ComEd 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Nuclear Uprate Program. Generation is engagedinindividual projectsaspart ofa plannedpower uprate programacross its

nuclear fleet.When economicallyviable,the projectstakeadvantageofnewproduction andmeasurement technologies, new

materialsandapplication ofexpertisegainedfromahalf-centuryofnuclear power operations. Basedon ongoingreviews, the

nuclear uprate implementation plan wasadjustedduring2013 to cancel certain projects. TheMeasurement UncertaintyRecapture

uprate projectsat theDresden andQuadCitiesnuclear stationswere cancelledasaresult ofthecostofadditional plant

modificationsidentifiedduringfinal designwork which, when combinedwiththen current market conditions, madethe projectsnot

economicallyviable.Additionally, themarket conditionspromptedGeneration to cancel the previouslydeferredextendedpower

uprate projectsat theLaSalle and Limerick nuclear stations. During2013,Generation recordeda pre-taxcharge to operatingand

maintenanceexpenseandinterestexpenseofapproximately$111 million and$8million,respectively, to accrue remainingcosts

andreversethe previouslycapitalizedcosts.

Under thenuclear uprate program, Generation hasplacedinto service projectsrepresenting316 MWs ofnewnuclear generation at

acostof $952million, which hasbeen capitalizedto property, plant andequipment on Exelon’s andGeneration’s consolidated

balancesheets. At December 31,2013,Generation hascapitalized$203 million to construction workin progress within property,

plant andequipment for nuclear uprate projectsexpectedto be placedinserviceby theendof2016, consistingof200 MWs ofnew

nuclear generation,that are intheinstallation phaseacross four nuclear stations; Peach BottominPennsylvaniaandByron,

BraidwoodandDresden inIllinois. Theremainingspendassociatedwiththese projectsisexpectedto be approximately$300 million

through theendof2016. Generation believesthat itis probable that these projectswill becompleted. If a projectis expectednot to

becompletedasplanned, previouslycapitalizedcostswill bereversedthrough earnings asacharge to operatingandmaintenance

expenseandinterest.

Liquidity

Each oftheRegistrantsannuallyevaluatesitsfinancingplan, dividendpracticesandcreditline sizing, focusingon maintainingits

investment grade ratings while meetingitscash needs to fundcapital requirements, retire debt,pay dividends, fundpension and

other postretirement benefitobligationsandinvestinnewandexistingventures. TheRegistrantsexpectcash flows to besufficient to

meet operatingexpenses, financingcostsandcapital expenditure requirements.

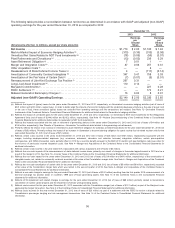

Exelon,Generation,ComEd, PECO and BGE haveunsecuredsyndicatedrevolvingcreditfacilitieswithaggregate bank

commitmentsof$0.5 billion, $5.3billion,$1.0billion,$0.6 billion and$0.6 billion,respectively. Generation alsohasbilateral credit

facilitieswithaggregate maximumavailabilityof$0.4 billion.

Exposure to Worldwide Financial Markets. Exelon hasexposure to worldwidefinancial markets. TheongoingEuropean debt

crisis hascontributedto theinstabilityinglobal creditmarkets. Further disruptionsintheEuropean marketscouldreduceorrestrict

theRegistrants’ abilityto secure sufficient liquidityor secure liquidityat reasonable terms. AsofDecember 31,2013,approximately

30%, or $2.5 billion,oftheRegistrants’ aggregate total commitmentswere withEuropean banks. Thecreditfacilitiesinclude$8.4

billion inaggregate total commitmentsof which $6.6 billion wasavailable asofDecember 31,2013.There were no borrowings under

theRegistrants’ creditfacilitiesasofDecember 31,2013.See Note 13—DebtandCreditAgreementsoftheCombinedNotesto the

ConsolidatedFinancial Statementsfor additional information on thecreditfacilities.

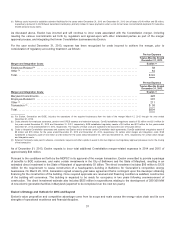

February 5, 2014 Winter Ice Storm. OnFebruary5,2014, awinter storm which broughtamix ofsnow, iceandfreezingraintothe

region interruptedelectric servicedeliveryto nearly715,000 customersinPECO’s service territory. Restoration effortsare continuing

andwill includesignificant costsassociatedwithemployee overtime,support fromother utilitiesandincremental equipment,

contractedtree trimmingcrews andsupplies. PECO estimatesthat restoration effortswill result in$60million to $80million of

incremental operatingandmaintenanceexpenseand$30 million to $40million ofincremental capital expendituresfor thefirst

quarter of2014.

Tax Matters

See Note 14—IncomeTaxesoftheCombinedNotesto ConsolidatedFinancial Statementsfor additional information.

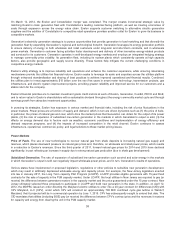

Environmental Legislative and Regulatory Developments.

Exelon supportsthe promulgation ofcertainenvironmental regulationsbytheU.S. EPA,includingair,water andwaste controlsfor

electric generatingunits. See discussion belowfor further details. Theairandwaste regulationswill haveadisproportionate adverse

impactonfossil-fuel power plants, requiring significant expendituresofcapital andvariable operatingandmaintenanceexpense,and

will likelyresult inthe retirement ofolder,marginal facilities. Due to theirlowemission generation portfolios, Generation and CENG

42