ComEd 2013 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

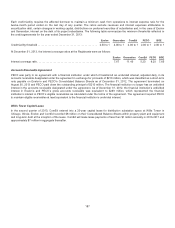

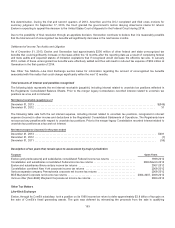

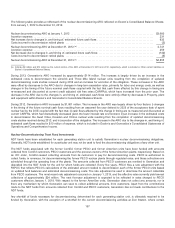

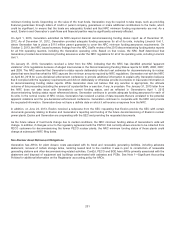

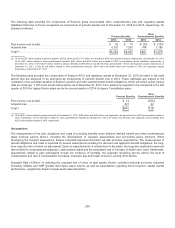

Thefollowingtable providesa rollforwardofthenuclear decommissioningAROreflectedon Exelon’s ConsolidatedBalanceSheets,

fromJanuary1,2012 to December 31,2013:

Nuclear decommissioningAROat January1,2012 ............................................................ $3,680

Accretion expense....................................................................................... 231

Net increasedue to changesin,andtimingof, estimatedfuture cash flows ......................................... 833

Costsincurredto decommission retiredplants ................................................................ (3)

Nuclear decommissioningAROat December 31,2012 (a)....................................................... 4,741

Accretion expense....................................................................................... 259

Net decreasedue to changesin,andtimingof, estimatedfuture cash flows ........................................ (140)

Costsincurredto decommission retiredplants ................................................................ (5)

Nuclear decommissioningAROat December 31,2013 (a)....................................................... $4,855

(a)Includes$9million and$10 million asthecurrent portion oftheAROat December 31,2013 and2012,respectively, which is includedinOther current liabilitieson

Exelon’s ConsolidatedBalanceSheets.

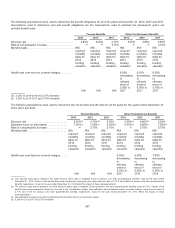

During2013,Generation’s AROincreasedbyapproximately$114million.Theincreaseis largelydriven by an increaseinthe

estimatedcoststo decommission theLimerick andThree Mile Islandnuclear unitsresultingfromthecompletion ofupdated

decommissioningcostsstudiesreceivedduring2013 andan increasefor accretion oftheobligation.TheseincreasesintheARO

were offset by decreasesto theAROdue to changesin long-termescalation rates, primarilyfor labor andenergy costs, aswell as

changesinthetimingofthefuture nominal cash flows coupledwiththefactthat cash flows affectedbythis changeintimingare

re-measuredand discountedat current creditadjustedrisk free rates(CARFRs), which haveincreasedfromtheprior year.The

decreaseintheAROdue to thechangesin,andtimingof, estimatedcash flows were entirelyoffset by decreasesinProperty, plant

andequipment withinExelon’s andGeneration’s ConsolidatedBalanceSheets.

During2012,Generation’s AROincreasedby$1,061million.TheincreaseintheAROwaslargelydriven by four factors: i) changes

inthetimingofthefuture nominal cash flows resultingfroman assumed fiveyear deferral to 2025oftheacceptancedate ofspent

nuclear fuel by theDOE coupledwiththefactthat; ii) cash flows affectedbythis changeintimingare re-measuredand discountedat

current CARFRs, which haddramaticallydecreased given thelower interest rate environment; iii) an increaseintheestimatedcosts

to decommission theQuadCities, Dresden andClinton nuclear unitsresultingfromthecompletion ofupdateddecommissioning

costsstudiesreceivedduring2012;and iv) accretion oftheobligation.TheincreaseintheAROdue to thechangesin,andtimingof,

estimatedcash flows resultedin$10 million ofexpense, which is includedinExelon’s andGeneration’s ConsolidatedStatementsof

OperationsandComprehensiveIncome.

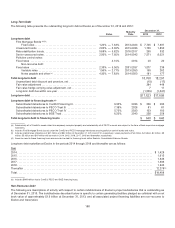

Nuclear Decommissioning Trust Fund Investments

NDT funds havebeen establishedfor each generatingstation unittosatisfy Generation’s nuclear decommissioningobligations.

Generally, NDT funds establishedfor a particular unitmaynot beusedto fundthedecommissioningobligationsofanyother unit.

TheNDT funds associatedwiththeformer ComEd, former PECO andformer AmerGen unitshavebeen fundedwithamounts

collectedfromComEd customers, PECO customersandthe previousownersoftheformer AmerGen plants, respectively. Basedon

an ICC order,ComEd ceasedcollectingamountsfromitscustomersto payfor decommissioningcosts. PECO is authorizedto

collectfunds, inrevenues, for decommissioningtheformer PECO nuclear plantsthrough regulatedrates, andthesecollectionsare

scheduledthrough the operatinglivesofthe plants. Theamountscollectedfrom PECO customersare remittedto Generation and

depositedinto theNDT funds for theunitfor which funds are collected. Every fiveyears, PECO filesa rate adjustment withthe

PAPUC that reflects PECO’s calculationsoftheestimatedamount neededto decommission each oftheformer PECO unitsbased

on updatedfundbalancesandestimateddecommissioningcosts. The rate adjustment is usedto determine theamount collectible

from PECO customers. Themostrecent rate adjustment occurredon January1,2013,andtheeffective ratescurrentlyyieldannual

collectionsofapproximately$24million.Thenextfive-year adjustment is expectedto bereflectedin rateschargedto PECO

customerseffectiveJanuary1,2018. Withrespecttotheformer AmerGen units, Generation doesnot collectanyamounts, nor is

there anymechanism by which Generation can seekto collectadditional amounts, fromcustomers. Apart fromthecontributions

madetotheNDT funds fromamountscollectedfromComEd and PECO customers, Generation hasnot madecontributionsto the

NDT funds.

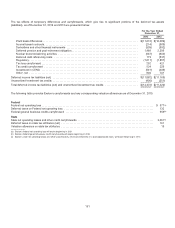

Anyshortfall offunds necessaryfor decommissioning, determinedfor each generatingstation unit,isultimatelyrequiredto be

fundedbyGeneration,withtheexception ofashortfall for thecurrent decommissioningactivitiesat Zion Station,where certain

197