ComEd 2013 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

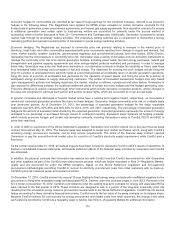

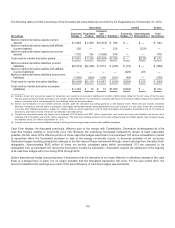

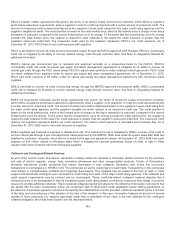

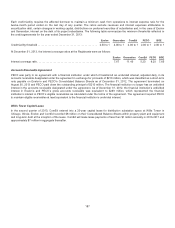

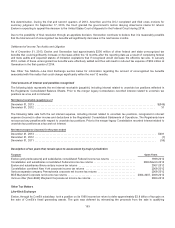

Theaggregate fairvalue ofall derivativeinstrumentswithcredit-risk-relatedcontingent featuresinaliabilityposition that are not fully

collateralized(excludingtransactionson theexchangesthat are fullycollateralized) is detailedinthetable below:

For the Years Ended December 31,

Credit-Risk Related Contingent Feature 2013 2012

Gross FairValue ofDerivativeContractsContainingthis Feature (a)......................... $(1,056) $(1,849)

OffsettingFairValue ofIn-the-MoneyContractsUnder Master NettingArrangements(b) ......... $ 846 $1,426

Net FairValue ofDerivativeContractsContaining This Feature (c) ....................... $ (210)$(423)

(a)Amount representsthegross fairvalue ofout-of-the-moneyderivativecontractscontainingcredit-risk-relatedcontingent ignoringtheeffectsofmaster netting

agreements.

(b) Amount representstheoffsettingfairvalue ofin-the-moneyderivativecontractsunder legallyenforceable master nettingagreementswiththesamecounterparty,

which reducestheamount ofanyliabilityfor which aRegistrant couldpotentiallyberequiredto postcollateral.

(c) Amount representsthe net fairvalue ofout-of-the-moneyderivativecontractscontainingcredit-risk relatedcontingent featuresafter consideringthemitigatingeffects

ofoffsettingpositionsunder master nettingarrangementsandreflectstheactual net liabilityupon which anypotential contingent collateral obligationswouldbe

based.

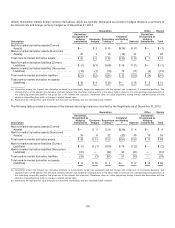

Generation hadcash collateral postedof$72million,lettersofcreditpostedof$364 million,cash collateral heldof$206million and

lettersofcreditheldof$34million asofDecember 31,2013 for counterpartieswithderivativepositions. Generation hadcash

collateral postedof$527million andlettersofcreditpostedof $563million andcash collateral heldof $499 million andlettersof

creditheldof $45 million at December 31,2012 for counterpartieswithderivativepositions. Intheevent ofacreditdowngradebelow

investment grade(i.e. BB+ or Ba1), Generation couldberequiredto postadditional collateral of$2.0billion asofDecember 31,2013

andDecember 31,2012.Theseamountsrepresent the potential additional collateral requiredafter givingconsideration to offsetting

derivativeandnon-derivativepositionsunder master nettingagreements.

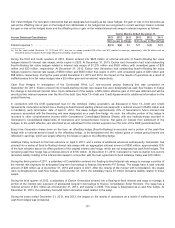

Generation’s andExelon’s interest rate swapscontain provisionsthat,intheevent ofamerger,ifGeneration’s debt ratings were to

materiallyweaken,itwouldbeinviolation ofthese provisions, resultingintheabilityofthecounterpartyto terminate theagreement

prior to maturity. Collateralization wouldnot berequiredunder anycircumstance.Termination oftheagreement couldresult ina

settlement payment by Exelon or thecounterpartyon anyinterest rate swap in a net liabilityposition.Thesettlement amount would

beequal to thefairvalue oftheswap on the termination date.AsofDecember 31,2013,Generation’s andExelon’s swapswere in

an asset position,withafairvalue of$18million and$21 million,respectively. See Note 24—Segment Information for additional

information regardingthe lettersofcreditsupportingthecash collateral.

Generation enteredinto supplyforwardcontractswithcertainutilities, including PECO and BGE, withone-sidedcollateral postings

onlyfromGeneration.Ifmarket pricesfall belowthebenchmarkpricelevelsinthesecontracts, theutilitiesare not requiredto post

collateral.However,when market pricesriseabovethebenchmarkpricelevels, counterpartysuppliers, includingGeneration,are

requiredto postcollateral oncecertainunsecuredcreditlimitsare exceeded. Under the terms ofComEd’s standardblock energy

contracts, collateral postings are one-sidedfromsuppliers, includingGeneration,shouldexposuresbetween market pricesand

benchmarkpricesexceedestablishedunsecuredcreditlimitsoutlinedinthecontracts. AsofDecember 31,2013,ComEd held

neither cash nor lettersofcreditfor the purposeofcollateral fromsuppliersinassociation withenergy procurement contracts. Under

the terms ofComEd’s annual renewable energy contracts, collateral postings are requiredto cover a fixedvalue for RECs only. In

addition,under the terms ofComEd’s long-termrenewable energy contracts, collateral postings are requiredfromsuppliersfor both

RECs andenergy. TheREC portion is afixedvalue andthe energy portion is one-sidedfromsuppliersshouldtheforwardmarket

pricesexceedcontractprices. AsofDecember 31,2013,ComEd heldapproximately$19million intheformofcash andlettersof

creditasmarginfor boththe annual andlong-termREC obligations. See Note 1—Significant AccountingPoliciesfor additional

information.

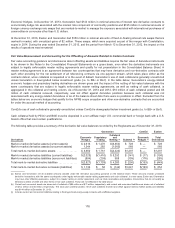

PECO’s natural gasprocurement contractscontain provisionsthat couldrequire PECO to postcollateral. This collateral maybe

postedintheformofcash or creditsupport withthresholds contingent upon PECO’s credit ratingfromthemajor credit rating

agencies. Thecollateral andcreditsupport requirementsvarybycontractandbycounterparty. AsofDecember 31,2013, PECO

wasnot requiredto postcollateral for anyoftheseagreements. If PECO lostitsinvestment gradecredit ratingasofDecember 31,

2013, PECO couldhavebeen requiredto post approximately$42million ofcollateral to itscounterparties.

PECO’s supplier master agreementsthat govern the terms ofits DSP Programcontractsdo not contain provisionsthat wouldrequire

PECO to postcollateral.

BGE’s full requirementswholesale power agreementsthat govern the terms ofitselectric supplyprocurement contractsdo not

contain provisionsthat wouldrequire BGE to postcollateral.

184