ComEd 2013 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

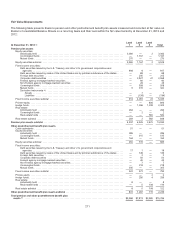

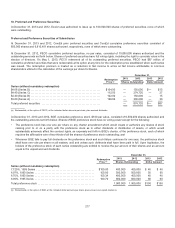

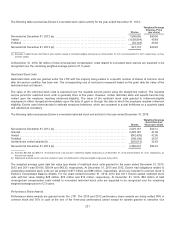

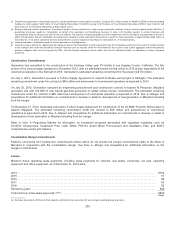

Thefairvalue ofeach option is estimatedon thedate ofgrant usingtheBlack-Scholes-Merton option-pricingmodel.Thefollowing

table presentstheweightedaverageassumptionsusedinthepricingmodel for grantsandtheresultingweightedaveragegrant date

fairvalue ofstock optionsgrantedfor theyearsended2012 and2011:

Year Ended

December 31,

2012 2011

Dividendyield ................................................................................... 5.28% 4.84%

Expectedvolatility................................................................................ 23.20%24.40%

Risk-free interest rate ............................................................................. 1.30%2.65%

Expectedlife(years).............................................................................. 6.256.25

Weightedaveragegrant date fairvalue (per share) .................................................... $ 4.18$6.22

Theassumptionsabove relate to Exelon stock optionsgrantedduringthe periods presentedandtherefore do not includestock

optionsthat were convertedinconnection withthemerger withConstellation duringtheyear ended2012.

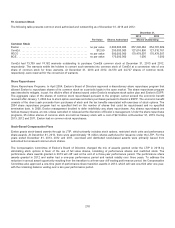

Thedividendyieldisbasedon several factors, includingExelon’s mostrecent dividendpayment at thegrant date andtheaverage

stock priceover the previousyear.Expectedvolatilityisbasedon impliedvolatilitiesoftradedstock optionsinExelon’s common

stock and historical volatilityover theestimatedexpectedlifeofthestock options. Therisk-free interest rate for a securitywitha term

equal to theexpectedlifeis basedon a yieldcurveconstructedfrom U.S. Treasurystripsat thetimeofgrant.For each year

presented, theexpectedlife representsthe periodoftimethestock optionsare expectedto be outstandingandisbasedon the

simplifiedmethod. Exelon believesthat thesimplifiedmethodisappropriate due to several factorsthat result inhistorical exercise

data not beingsufficient to determine a reasonable estimate ofexpectedterm. Exelon uses historical data to estimate employee

forfeitures, which are comparedto actual forfeitureson a quarterlybasis andadjustedasnecessary.

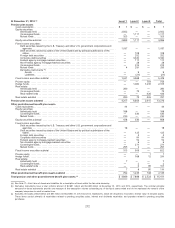

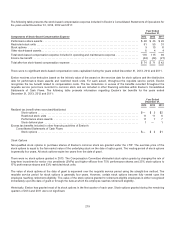

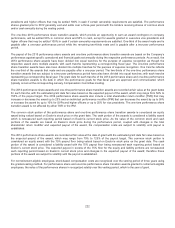

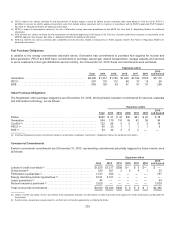

Thefollowingtable presentsinformation withrespecttostock option activityfor theyear endedDecember 31,2013:

Shares

Weighted

Average

Exercise

Price

(per

share)

Weighted

Average

Remaining

Contractual

Life

(years)

Aggregate

Intrinsic

Value

Balanceofsharesoutstandingat December 31,2012 ...................... 21,903,781$45.91

Optionsreinstated.................................................... 751,122 38.60

Optionsexercised .................................................... (670,957) 28.02

Optionsforfeited ..................................................... (54,743)39.36

Optionsexpired...................................................... (893,758) 49.08

Balanceofsharesoutstandingat December 31,2013 ...................... 21,035,445 $46.07 4.72$10

Exercisable at December 31,2013 (a) ................................... 20,188,327 $46.31 4.58 $10

(a)Includesstock options issuedto retirement eligible employees.

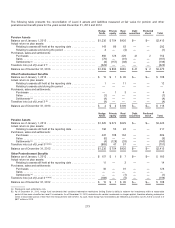

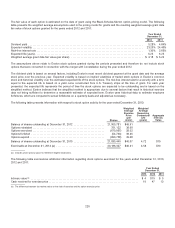

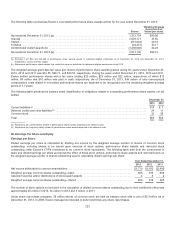

Thefollowingtable summarizesadditional information regardingstock optionsexercisedfor theyearsendedDecember 31,2013,

2012 and2011:

Year Ended

December 31,

2013 2012 2011

Intrinsic value (a).............................................................................. $ 4 $19$5

Cash receivedfor exerciseprice................................................................. 194713

(a)Thedifferencebetween themarket value on thedate ofexerciseandthe option exerciseprice.

220