ComEd 2013 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

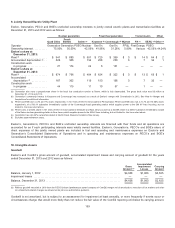

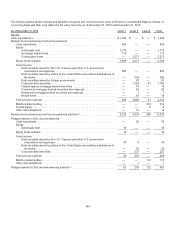

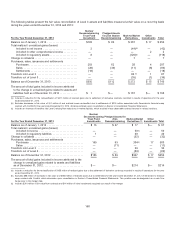

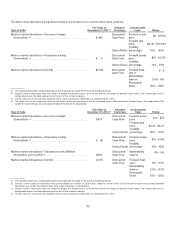

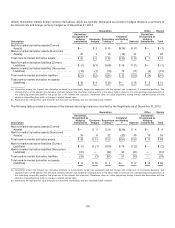

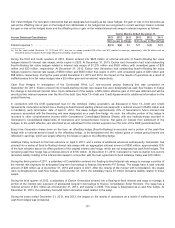

Thefollowingtablespresent theincomestatement classification ofthe total realizedandunrealizedgains(losses) includedin

incomefor Level 3 assetsandliabilitiesmeasuredat fairvalue on a recurringbasis duringtheyearsendedDecember 31,2013 and

2012:

Operating

Revenue

Purchased

Power and

Fuel

Other,

net (a)

Total gains(losses) includedinincomefor theyear endedDecember 31,2013 ................. $(152)$108$2

Changeinthe unrealizedgainsrelatingto assetsandliabilitiesheldfor theyear ended

December 31,2013 ................................................................ $ 40$127$1

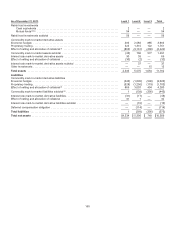

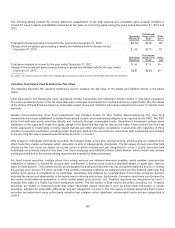

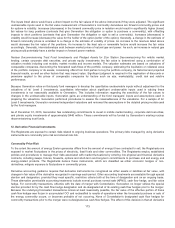

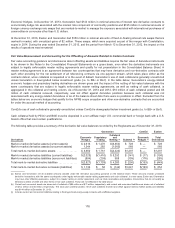

Operating

Revenue

Purchased

Power and

Fuel

Other,

net

Total gainsincludedinincomefor theyear endedDecember 31,2012 ........................ $ 54 $ 5 $—

Changeinthe unrealizedgains(losses) relatingto assetsandliabilitiesheldfor theyear ended

December 31,2012 ................................................................ $230 $(16) $—

(a)Other,net activityconsistsofrealizedandunrealizedgains(losses) includedinincomefor theNDT funds heldbyGeneration.

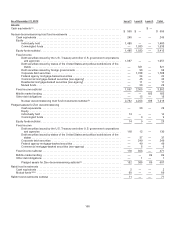

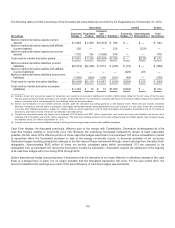

Valuation Techniques Used to Determine Fair Value

Thefollowingdescribesthevaluation techniquesusedto measure thefairvalue oftheassetsandliabilitiesshowninthetables

above.

Cash Equivalents TheRegistrants’ cash equivalentsincludeinvestmentswithmaturitiesofthree months or less when purchased.

Thecash equivalentsshowninthefairvalue tablesare comprisedofinvestmentsinmutual andmoneymarket funds. Thefairvalues

ofthesharesofthesefunds are basedon observable market pricesand, therefore,havebeen categorizedinLevel 1 inthefairvalue

hierarchy.

Nuclear Decommissioning Trust Fund Investments and Pledged Assets for Zion Station Decommissioning The trustfund

investmentshavebeen establishedto satisfy Generation’s nuclear decommissioningobligationsasrequiredbytheNRC. TheNDT

funds holddebtandequitysecuritiesdirectlyandindirectlythrough commingledfunds. Generation’s investment policiesplace

limitationson thetypesandinvestment grade ratings ofthesecuritiesthat maybeheldbythe trusts. These policieslimitthe trust

funds’ exposuresto investmentsinhighlyilliquid marketsandother alternativeinvestments. Investmentswithmaturitiesofthree

months or less when purchased, includingcertainshort-term fixedincomesecuritiesare consideredcash equivalentsandincluded

intherecurringfairvalue measurementshierarchy asLevel 1 or Level 2.

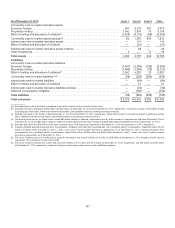

Withrespecttoindividuallyheldequitysecurities, the trusteesobtainpricesfrompricingservices, whosepricesare obtainedfrom

directfeeds frommarket exchanges, which Generation is able to independentlycorroborate.Thefairvaluesofequitysecuritiesheld

directlybythe trustfunds are basedon quotedpricesinactivemarketsandare categorizedinLevel 1.Equitysecuritiesheld

individuallyare primarilytradedon theNewYorkStock ExchangeandNASDAQ-Global SelectMarket, which contain onlyactively

tradedsecuritiesdue to thevolume tradingrequirementsimposedbytheseexchanges.

For fixedincomesecurities, multiple pricesfrompricingservicesare obtainedwhenever possible, which enablescross-provider

validationsinaddition to checks for unusual dailymovements. Aprimarypricesourceis identifiedbasedon asset type,class or

issue for each security. The trusteesmonitor pricessuppliedbypricingservicesandmayuseasupplemental pricesourceorchange

theprimarypricesourceofagiven securityifthe portfoliomanagerschallengeanassignedpriceandthe trusteesdetermine that

another pricesourceis consideredto be preferable.Generation hasobtainedan understandingofhowthesepricesare derived,

includingthe nature andobservabilityoftheinputsusedinderivingsuch prices. Additionally, Generation selectivelycorroboratesthe

fairvaluesofsecuritiesbycomparison to other market-basedpricesources. U.S. Treasurysecuritiesare categorizedasLevel 1

becausetheytradeinahighlyliquid andtransparent market.Thefairvaluesof fixedincomesecurities, excluding U.S. Treasury

securities, are basedon evaluatedpricesthat reflectobservable market information,such asactual tradeinformation or similar

securities, adjustedfor observable differencesandare categorizedinLevel 2.Thefairvaluesofprivate placement fixedincome

securitiesare determinedusingathirdpartyvaluation that containscertainsignificant unobservable inputsandare categorizedin

Level 3.

169