ComEd 2013 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

resultsinlower minimumpension contributionsinthe near term while increasingthe premiums pension planspayto thePension

BenefitGuarantyCorporation.Certain provisionsofthelawwere appliedin 2012 while otherswere appliedin 2013.Theestimated

impactsofthelaware reflectedinthe projectedpension contributions.

Unlikethequalifiedpension plans, other postretirement plansare not subjecttostatutoryminimumcontribution requirements.

Exelon’s management has historicallyconsideredseveral factorsindeterminingthelevel ofcontributionsto itsother postretirement

benefit plans, includinglevelsofbenefitclaims paid andregulatoryimplications(amountsdeemedprudent to meet regulatory

expectationsandbestassure continuedrate recovery). In 2014, Exelon anticipatesfundingitsother postretirement benefit plans

basedon thefundingconsiderations discussedabove,withtheexception ofthose plans which remainunfunded. Exelon expectsto

makeother postretirement benefit plan contributions, includingbenefitpaymentsrelatedto unfundedplans, ofapproximately$430

million in 2014.

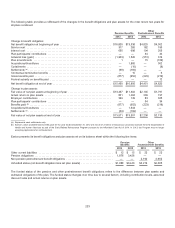

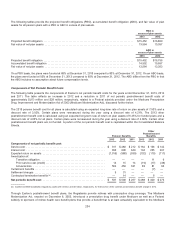

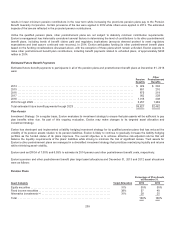

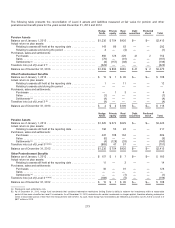

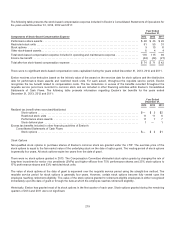

Estimated Future Benefit Payments

Estimatedfuture benefitpaymentsto participantsin all ofthe pension plansandpostretirement benefit plansat December 31,2013

were:

Pension

Benefits

Other

Postretirement

Benefits

2014.................................................................................... $ 929$204

2015.................................................................................... 851 210

2016.................................................................................... 873219

2017.................................................................................... 902 228

2018.................................................................................... 1,015238

2019through 2023 ........................................................................ 5,257 1,383

Total estimatedfuture benefitpaymentsthrough 2023 ........................................... $9,827$2,482

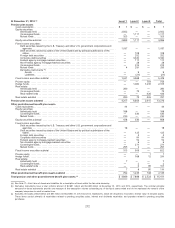

Plan Assets

Investment Strategy. Onaregular basis, Exelon evaluatesitsinvestment strategy to ensure that plan assetswill besufficient to pay

plan benefitswhen due.Aspart ofthis ongoingevaluation,Exelon maymakechangesto itstargetedasset allocation and

investment strategy.

Exelon hasdevelopedandimplementedaliabilityhedginginvestment strategy for itsqualifiedpension plansthat hasreducedthe

volatilityofitspension assetsrelativetoitspension liabilities. Exelon is likelyto continue to graduallyincreasetheliabilityhedging

portfolioasthefundedstatusofitsplansimproves. Theoverall objectiveis to achieve attractiverisk-adjustedreturnsthat will

balancetheliquidityrequirementsofthe plans’ liabilities while strivingto minimizetherisk of significant losses. Trustassetsfor

Exelon’s other postretirement plansare managedinadiversifiedinvestment strategy that prioritizesmaximizingliquidityandreturns

while minimizingasset volatility.

Exelon usedan EROAof7.00%and 6.59% to estimate its2014pension andother postretirement benefitcosts, respectively.

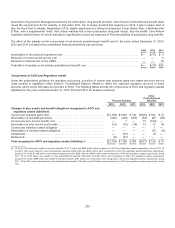

Exelon’s pension andother postretirement benefit plan target asset allocationsandDecember 31,2013 and2012 asset allocations

were asfollows:

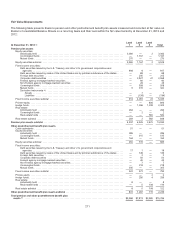

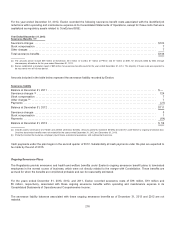

Pension Plans

Percentage of Plan Assets

at December 31,

Asset Category Target Allocation 2013 2012

Equitysecurities .......................................................... 31%35% 35%

Fixedincomesecurities .................................................... 38% 3740

Alternativeinvestments(a).................................................. 31%2825

Total ................................................................... 100%100%

209