ComEd 2013 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Credit Risk

TheRegistrantswouldbeexposedto credit-relatedlossesintheevent ofnon-performanceby counterpartiesthat enter into

derivativeinstruments. Thecreditexposure ofderivativecontracts, before collateral,isrepresentedbythefairvalue ofcontractsat

the reportingdate.For energy-relatedderivativeinstruments, Generation entersinto enablingagreementsthat allowfor payment

nettingwithitscounterparties, which reducesGeneration’s exposure to counterpartyrisk by providingfor theoffset ofamounts

payable to thecounterpartyagainstamountsreceivable fromthecounterparty. Typically, each enablingagreement is for a specific

commodityandso,withrespecttoeach individual counterparty, nettingislimitedto transactionsinvolvingthat specific commodity

product,except where master nettingagreementsexistwithacounterpartythat allowfor cross product netting. Inaddition to

payment nettinglanguageinthe enablingagreement,Generation’s creditdepartment establishescreditlimits, marginingthresholds

andcollateral requirementsfor each counterparty, which are definedinthederivativecontracts. Counterpartycreditlimitsare based

on an internal creditreviewprocess that considersavarietyoffactors, includingtheresultsofascoringmodel,leverage,liquidity,

profitability, credit ratings by credit ratingagencies, andrisk management capabilities. Totheextent that a counterparty’s margining

thresholds are exceeded, thecounterpartyisrequiredto postcollateral withGeneration asspecifiedineach enablingagreement.

Generation’s creditdepartment monitorscurrent andforwardcreditexposure to counterpartiesandtheiraffiliates, bothon an

individual andan aggregate basis.

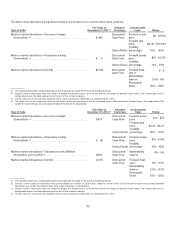

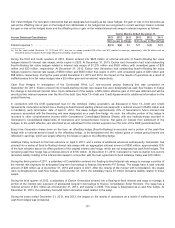

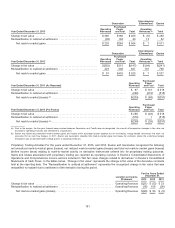

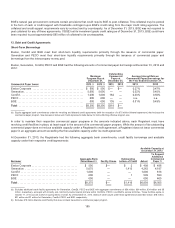

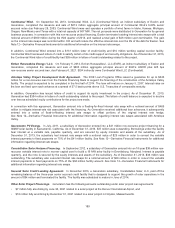

Thefollowingtablesprovideinformation on Generation’s creditexposure for all derivativeinstruments, NPNS, andapplicable

payablesandreceivables, net ofcollateral andinstrumentsthat are subjecttomaster nettingagreements, asofDecember 31,2013.

Thetablesfurther delineate that exposure by credit ratingofthecounterpartiesandprovideguidanceontheconcentration ofcredit

risk to individual counterparties. Thefiguresinthetablesbelowdo not includecreditrisk exposure fromuraniumprocurement

contractsor exposure through RTOs, ISOs, NYMEX, ICE andNodal commodityexchanges, further discussedinITEM 7A—

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK. Additionally, thefiguresinthetablesbelowdo not

includeexposureswithaffiliates, includingnet receivableswithComEd, PECO and BGE of$38million,$38million and$27million,

respectively.

Rating as of December 31, 2013

Total

Exposure

Before Credit

Collateral

Credit

Collateral (a)

Net

Exposure

Number of

Counterparties

Greater than 10%

of Net Exposure

Net Exposure of

Counterparties

Greater than 10%

of Net Exposure

Investment grade............................... $1,621 $172$1,449 $ 1$491

Non-investment grade........................... 27918— —

Noexternal ratings ..............................

Internallyrated—investment grade............. 41614151226

Internallyrated—non-investment grade......... 30 2 28— —

Total ......................................... $2,094 $184 $1,910 $2$717

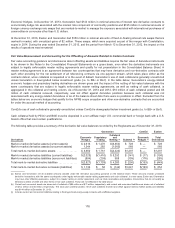

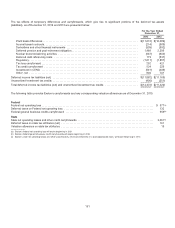

Net Credit Exposure by Type of Counterparty December 31, 2013

Financial Institutions ............................................................................ $ 256

Investor-ownedutilities, marketers, power producers.................................................. 684

Energy cooperativesandmunicipalities............................................................. 907

Other ......................................................................................... 63

Total ......................................................................................... $1,910

(a)AsofDecember 31,2013,creditcollateral heldfromcounterpartieswhere Generation hadcreditexposure included$155 million ofcash and$29million oflettersof

credit.

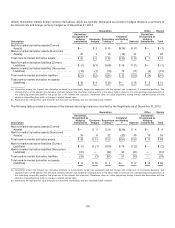

ComEd’s power procurement contractsprovidesupplierswithacertainamount ofunsecuredcredit.Thecreditposition is basedon

forwardmarket pricescomparedto thebenchmarkprices. Thebenchmarkpricesare theforwardpricesofenergy projectedthrough

thecontract termandare set at thepoint ofsupplier bid submittals. If theforwardmarket priceofenergy exceeds thebenchmark

price,thesuppliersare requiredto postcollateral for thesecuredcredit portion after adjustingfor anyunpaid deliveriesand

unsecuredcredit allowedunder thecontract.TheunsecuredcreditusedbythesuppliersrepresentsComEd’s net creditexposure.

AsofDecember 31,2013,ComEd’s creditexposure to supplierswas immaterial.

ComEd is permittedto recover itscostsofprocuringenergy through theIllinois Settlement Legislation.ComEd’s counterpartycredit

risk is mitigatedbyitsabilityto recover realizedenergy coststhrough customer rates. See Note 3—RegulatoryMattersfor additional

information.

182