ComEd 2013 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Thecycle ofproduction andutilization ofnuclear fuel includestheminingandmillingofuraniumore into uraniumconcentrates, the

conversion ofuraniumconcentratesto uraniumhexafluoride,the enrichment ofthe uraniumhexafluorideandthefabrication offuel

assemblies. Generation hasuraniumconcentrate inventoryandsupplycontractssufficient to meet all ofitsuraniumconcentrate

requirementsthrough 2016. Generation’s contractedconversion servicesare sufficient to meet all ofitsuraniumconversion

requirementsthrough 2020.All ofGeneration’s enrichment requirementshavebeen contractedthrough 2018. Contractsfor fuel

fabrication havebeen obtainedthrough 2018. Generation doesnot anticipate difficultyinobtainingthenecessaryuranium

concentratesor conversion,enrichment or fabrication servicesto meet thenuclear fuel requirementsofitsnuclear units.

Natural gasisprocuredthrough long-termandshort-termcontracts, aswell asspot-market purchases. Fuel oilinventoriesare

managedsothat inthewinter months sufficient volumesoffuel are available intheevent ofextremeweather conditionsandduring

theremainingmonths to takeadvantageoffavorable market pricing.

Generation usesfinancial instrumentsto mitigate pricerisk associatedwithcertaincommoditypriceexposures. Generation also

hedgesforwardpricer

isk, usingbothover-the-counter andexchange-tradedinstruments. See ITEM 1A.RISK FACTORSof

Exelon’s 2013 Form10-K, Management’s Discussion andAnalysis ofFinancial Condition andResultsofOperations, Critical

AccountingPoliciesandEstimatesandNote 12 oftheCombinedNotesto ConsolidatedFinancial Statementsfor additional

information regardingderivativefinancial instruments.

Power Marketing

Generation’s integratedbusiness operationsincludethephysical deliveryandmarketingofpower obtainedthrough itsgeneration

capacityandthrough long-term, intermediate-termandshort-termcontracts. Generation maintainsan effectivesupplystrategy

through ownershipofgeneration assetsandpower purchaseandleaseagreements. Generation hasalsocontractedfor access to

additional generation through bilateral long-termPPAs. PPAsare commitmentsrelatedto power generation ofspecific generation

plantsand/or are dispatchable in nature similar to asset ownershipdependingon thetype ofunderlyingasset.Generation secures

contractedgeneration aspart ofitsoverall strategic plan,withobjectivessuch asobtaininglow-cost energy supplysourcesto meet

itsphysical deliveryobligationsto bothwholesale andretailcustomersandassistingcustomersto meet renewable portfolio

standards. Generation maybuypower to meet the energy demandofitscustomers, includingComEd, PECO and BGE. Generation

sellselectricity, natural gas, andrelatedproductsandsolutionsto variouscustomers, including distribution utilities, municipalities,

cooperatives, andcommercial,industrial,governmental,andresidential customersincompetitivemarkets. Generation’s customer

facingoperationscombine a unifiedsalesforcewithacustomer-centric model that leveragestechnology to broaden the rangeof

productsandsolutionsoffered, which Generation believespromotesstronger customer relationships. This model focuseson

efficiency andcostreduction, which providesa platformthat is scalable andable to capitalize on opportunitiesfor future growth.

Generation’s purchasesm

aybefor more than the energy demandedbyGeneration’s customers. Generation then sellsthis open

position,alongwithcapacitynot usedto meet customer demand, inthewholesale electricitymarkets. Where necessary, Generation

also purchasestransmission servicetoensure that ithasreliable transmission capacityto physicallymoveitspower suppliesto

meet customer deliveryneeds inmarketswithout an organizedRTO. Generation alsoincorporatescontingenciesinto itsplanningfor

extremeweather conditions, includingpotentiallyreservingcapacityto meet summer loads at levelsrepresentativeofwarmer-than-

normal weather conditions. Generation activelymanagesthesephysical andcontractual assetsinorder to deriveincremental value.

Additionally, Generation is involvedinthedevelopment,exploration,andharvestingofoil,natural gasandnatural gasliquids

properties.

Price Supply Risk Management

Generation alsomanagesthepriceandsupplyrisks for energy andfuel associatedwithgeneration assetsandtherisks ofpower

marketingactivities. Generation implementsathree-year ratable salesplan to alignitshedgingstrategy withitsfinancial objectives.

Generation also entersinto transactionsthat are outsideofthis ratable salesplan.Generation is exposedto relativelygreater

commoditypricerisk in 2014andbeyondfor which a larger portion ofitselectricityportfoliomaybeunhedged. Generation hasbeen

andwill continue to be proactiveinusinghedgingstrategiesto mitigate this risk insubsequent years. AsofDecember 31,2013,the

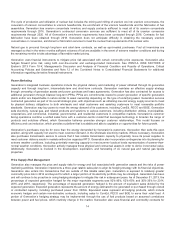

percentageofexpectedgeneration hedgedfor themajor reportable segmentswas92%-95%, 62%-65% and30%-33%for 2014,

2015, and2016, respectively. The percentageofexpectedgeneration hedgedistheamount ofequivalent sales dividedbythe

expectedgeneration.Expectedgeneration representstheamount ofenergy estimatedto begeneratedor purchasedthrough owned

or contractedcapacity, includingpurchasedpower from CENG. Equivalent salesrepresent all hedgingproducts, which include

economic hedgesandcertain non-derivativecontracts, includingsalesto ComEd, PECO and BGE to servetheir retail load. A

portion ofGeneration’s hedgingstrategy maybeimplementedthrough theuseoffuel productsbasedon assumedcorrelations

between power andfuel prices, which routinelychangeinthemarket.Generation alsousesfinancial andcommoditycontractsfor

14