ComEd 2013 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

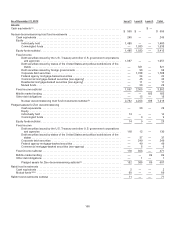

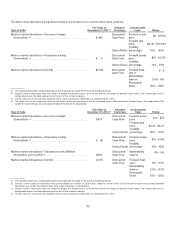

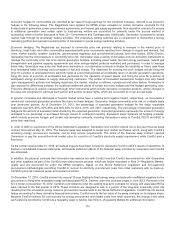

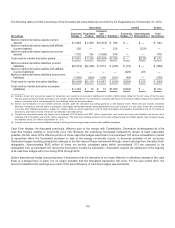

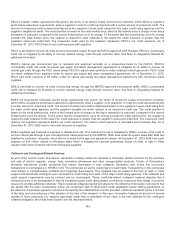

dollars, Generation utilizesforeigncurrency derivatives, which are typicallydesignatedaseconomic hedges. Belowisasummaryof

theinterest rate andforeigncurrency hedgesasofDecember 31,2013.

Generation Other Exelon

Description

Derivatives

Designated as

Hedging

Instruments

Economic

Hedges

Proprietary

Trading (a)

Collateral

and Netting

(b) Subtotal

Derivatives

Designated as

Hedging

Instruments Total

Mark-to-market derivativeassets(Current

Assets) ................................... $— $3$15$(19) $ (1)$— $(1)

Mark-to-market derivativeassets(Noncurrent

Assets) ................................... 26315(13)31 738

Total mark-to-market derivativeassets ........... $26$6$30 $(32)$30 $7 $37

Mark-to-market derivativeliabilities(Current

Liabilities) ................................. $ (1)$(1)$(18) $ 19$(1)$— $(1)

Mark-to-market derivativeliabilities(Noncurrent

Liabilities) ................................. (10)(1)(13)13 (11) (4) (15)

Total mark-to-market derivativeliabilities ......... $(11)$(2)$(31)$32 $(12) $ (4) $(16)

Total mark-to-market derivative net assets

(liabilities) ................................. $ 15$4$(1)$— $18$3$21

(a)Generation entersinto interest rate derivativecontractsto economicallyhedgerisk associatedwiththeinterest rate component ofcommoditypositions. The

characterization oftheinterest rate derivativecontractsbetween the proprietarytradingactivityintheabovetable is driven by thecorrespondingcharacterization of

theunderlyingcommodityposition that givesrisetotheinterest rate exposure.Generation doesnot utilize proprietarytradinginterest rate derivativeswiththe

objectiveofbenefitingfrom shiftsor changesinmarket interest rates.

(b) Representsthe nettingoffairvalue balanceswiththesamecounterpartyandanyassociatedcash collateral.

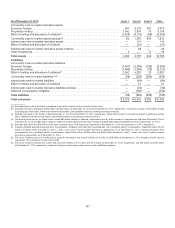

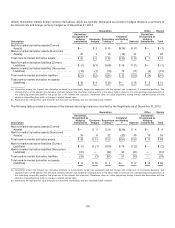

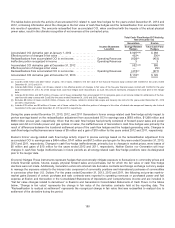

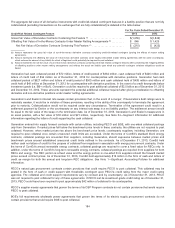

Thefollowingtable providesasummaryoftheinterest rate hedgebalancesrecordedbytheRegistrantsasofDecember 31,2012:

Generation Other Exelon

Description

Derivatives

Designated as

Hedging

Instruments

Economic

Hedges

Proprietary

Trading (a)

Collateral

and Netting

(b) Subtotal

Derivatives

Designated as

Hedging

Instruments Total

Mark-to-market derivativeassets(Current

Assets) ................................... $— $ 3$20 $(19) $ 4 $— $ 4

Mark-to-market derivativeassets(Noncurrent

Assets) ................................... 38832 (32)46 13 59

Total mark-to-market derivativeassets ........... $ 38$11 $52$(51)$50$13 $63

Mark-to-market derivativeliabilities(Current

Liabilities) ................................. $ (1)$(1)$(19) $ 19$(2)$— $(2)

Mark-to-market derivativeliabilities(Noncurrent

Liabilities) ................................. (31)— (32)32 (31)— (31)

Total mark-to-market derivativeliabilities ......... (32)(1)(51)51(33)— (33)

Total mark-to-market derivative net assets

(liabilities) ................................. $ 6 $ 10 $1$— $ 17$13 $30

(a)Generation entersinto interest rate derivativecontractsto economicallyhedgerisk associatedwiththeinterest rate component ofcommoditypositions. The

characterization oftheinterest rate derivativecontractsbetween the proprietarytradingactivityintheabovetable is driven by thecorrespondingcharacterization of

theunderlyingcommodityposition that givesrisetotheinterest rate exposure.Generation doesnot utilize proprietarytradinginterest rate derivativeswiththe

objectiveofbenefitingfrom shiftsor changesinmarket interest rates.

(b) Representsthe nettingoffairvalue balanceswiththesamecounterpartyandanyassociatedcash collateral.

176