control andvaluation,counterpartycredit approval,andthemonitoringandreportingofrisk exposures. TheRMC is

chairedbythechiefrisk officer andincludesthechieffinancial officer,corporate controller,general counsel,treasurer, vice president

ofstrategy, vice president ofauditservicesandofficersrepresentingExelon’s business units. TheRMC reportsto theExelon board

ofdirectorson thescope oftherisk management activitiesandisresponsible for approvingall valuation proceduresat Exelon.

Forwardpricecurvesfor thepower market utilizedbythefront officetomanagethe portfolio are reviewedandverifiedbythemiddle

officeandusedfor financial reportingbytheback office.TheRegistrantsconsider creditandnonperformancerisk inthevaluation of

derivativecontractscategorizedinLevel 2 and3,includingboth historical andcurrent market data initsassessment ofcreditand

nonperformancerisk by counterparty. Due to master nettingagreementsandcollateral postingrequirements, theimpactsofcredit

andnonperformancerisk were not material to thefinancial statements.

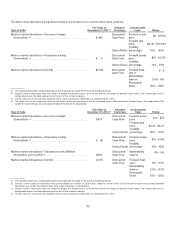

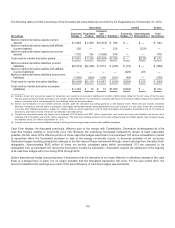

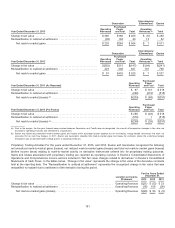

DisclosedbelowisdetailsurroundingtheRegistrants’ significant Level 3 valuations. Thecalculatedfairvalue includesmarketability

discountsfor marginingprovisionsandnotional size.Generation’s Level 3 balancegenerallyconsistsofforwardsalesand

purchasesofpower andnatural gas, coal purchases, certain transmission congestion contracts, andprojectfinancingdebt.

Generation utilizesvariousinputsandfactorsincludingmarket data andassumptionsthat market participantswoulduseinpricing

assetsor liabilitiesaswell asassumptionsabout therisks inherent intheinputsto thevaluation technique.Theinputsandfactors

includeforwardcommodityprices, commoditypricevolatility, contractual volumes, deliverylocation,interest rates, creditqualityof

counterpartiesandcreditenhancements.

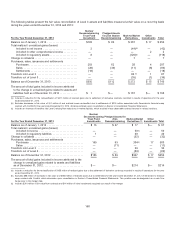

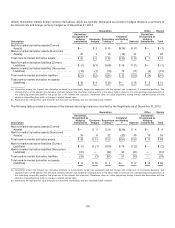

For commodityderivatives, theprimaryinput to thevaluation modelsistheforwardcommoditypricecurvefor each instrument.

Forwardcommoditypricecurvesare derivedbyrisk management for liquid locationsandbythe tradersandportfoliomanagersfor

illiquid locations. All locationsare reviewedandverifiedbyrisk management consideringpublishedexchange transaction prices,

executedbilateral transactions, broker quotes, andother observable or public data sources. The relevant forwardcommoditycurve

usedto value each ofthederivativesdepends on a number offactors, includingcommoditytype,deliverylocation,anddelivery

period. Pricevolatilityvariesbycommodityandlocation.When appropriate,Generation discountsfuture cash flows usingrisk free

interest rateswithadjustmentsto reflectthecreditqualityofeach counterpartyfor assetsandGeneration’s owncreditqualityfor

liabilities. Thelevel ofobservabilityofaforwardcommoditypriceis generallydue to thedeliverylocation anddeliveryperiod. Certain

deliverylocationsincluding PJM WestHub(for power)andHenryHub(for natural gas) are highlyliquid andpricesare observable

for up to three yearsinthefuture.Theobservabilityperiodofvolatilityisgenerallyshorter than theunderlyingpower curveusedin

option valuations. Theforwardcurvefor a less liquid location is estimatedbyusingtheforwardcurvefromtheliquid location and

applyingaspreadto represent thecost to transport thecommodityto thedeliverylocation. This spreaddoesnot typicallyrepresent a

majorityoftheinstrument’s market price.Asaresult,thechangeinfairvalue is closelytiedto liquid market movementsandnot a

changeinthe appliedspread. Thechangeinfairvalue associatedwithachangeinthespreadisgenerally immaterial.An average

spreadcalculatedacross all Level 3 power andgasdeliverylocationsisapproximately$3.92and$0.12 for power andnatural gas,

respectively. Manyofthecommodityderivativesare short termin nature andthusamajorityofthefairvalue maybebasedon

observable inputseven though thecontractasawhole mustbeclassifiedasLevel 3.See ITEM 7A.—QUANTITATIVE AND

QUALITATIVE DISCLOSURES ABOUT MARKET RISK for information regardingthematuritybyyear oftheRegistrant’s mark-to-

market derivativeassetsandliabilities.

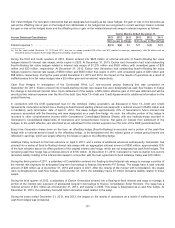

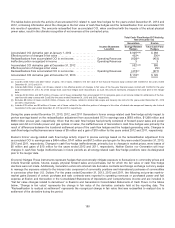

OnDecember 17, 2010,ComEd enteredinto several 20-year floatingto fixedenergy swap contractswithunaffiliatedsuppliersfor

the procurement oflong-termrenewable energy andassociatedRECs. See Note 12—DerivativeFinancial Instrumentsfor more

information.Thefairvalue oftheseswapshasbeen designatedasaLevel 3 valuation due to the longtenure ofthepositionsand

internal modelingassumptions. Themodelingassumptionsincludeusingnatural gasheat ratesto project longtermforwardpower

curvesadjustedbya renewable factor that incorporatestimeofdayandseasonalityfactorsto reflectaccurate renewable energy

pricing. Inaddition,marketabilityreservesare appliedto thepositionsbasedon the tenor andsupplier risk.

171