ComEd 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

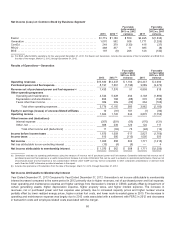

Mark-to-market

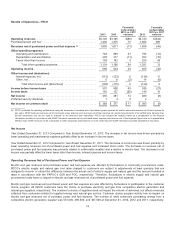

Year Ended December 31, 2013 Compared to Year Ended December 31, 2012.Generation is exposedto market risks associated

withchangesincommoditypricesandentersinto economic hedgesto mitigate exposure to thesefluctuations. Mark-to-market gains

on economic hedgingactivitieswere $504million in 2013 comparedto gainsof$515million in 2012.See Notes11 and12 ofthe

CombinedNotesto theConsolidatedFinancial Statementsfor information on gainsandlossesassociatedwithmark-to-market

derivatives.

Year Ended December 31, 2012 Compared to Year Ended December 31, 2011.Generation is exposedto market risks associated

withchangesincommoditypricesandentersinto economic hedgesto mitigate exposure to thesefluctuations. Mark-to-market gains

on economic hedgingactivitieswere $515million in 2012 comparedto lossesof$288 million in 2011.See Note 11 and12 ofthe

CombinedNotesto theConsolidatedFinancial Statementsfor information on gainsandlossesassociatedwithmark-to-market

derivatives.

Other

Year Ended December 31, 2013 Compared to Year Ended December 31, 2012. The$627million increaseinother revenue net of

purchasedpower andfuel wasprimarilydue to reducedamortization expenseoftheacquiredenergy contractsrecordedat fairvalue

at themerger date.Inaddition,theincreaseis also attributable to resultsfromactivitiesacquiredaspart ofthe 2012 merger with

Constellation includingretailgas, energy efficiency, energy management anddemandresponse,upstreamnatural gas, andthe

designandconstruction ofrenewable energy facilities. Theseincreaseswere partiallyoffset by thereduction inrevenuesnet of

purchasedpower andfuel expensefromthesale ofBrandon Shores, H.A.Wagner and C.P. Crane,thegeneratingfacilities divested

inthefourthquarter of2012 asaresult oftheExelon andConstellation merger.See Note 4oftheCombinedNotesto Consolidated

Financial Statementsfor information regardingcontractintangiblesandassetsplannedfor divestiture asaresult oftheConstellation

merger.

Year Ended December 31, 2012 Compared to Year Ended December 31, 2011. The$510 million decreaseinother revenue net of

purchasedpower andfuel wasprimarilydue to increasedamortization expenseoftheacquiredenergy contractsrecordedat fair

value at themerger date. This decreasewaspartiallyoffset by resultsfromactivitiesacquiredaspart ofthe 2012 merger with

Constellation includingretailgas, energy efficiency, energy management anddemandresponse,upstreamnatural gasandthe

designandconstruction ofrenewable energy facilities. Inaddition,other revenue net ofpurchasedpower andfuel includesthe

resultsofBrandon Shores, H.A.Wagner and C.P. Crane,thegeneratingfacilities divestedinfourthquarter of2012 asaresult ofthe

Exelon andConstellation merger.See Note 4oftheCombinedNotesto ConsolidatedFinancial Statementsfor information regarding

contractintangiblesandassetsplannedfor divestiture asaresult oftheConstellation merger.

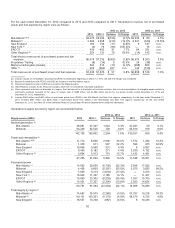

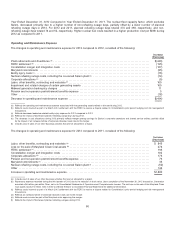

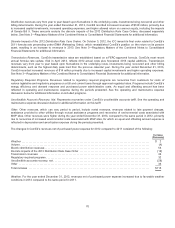

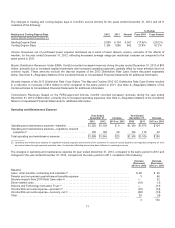

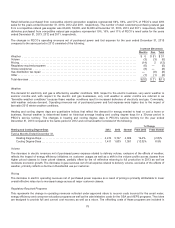

Nuclear Fleet Capacity Factor and Production Costs

Thefollowingtable presentsnuclear fleet operatingdata for 2013,ascomparedto 2012 and2011,for theGeneration-operated

plants. Thenuclear fleet capacityfactor presentedinthetable is definedasthe ratiooftheactual output ofa plant over a periodof

timetoitsoutput if the plant hadoperatedat full average annual mean capacityfor that time period. Nuclear fleet production costis

definedasthecoststo produce one MWh ofenergy, includingfuel,materials, labor,contractingandother miscellaneouscosts, but

excludesdepreciation andcertainother non-production relatedoverheadcosts. Generation considerscapacityfactor andproduction

costsuseful measuresto analyzethenuclear fleet performancebetween periods. Generation hasincludedthe analysis belowasa

complement to thefinancial information providedinaccordancewithGAAP. However,thesemeasuresare not a presentation

definedunder GAAPandmaynot becomparable to other companies’ presentationsor bemore useful than theGAAPinformation

providedelsewhere inthis report.

2013 2012 2011

Nuclear fleet capacityfactor (a)............................................................. 94.1%92.7% 93.3%

Nuclear fleet production cost per MWh (a)..................................................... $19.83$19.50$18.86

(a) ExcludesSalem, which is operated by PSEG Nuclear, LLC, and CENG’s nuclear facilities, which are operated by CENG. Reflectsownership percentageofstations

operatedbyExelon.

Year Ended December 31, 2013 Compared to Year Ended December 31, 2012.Thenuclear fleet capacityfactor, which excludes

Salem, increasedprimarilydue to a lower number ofplannedrefuelingoutagedays in 2013,partiallyoffset by ahigher number of

non-refuelingoutagedays. For 2013 and2012,plannedrefuelingoutagedays totaled233 and274, respectively, andnon-refueling

outagedays totaled75and73,respectively. Higher nuclear fuel costsand higher plant operatingandmaintenancecosts, partially

offset by higher number ofnet MWhs generatedresultedinahigher production cost per MWh during2013 ascomparedto 2012.

65