ComEd 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ComEd, PECO and BGE couldalsobesubjecttovariousDodd-FrankActrequirementsto theextent theyenter into Swap

transactions. However,at this time,management ofComEd, PECO and BGE do not expecttobemateriallyaffectedbythis

legislation.

Energy Infrastructure Modernization Act. Since 2011,ComEd’s distribution ratesare establishedthrough a performance-based

rate formula,pursuant to EIMA. EIMAalso providesastructure for substantial capital investment by utilitiesover a ten-year periodto

modernizeIllinois’ electric utilityinfrastructure.Participatingutilitiesare requiredto file an annual update to the performance-based

formula rate tariff on or before May1,withresultingrateseffectiveinJanuaryofthefollowingyear. This annual formula rate update

is basedon prior year actual costsandcurrent year projectedcapital additions. Theupdate alsoreconcilesany differencesbetween

therevenue requirement(s) ineffectfor theprior year andactual costsincurredfor that year.Throughout each year,ComEd records

regulatoryassetsor regulatoryliabilitiesandcorrespondingincreasesor decreasesto operatingrevenuesfor any differences

between therevenue requirement(s) ineffectandComEd’s bestestimate oftherevenue requirement expectedto be approvedby

theICC for that year’s reconciliation.

Formula Rate Tariff

InMarch 2013,theIllinois legislature passedSenate Bill 9to clarify theintent of EIMAonthethree issuesdecidedintheRehearing

Order:an allowedreturn on ComEd’s pension asset;theuseofyear-endrather than average rate baseandcapital structure inthe

annual reconciliation;andtheuseofComEd’s weightedaveragecostofcapital interest rate rather than a short-termdebt rate to

applyto the annual reconciliation.OnMay22,2013,Senate Bill 9becameeffectiveafter theIllinois legislature overrodethe

Governor’s veto ofthat Bill.OnJune 5, 2013,theICC approvedComEd’s updated distribution formula rate structure to reflectthe

impactsofSenate Bill 9.

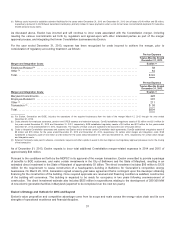

InOctober 2013,theICC openedan investigation (theInvestigation), inresponsetoacomplaint filedbytheIllinois AttorneyGeneral,

to changetheformula rate structure by requestingthree changes: theelimination oftheincometaxgross-up on theweighted

averagecostofcapital usedto calculate interestonthe annual reconciliation balance,the nettingofassociatedaccumulated

deferredincometaxesagainstthe annual reconciliation balanceincalculatinginterest,andtheuseofaverage rather than year-end

rate basefor determininganyROE collar adjustment.OnNovember 26, 2013,theICC issueditsfinal order intheInvestigation,

rejectingtwoofthe proposedchangesbut acceptingthe proposedchangetoeliminate theincometaxgross-up on theweighted

averagecostofcapital usedto calculate interestonthe annual reconciliation balance.Theacceptedchangebecameeffectivein

January2014, andisestimatedto reduceComEd’s 2014revenue by approximately$8million.ComEd andintervenorsrequested

rehearing, however all rehearingrequestswere deniedbytheICC. ComEd andintervenorshavefiledappealswiththeIllinois

Appellate Court.ComEd cannot predicttheresultsofanysuch appeals. See 3—RegulatoryMattersoftheCombinedNotesto

ConsolidatedFinancial Statementsfor additional information.

Annual Reconciliation

OnMay30,2013,ComEd updateditsrevenue requirement allowedintheDecember 2012 Order to reflecttheimpactsofSenate Bill

9, which resultedinareduction to thecurrent revenue requirement ineffectof$14million.The ratestookeffectinJuly2013.

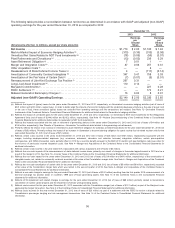

2013 Filing. On April29, 2013,ComEd fileditsannual distribution formula rate, which wasupdatedon May30,2013 to reflectthe

impactsofSenate Bill 9. TheICC’s final order, issuedon December 19, 2013,increasedtherevenue requirement by $341million,

reflectingan increaseof$160million for theinitial revenue requirement for 2013 andan increaseof$181million for the annual

reconciliation for 2012.The rate increasewasset usingan allowedreturn on capital of 6.94% (inclusiveofan allowedreturn on

common equityof 8.72%). The ratestookeffectinJanuary2014. ComEd requestedarehearingon specific issues, which was

deniedbytheICC. ComEd andintervenorsalsofiledappeals. ComEd cannot predicttheresultsofanysuch

appeals. See 3—RegulatoryMattersoftheCombinedNotesto ConsolidatedFinancial Statementsfor additional information.

FERC Ameren Order. InJuly2012,FERC issuedan order to Ameren Corporation (Ameren)findingthat Ameren hadimproperly

includedacquisition premiums/ goodwill initstransmission formula rate,particularlyinitscapital structure andinthe application of

AFUDC. FERCalsodirectedAmeren to makerefunds for theimpliedincreasein ratesinprior years. Ameren hasfiledfor rehearing

regardingtheJuly2012 FERCorder.ComEd believesthat theFERCorder authorizingitstransmission formula rate is

distinguishable fromthecircumstancesthat ledto theJuly2012 FERCorder intheAmeren case.However,ifComEd were required

to excludeacquisition premiums/ goodwill fromitstransmission formula rate,theimpactcouldbematerial to ComEd’s resultsof

operationsandcash flows.

46