ComEd 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

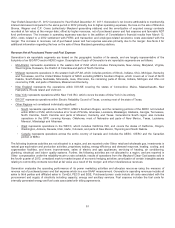

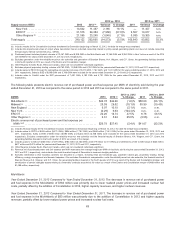

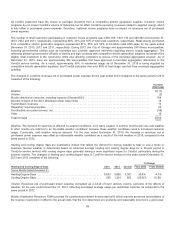

Year Ended December 31, 2012 Compared to Year Ended December 31, 2011. Generation’s net income attributable to membership

interestdecreasedcomparedto thesame periodin 2012 primarilydue to higher operatingexpenses, theloss on thesale ofBrandon

Shores, Wagner and C.P. Crane (collectivelyMarylandgeneratingstations) andtheamortization ofacquiredenergy contracts

recordedat fairvalue at themerger date;offset by higher revenues, net ofpurchasedpower andfuel expenseandfavorable NDT

fundperformance.Theincreasein operatingexpenseswasdue to theaddition ofConstellation’s financial resultsfromMarch 12,

2012,costsrelatedto a 2012 settlement withFERCandtransaction andemployee-relatedseverancecostsassociatedwiththe

merger.Theincreaseinrevenues, net ofpurchasedpower andfuel expensewasalsoprimarilydue to themerger.See Note 4for

additional information regardingtheloss on thesale ofthree Marylandgeneratingstations.

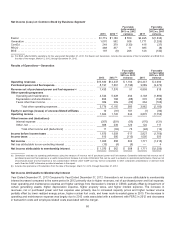

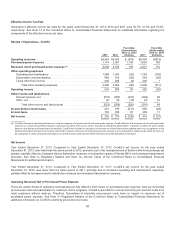

Revenue Net of Purchased Power and Fuel Expense

Generation’s six reportable segmentsare basedon thegeographic location ofitsassets, andare largelyrepresentativeofthe

footprintsofan ISO/RTO and/or NERCregion.Descriptionsofeach ofGeneration’s six reportable segmentsare asfollows:

• Mid-Atlantic representsoperationsintheeastern halfof PJM, which includesPennsylvania,NewJersey, Maryland, Virginia,

WestVirginia,Delaware,theDistrictofColumbiaandpartsofNorthCarolina.

• Midwest representsoperationsinthewestern halfof PJM, which includesportionsofIllinois, Indiana, Ohio, Michigan,Kentucky

andTennessee,andtheUnitedStatesfootprint of MISO excluding MISO’s Southern Region, which coversall or mostofNorth

Dakota,SouthDakota,Nebraska,Minnesota,Iowa, Wisconsin,theremainingpartsofIllinois, Indiana, Michigan and Ohio not

covered by PJM, andpartsofMontana, MissouriandKentucky.

•NewEnglandrepresentsthe operationswithinISO-NE coveringthestatesofConnecticut,Maine,Massachusetts, New

Hampshire,RhodeIslandandVermont.

• NewYorkrepresentsoperationswithinNewYork ISO, which coversthestate ofNewYorkinitsentirety.

•ERCOT representsoperationswithinElectric ReliabilityCouncilofTexas, coveringmostofthestate ofTexas.

•Other Regionsnot consideredindividually significant:

•SouthrepresentsoperationsintheFRCC, MISO’s Southern Region,andtheremainingportionsoftheSERCnot included

withinMISO or PJM, which includesall or mostofFlorida,Arkansas, Louisiana, Mississippi, Alabama,Georgia,Tennessee,

NorthCarolina,SouthCarolina andpartsof Missouri, Kentucky andTexas. Generation’s Southregion alsoincludes

operationsintheSPP, coveringKansas, Oklahoma,mostofNebraskaandpartsofNewMexico,Texas, Louisiana,

Missouri, MississippiandArkansas.

•West representsoperationsintheWECC, which includesCaliforniaISO, andcoversthestatesofCalifornia,Oregon,

Washington,Arizona,Nevada,Utah, Idaho,Colorado,andpartsofNewMexico,WyomingandSouthDakota.

• Canada representsoperationsacross the entire countryofCanadaandincludestheAESO, OIESO andtheCanadian

portion of MISO.

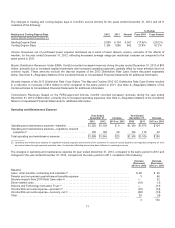

Thefollowingbusiness activitiesare not allocatedto a region,andare reportedunder Other:retailandwholesale gas, investmentsin

natural gasexploration andproduction activities, proprietarytrading, energy efficiency anddemandresponse,heating, cooling, and

cogeneration facilities, andhomeimprovements, salesofelectric andgasappliances, servicingofheating, airconditioning,

plumbing, electrical,andindoor quality systems. Further,thefollowingactivitiesare not allocatedto a region,andare reportedin

Other:compensation under the reliability-must-run rate schedule;resultsofoperationsfromtheMarylandClean-Coal assetssoldin

thefourthquarter of2012;unrealizedmark-to-market impactofeconomic hedgingactivities; amortization ofcertainintangible assets

relatingto commoditycontractsrecordedat fairvalue asaresult ofthemerger;andother miscellaneousrevenues.

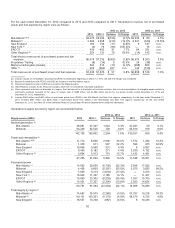

Generation evaluatesthe operatingperformanceofitspower marketingactivitiesandallocatesresourcesusingthemeasure of

revenue net ofpurchasedpower andfuel expensewhich is a non-GAAPmeasurement.Generation’s operatingrevenuesinclude all

salesto thirdpartiesandaffiliatedsalesto ComEd, PECO and BGE. Purchasedpower costsinclude all costsassociatedwiththe

procurement andsupplyofelectricityincludingcapacity, energy andancillaryservices. Fuel expenseincludesthefuel costsfor

internallygeneratedenergy andfuel costsassociatedwithtollingagreements.

61