ComEd 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

accountingguidancerequiredGeneration to establish an AROat fairvalue at thetimeoftheinitial adoption ofthecurrent accounting

standard. Subsequent to theinitial adoption,theAROisadjustedfor changesto estimatedcosts, timingoffuture cash flows and

modificationsto decommissioningassumptions, asdescribedabove.

Under thecurrent accountingframework, theAROisnot requiredor permittedto bere-measuredfor changesintheCARFRthat

occur inisolation. This differsfromtheaccountingrequirementsfor other long-datedobligations, such aspension andother post-

employment benefitsthat are requiredto bere-measuredasandwhen corresponding discount rateschange.IfGeneration’s future

nominal cash flows associatedwiththeAROwere to bediscountedat current prevailingCARFRs, theobligation wouldincrease

fromapproximately $4.9 billion to approximately $5.5 billion.The ultimate decommissioningobligation will befundedbytheNDTs.

TheNDTs are recordedon Exelon’s andGeneration’s ConsolidatedBalanceSheetsat December 31,2013 at fairvalue of

approximately $8.1billion andhaveanestimatedtargetedannual pre-taxreturn of 5.9 % to 6.7 %.

Toillustrate thesignificant impactthat changesintheCARFR,when combinedwithchangesin projectedamountsandexpected

timingofcash flows, can haveonthevaluation oftheARO: i) hadGeneration usedthe 2012 CARFRsrather than the 2013 CARFRs

in performingitsthirdquarter 2013 AROupdate,Generation wouldhavereducedtheARObyapproximately$10 million as

comparedto theactual decreasetotheAROof$140million;and ii) if theCARFRusedin performingthethirdquarter 2013 ARO

update (which alsoreflectedincreasesintheamountsandchangesto thetimingofprojectedcash flows) wasincreasedor

decreasedby100 basis points, theAROwouldhavedecreasedby$300 million andincreased$40million,respectively, as

comparedto theactual decreaseof$140million.

ARO Sensitivities. Changesintheassumptionsunderlyingtheforegoingitems couldmateriallyaffectthedecommissioning

obligation.TheimpacttotheAROofachangeinanyone oftheseassumptions is highlydependent on howtheother assumptions

will changeaswell.Asan example,Exelon hadahistorical increaseofapproximately $670million inthevalue oftheARO which

wasdriven by Generation modifyingtheassumedtimingoftheDOE acceptanceof SNF for disposal from2020 to 2025. The

modification oftheassumed DOE acceptancedate affectedthecalculation oftheAROinisolation asfollows; i) thechangeinthe

timingof DOE acceptanceof SNF increasedthe total number ofyearsinwhich decommissioningactivitiesare estimatedto occur,

by fiveyearson average,thereby increasingthe total expectednominal cash flows requiredto decommission theunits; ii) the

nominal cash flows were subjectedto additional escalation asaresult oftheextension ofthedecommissioningperiodincreasingthe

total estimatedcostsrequiredto decommission theunits; and iii) theescalatedcash flows were discountedat thethen current

CARFRs which haddramaticallydecreasedduringthat time period.

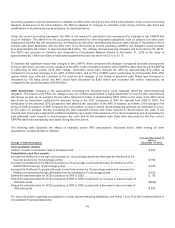

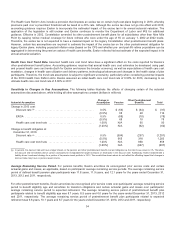

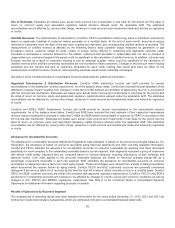

Thefollowingtable illustratestheeffectsofchangingcertainAROassumptions, discussedabove, while holdingall other

assumptionsconstant (dollarsinmillions):

Change in ARO Assumption

Increase (Decrease) to

ARO at

December 31, 2013

Cost escalation studies

Uniformincreaseinescalation ratesof25basis points ............................................. $560

Probabilistic cash flow models

Increasethelikelihoodofthehigh-costscenarioby 10 percentagepointsanddecreasethelikelihoodofthe

low-costscenarioby 10 percentagepoints ..................................................... $190

IncreasethelikelihoodoftheDECON scenarioby 10 percentagepointsanddecreasethelikelihoodofthe

SAFSTORscenarioby 10 percentagepoints ................................................... $290

Increasethelikelihoodofoperatingthrough current licensel

ivesby10 percentagepointsanddecreasethe

likelihoodofoperatingthrough anticipatedlicense renewalsby10 percentagepoints .................. $430

Extendtheestimateddate for DOE acceptanceof SNF to 2030 ...................................... $ 50

Extendtheestimateddate for DOE acceptanceo

f SNF to 2030 coupledwithan increaseindiscount ratesof

100 basis points ........................................................................... $(230)

Extendtheestimateddate for DOE acceptanceof SNF to 2030 coupledwithadecreaseindiscount ratesof

100 basis points ........................................................................... $600

For more information regardingaccountingfor nuclear decommissioningobligations, see Notes1and15oftheCombinedNotesto

ConsolidatedFinancial Statements.

49