ComEd 2013 Annual Report Download - page 200

Download and view the complete annual report

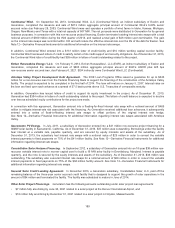

Please find page 200 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.replacement propertyunder thelike-kindexchange provisionsoftheIRC. Thelike-kindexchange replacement propertypurchased

by Exelon includedinterestsinthree municipal-ownedelectric generation facilities which were properlyleasedback to the

municipalities. TheIRS disagreedwiththis position andassertedthat the entire gainofapproximately$2.8 billion wastaxable in

1999.

Exelon hasbeen unable to reach agreement withtheIRSregardingthedispute over thelikekindexchangeposition.TheIRShas

assertedthat theExelon purchaseandleaseback transaction is substantially similar to a leasingtransaction,knownasaSILO,

which theIRSdoesnot respectastheacquisition ofan ownershipinterestin property. ASILO is a“listedtransaction”that theIRS

hasidentifiedasa potentiallyabusivetaxshelter under guidanceissuedin 2005. Accordingly, theIRShasassertedthat thesale of

thefossil plantsfollowedbythe purchaseandleaseback ofthemunicipal ownedgeneration facilitiesdoesnot qualify asalike-kind

exchangeandthegainonthesale is fullysubjecttotax. TheIRShasalsoasserteda penaltyofapproximately $87 million for a

substantial understatement oftax.

Exelon disagreeswiththeIRSandcontinuesto believethat itslike-kindexchange transaction is not thesameasor substantially

similar to a SILO. Although Exelon hasbeen andremainswillingto settle thedisagreement on terms commensurate withthe

hazards oflitigation,Exelon doesnot believeasettlement is possible.BecauseExelon believed, asofDecember 31,2012,that it

wasmore-likely-than-not that Exelon wouldprevailinlitigation,Exelon andComEd hadno liabilityfor unrecognizedtaxbenefitswith

respecttothelike-kindexchangeposition.

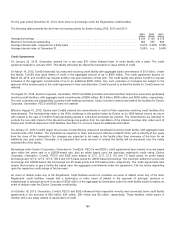

OnJanuary9,2013,theU.S. Court ofAppealsfor theFederal CircuitreversedtheU.S. Court ofFederal Claims andreacheda

decision for thegovernment inConsolidated Edison v. UnitedStates. TheCourt disallowedConsolidated Edison’s deductions

stemmingfromitsparticipation inaLILO transaction that theIRSalsohascharacterizedasataxshelter.

Inaccordancewithapplicable accountingstandards, Exelon is requiredto assess whether itis more-likely-than-not that itwill prevail

inlitigation.Exelon continuesto believethat itstransaction is not a SILO andthat ithasastrongcaseonthemerits. However,in

lightoftheConsolidated Edison decision andExelon’s current determination that settlement is unlikely, Exelon hasconcludedthat

subsequent to December 31,2012,itis no longer more-likely-than-not that itsposition will besustained. Asaresult,inthefirst

quarter of2013,Exelon recordeda non-cash charge to earnings ofapproximately$265 million, which representstheamount of

interestexpense(after-tax) andincremental state incometaxexpensefor periods through March 31,2013 that wouldbepayable in

theevent that Exelon is unsuccessful inlitigation.Ofthis amount,approximately$170million wasrecordedat ComEd. Exelon

intends to holdComEd harmless fromanyunfavorable impactsoftheafter-taxinterestamountson ComEd’s equity. Assuch,

ComEd recordedon itsconsolidatedbalancesheet asofMarch 31,2013,a$172million receivable andnon-cash equity

contributionsfromExelon.Exelon andComEd will continue to accrue interestontheuncertaintaxposition,andthechargesarising

fromfuture interestaccrualsare not expectedto bematerial to the annual operatingearnings ofExelon or ComEd. Inaddition

ComEd will continue to recordnon-cash equitycontributionsfromExelon intheamount ofthe net after-taxinterestcharges

attributable to ComEd inconnection withthelike-kindexchangeposition.Exelon continuesto believethat itis unlikelythat the$87

million penaltyassertion will ultimatelybesustainedandtherefore no liabilityfor the penaltyhasbeen recorded.

OnSeptember 30,2013,theInternal Revenue Serviceissueda noticeofdeficiency to Exelon for thelike-kindexchangeposition.

Exelon fileda petition on December 13,2013 to initiate litigation intheUnitedStatesTaxCourt.Exelon wasnot requiredto remitany

part oftheassertedtaxor penaltyinorder to litigate theissue.Thelitigation couldtakethree to fiveyearsincludingappeals, if

necessary. DecisionsintheTaxCourt are not controlledbytheFederal Circuit’s decision inConsolidated Edison.

AsofDecember 31,2013,intheevent ofafullysuccessful IRSchallengetoExelon’s like-kindexchangeposition,the potential tax

andafter-taxinterest,exclusiveofpenalties, that couldbecomecurrentlypayable maybeasmuch as $840million,of which

approximately$305million wouldbe attributable to ComEd after consideration ofExelon’s agreement to holdComEd harmless, and

thebalanceatExelon.Litigation couldtakeseveral yearssuch that theestimatedcash impactswouldlikelychangeby amaterial

amount.

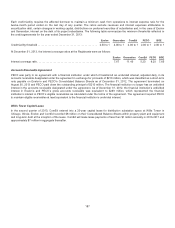

Accounting for Generation Repairs

On April30,2013,theIRS issuedRevenue Procedure 2013-24providingguidancefor determiningthe appropriate taxtreatment of

costsincurredto repair electric generation assets. Generation expectsto changeitsmethodofaccountingfor deductingrepairsin

accordancewiththis guidancebeginningwithits2014taxyear.Generation hasestimatedthat adoption ofthenewmethodwill result

inacash taxdetriment ofapproximately$100 -$120 million.

194