ComEd 2013 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Accounts Receivable Agreement PECO waspartyto an agreement withafinancial institution under which it transferredan

undividedinterest,adjusteddaily, initsaccountsreceivable designatedunder theagreement inexchangefor proceeds of$210

million, which wasclassifiedasashort-termnote payable on Exelon’s and PECO’s ConsolidatedBalanceSheetsasof

December 31,2012.Theagreement terminatedon August30,2013 and PECO paid downthe outstandingprincipal of$210 million.

Thefinancial institution no longer hasan undividedinterestintheaccountsreceivable designatedunder theagreement.Asof

December 31,2012,thefinancial institution’s undividedinterestinExelon’s and PECO’s gross accountsreceivable wasequivalent

to $289 million, which representedthefinancial institution’s interestinPECO’s eligible receivablesascalculatedunder the terms of

theagreement.Theagreement required PECO to maintaineligible receivablesat leastequivalent to thefinancial institution’s

undividedinterest.

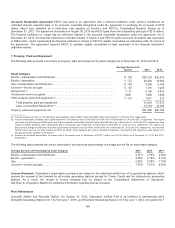

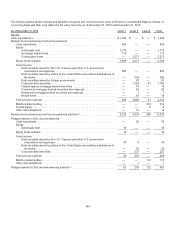

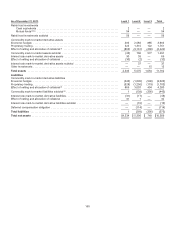

7. Property, Plant and Equipment

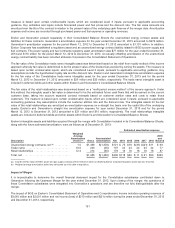

Thefollowingtable presentsasummaryofproperty, plant andequipment by asset categoryasofDecember 31,2013 and2012:

Average Service Life

(years) 2013 2012

Asset Category

Electric—transmission and distribution .......................................... 5-90$28,123 $26,576

Electric—generation ......................................................... 1-5220,420 19,004

Gas—transportation and distribution ............................................ 5-903,296 3,108

Common—electric andgas ................................................... 5-501,101 1,029

Nuclear fuel (a).............................................................. 1-8 5,196 4,815

Construction workin progress ................................................. N/A1,8901,926

Other property, plant andequipment (b) .......................................... 1-511,017912

Total property, plant andequipment ........................................ 61,04357,370

Less: accumulateddepreciation (c) .......................................... 13,713 12,184

Property, plant andequipment,net ............................................. $47,330 $45,186

(a)Includesnuclear fuel that is inthefabrication andinstallation phaseof $947 million and $894 million at December 31,2013 and2012,respectively.

(b) IncludesGeneration’s buildings under capital leasewitha net carryingvalue of$23 million and$20 million at December 31,2013 and2012,respectively. Theoriginal

costbasis ofthebuildings was $59 million andtotal accumulatedamortization was$36million and$33 million asofDecember 31,2013 and2012,respectively. Also

includesComEd’s buildings under capital leasewitha net carryingvalue of$8million and$0million at December 31,2013 and2012,respectively. Theoriginal cost

basis ofthebuildings was$8million andtotal accumulatedamortization was$0million and$0million asofDecember 31,2013 and2012,respectively. Includesland

heldfor future useandnon utilitypropertyat PECO and BGE. Thesebalancesalsoincludecapitalizedacquisition,development andexploration costsrelatedto oil

andgasproduction activitiesat Generation.

(c) Includesaccumulatedamortization ofnuclear fuel inthe reactor core at Generation of$2,371million and$2,078 million asofDecember 31,2013 and2012,

respectively.

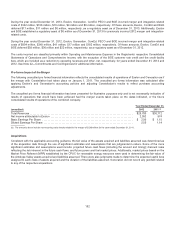

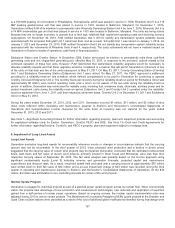

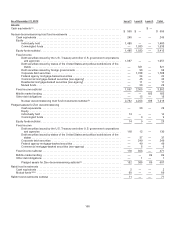

Thefollowingtable presentsthe annual depreciation provisionsasa percentageofaverageservicelifefor each asset category.

Average Service Life Percentage by Asset Category 2013 2012 2011

Electric—transmission and distribution ....................................................... 2.91%2.76% 2.59%

Electric—generation ...................................................................... 3.35% 3.15% 3.12%

Gas .................................................................................... 2.06% 2.03%1.73%

Common—electric andgas................................................................. 7.53% 7.61%8.05%

License Renewals. Generation’s depreciation provisionsare basedon theestimateduseful livesofitsgeneratingstations, which

assumethe renewal ofthelicensesfor all nuclear generatingstations(except for Oyster Creek) andthehydroelectric generating

stations. Asaresult,thereceipt oflicense renewalshasno impactontheConsolidatedStatementsofOperations.

See Note 3—RegulatoryMattersfor additional information regardinglicense renewals.

Plant Retirements

Schuylkill Station and Riverside Station.OnOctober 31,2012,Generation notified PJM ofitsintention to permanentlyretire

Schuylkill GeneratingStation Unit1by February1,2013,andRiversideGeneratingStation Unit6byJune 1,2014. Schuylkill Unit1

156