ComEd 2013 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PECO hascontractsto procure electric supplythat were executedthrough thecompetitive procurement process outlinedinits

PAPUC-approved DSP Programs, which are further discussedinNote 3—RegulatoryMatters. Basedon Pennsylvanialegislation

andtheDSP Programs permitting PECO to recover itselectric supplyprocurement costsfromretailcustomerswithno mark-up,

PECO’s pricerisk relatedto electric supplyprocurement is limited. PECO lockedinfixedpricesfor a significant portion ofits

commoditypricerisk through full requirementscontractsandblock contracts. PECO hascertainfull requirementscontractsand

block contracts, that are consideredderivativesandqualify for theNPNS scope exception under current derivative authoritative

guidance.

PECO’s natural gasprocurement policy is designedto achieve a reasonable balanceoflong-termandshort-termgaspurchases

under different pricingapproachesinorder to achievesystemsupplyreliabilityat the leastcost. PECO’s reliabilitystrategy is two-

fold. First, PECO mustassure that there is sufficient transportation capacityto satisfy deliveryrequirements. Second, PECO must

ensure that a firmsourceofsupplyexiststo utilizethecapacityresources. All of PECO’s natural gassupplyandasset management

agreementsthat are derivativeseither qualify for theNPNS scope exception andhavebeen designatedassuch, or havenomark-to-

market balancesbecausethederivativesare indexpriced. Additionally, inaccordancewiththe 2013 PAPUC PGC settlement andto

reducetheexposure of PECO anditscustomersto natural gaspricevolatility, PECO hascontinueditsprogramto purchase natural

gasfor bothwinter andsummer suppliesusingalayeredapproach oflocking-inpricesaheadofeach season withlong-termgas

purchaseagreements(thosewithprimaryterms ofat leasttwelvemonths). Under the terms ofthe 2013 PGC settlement, PECO is

requiredto lock in(i.e., economicallyhedge)thepriceofaminimumvolumeofitslong-termgascommoditypurchases. PECO’s gas-

hedgingprogramisdesignedto cover about 30%ofplannednatural gaspurchasesinsupport ofprojectedfirmsales. Thehedging

programfor natural gasprocurement hasno directimpactonPECO’s financial position or resultsofoperationsasnatural gascosts

are fullyrecoveredfromcustomersunder thePGC.

BGE hascontractsto procure SOS electric supplythat are executedthrough acompetitive procurement process approvedbythe

MDPSC. TheSOS rateschargedrecover BGE’s wholesale power supplycostsandincludeanadministrativefee.Theadministrative

fee includesan incremental costcomponent andashareholder return component for commercial andindustrial rate classes. BGE’s

pricerisk relatedto electric supplyprocurement is limited. BGE locks infixedpricesfor all ofits SOS requirementsthrough full

requirementscontracts. Certainof BGE’s full requirementscontracts, which are consideredderivatives, qualify for theNPNS scope

exception under current derivative authoritativeguidance.Other BGE full requirementscontractsare not derivatives.

BGE providesnatural gasto itscustomersunder a MBRmechanism approvedbytheMDPSC. Under this mechanism, BGE’s actual

costofgasiscomparedto a market index(ameasure ofthemarket priceofgasinagiven period). Thedifferencebetween BGE’s

actual costandthemarket indexissharedequallybetween shareholdersandcustomers. BGE mustalsosecure fixedprice

contractsfor at least10%, but not more than 20%, offorecasted systemsupplyrequirementsfor flowing (i.e., non-storage)gasfor

theNovember through March period. Thesefixed-pricecontractsare not subjecttosharingunder theMBRmechanism. BGE also

ensuresithassufficient pipeline transportation capacityto meet customer requirements. All of BGE’s natural gassupplyandasset

management agreementsqualify for theNPNS scope exception andresult inphysical delivery.

Proprietary Trading. Generation also entersinto certain energy-relatedderivativesfor proprietarytradingpurposes. Proprietary

tradingincludesall contractsenteredinto withtheintent ofbenefitingfrom shiftsor changesinmarket pricesasopposedto those

enteredinto withtheintent ofhedgingor managingrisk. Proprietarytradingactivitiesare subjecttolimitsestablishedbyExelon’s

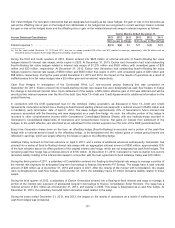

RMC. The proprietarytradingactivities, which includedsettledphysical salesvolumesof 8,762GWh, 12,958 GWh and 5,742Gwh

for theyearsendedDecember 31,2013,2012 and2011,are a complement to Generation’s energy marketingportfoliobut represent

asmall portion ofGeneration’s revenue fromenergy marketingactivities. ComEd, PECO and BGE do not enter into derivativesfor

proprietarytradingpurposes.

Interest Rate and Foreign Exchange Risk

TheRegistrantsuseacombination of fixed-rate andvariable-rate debttomanageinterest rate exposure.TheRegistrantsmayalso

utilizefixed-to-floatinginterest rate swaps, which are typicallydesignatedasfairvalue hedges, asameansto managetheirinterest

rate exposure.Inaddition,theRegistrantsmayutilizeinterest rate derivativesto lock in rate levelsin anticipation offuture financings,

which are typicallydesignatedascash flowhedges. Thesestrategiesare employedto manageinterest rate risks. At December 31,

2013,Exelon had$1,425million ofnotional amountsof fixed-to-floatinghedgesoutstandingand$190million ofnotional amountsof

floating-to-fixedhedgesoutstanding. Assumingthefairvalue andcash flowinterest rate hedgesare 100%effective,ahypothetical

50bpsincreaseintheinterest ratesassociatedwithunhedgedvariable-rate debt(excludingCommercial Paper)and fixed-to-floating

swapswouldresult in an approximate $5 million decreaseinExelon Consolidatedpre-taxincomefor theyear endedDecember 31,

2013.Tomanageforeignexchange rate exposure associatedwithinternational energy purchasesincurrenciesother than U.S.

175