ComEd 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

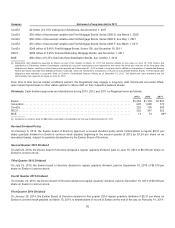

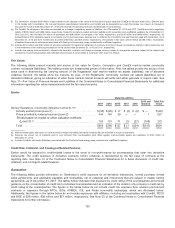

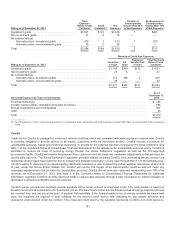

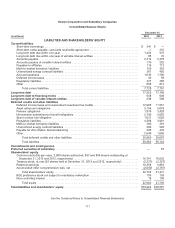

Rating as of December 31, 2013

Total

Exposure

Before Credit

Collateral

Credit

Collateral (a)

Net

Exposure

Number of

Counterparties

Greater than 10%

of Net Exposure

Net Exposure of

Counterparties

Greater than 10%

of Net Exposure

Investment grade............................... $1,621 $172$1,449 1$491

Non-investment grade........................... 27918— —

Noexternal ratings

Internallyrated—investment grade............. 41614151226

Internallyrated—non-investment grade......... 30 2 28— —

Total ......................................... $2,094 $184 $1,910 2 $717

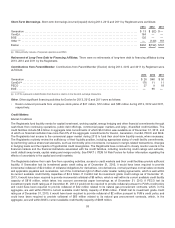

Maturity of Credit Risk Exposure

Rating as of December 31, 2013

Less than

2 Years

2-5

Years

Exposure

Greater than

5 Years

Total Exposure

Before Credit

Collateral

Investment grade..................................................... $1,146 $340$135$1,621

Non-investment grade................................................. 23 4— 27

Noexternal ratings

Internallyrated—investment grade................................... 2721386 416

Internallyrated—non-investment grade............................... 30 —— 30

Total ............................................................... $1,471$482$141$2,094

Net Credit Exposure by Type of Counterparty

As of

December 31,

2013

Financial Institutions ................................................................................ $ 256

Investor-ownedutilities, marketersandpower producers................................................... 684

Energy cooperativesandmunicipalities ................................................................. 907

Other ............................................................................................. 63

Total ............................................................................................. $1,910

(a)AsofDecember 31,2013,creditcollateral heldfromcounterpartieswhere Generation hadcreditexposure included$155 million ofcash and$29million oflettersof

credit.

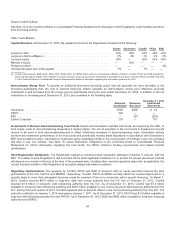

ComEd

Creditrisk for ComEd is managedbycreditandcollection policies, which are consistent withstate regulatoryrequirements. ComEd

is currentlyobligatedto provideservice to all electric customerswithinitsfranchisedterritory. ComEd records a provision for

uncollectible accounts, basedupon historical experience,to providefor the potential loss fromnonpayment by thesecustomers. See

Note 1 oftheCombinedNotesto ConsolidatedFinancial Statementsfor the allowancefor uncollectible accountspolicy. ComEd is

permittedto recover itscostsofprocuringenergy through theIllinois Settlement Legislation aswell astheICC-approved

procurement tariffs. ComEd will monitor nonpayment fromcustomersandwill makeanynecessaryadjustmentsto the provision for

uncollectible accounts. TheIllinois Settlement Legislation prohibitsutilities, includingComEd, fromterminatingelectric servicetoa

residential electric spaceheat customer due to nonpayment between December 1 ofanyyear through March 1ofthefollowingyear.

ComEd’s abilityto disconnect non space-heatingresidential customersisalsoimpactedbycertainweather restrictions, at anytime

ofyear,under theIllinois Public UtilitiesAct.ComEd will monitor theimpactofits disconnection practicesandwill makeany

necessaryadjustmentsto the provision for uncollectible accounts. ComEd did not haveanycustomersrepresentingover 10%ofits

revenuesasofDecember 31,2013.See Note 3 oftheCombinedNotesto ConsolidatedFinancial Statementsfor additional

information regardingComEd’s recentlyapprovedtariffs to adjust ratesannuallythrough arider mechanism to reflectincreasesor

decreasesin annual uncollectible accountsexpense.

ComEd’s power procurement contractsprovidesupplierswithacertainamount ofunsecuredcredit.Thecreditposition is basedon

forwardmarket pricescomparedto thebenchmarkprices. Thebenchmarkpricesare theforwardpricesofenergy projectedthrough

thecontract termandare set at thepoint ofsupplier bid submittals. If theforwardmarket priceofenergy exceeds thebenchmark

price,thesuppliersare requiredto postcollateral for thesecuredcredit portion after adjustingfor anyunpaid deliveriesand

unsecuredcredit allowedunder thecontract.TheunsecuredcreditusedbythesuppliersrepresentsComEd’s net creditexposure.

101