ComEd 2013 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Upstream Gas Property Asset-Based Lending Agreement

Generation hasafiveyear asset-basedlendingagreement associatedwithcertainupstreamgaspropertiesthat itowns. The

borrowingbasecommittedunder thefacilityis$110 million andcan increase to a total of$500 million if theassetssupport a higher

borrowingbaseandGeneration is able to obtainadditional commitmentsfromlenders. Thefacilitywasamendedandextended

through January2019. Borrowings under this facilityare securedbytheupstreamgasproperties, andthe lendersdo not have

recourseagainstExelon or Generation intheevent ofadefault.AsofDecember 31,2013, $77 million wasoutstandingunder the

facilitywithinterestpayable quarterly. Thefacilityincludesa provision that requirestheGeneration entitiesowningtheupstreamgas

propertiessubjecttotheagreement to maintainacurrent ratioofone-to-one.AsofDecember 31,2013,Generation wasin

compliancewiththis provision.

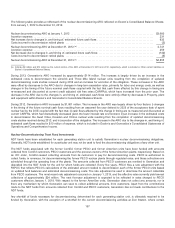

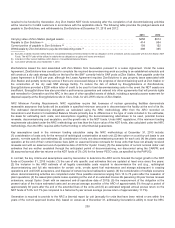

14. Income Taxes

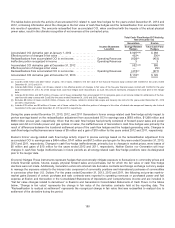

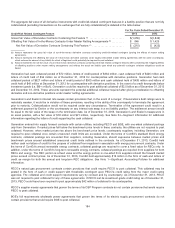

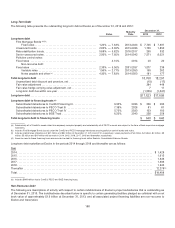

Incometaxexpense(benefit)fromcontinuingoperationsiscomprisedofthefollowingcomponents:

For the Year Ended

December 31,

2013 2012 2011

Includedin operations:

Federal

Current .............................................................................. $ 744 $ 37$ 1

Deferred ............................................................................. 140701 1,200

Investment taxcreditamortization ........................................................ (15) (11)(12)

State

Current .............................................................................. 181(25) (3)

Deferred ............................................................................. (6) (75) 271

Total ................................................................................. $1,044 $627$1,457

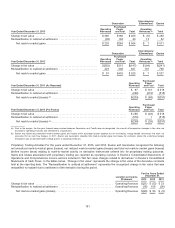

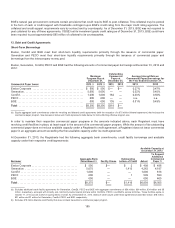

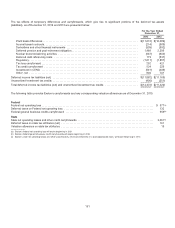

Theeffectiveincometaxrate fromcontinuingoperationsvariesfromtheU.S. Federal statutoryrate principallydue to thefollowing:

For the Year Ended December 31, 2013 2012 2011

U.S. Federal statutoryrate ....................................................................... 35.0%35.0%35.0%

Increase(decrease)due to:

State incometaxes, net ofFederal incometaxbenefit............................................ 4.7 (3.6) 4.4

Qualifiednuclear decommissioningtrustfundincome............................................. 3.7 5.4 0.5

Taxexempt income......................................................................... (0.2)(0.2)(0.2)

Healthcare reformlegislation ................................................................ 0.10.2(0.2)

Amortization ofinvestment taxcredit,net deferredtaxes .......................................... (1.9) (1.1)(0.3)

Production taxcreditsandother credits ........................................................ (2.1)(2.2)(0.9)

Plant basis differences ...................................................................... (1.6) (2.4) (1.0)

Merger expenses(b) ........................................................................ — 2.4 —

Finesandpenalties......................................................................... — 2.6 —

Domestic production activitiesdeduction ....................................................... — — (0.3)

Other .................................................................................... (0.1)(1.1)(0.2)

Effectiveincometaxrate ........................................................................ 37.6% 34.9% 36.8%

(a)Exelon activityfor thetwelvemonths endedDecember 31,2012 includestheresultsofConstellation and BGE for March 12,2012—December 31,2012.

(b) Prior to thecloseofthemerger,theRegistrantsrecordedthe applicable taxeson merger transaction costsassumingthemerger wouldnot becompleted. Upon

closingofthemerger,theRegistrantsreversedsuch taxesfor thosemerger transaction coststhat were determinedto be non tax-deductible upon successful

completion ofamerger.

190