ComEd 2013 Annual Report Download - page 120

Download and view the complete annual report

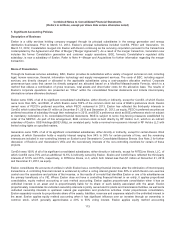

Please find page 120 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.to certaininvestmentsandjoint ventures, includingthe50.01%interestinCENG, andcertainfinancingtrustsofComEd, PECO, and

BGE. Under theequitymethod, Exelon reportsitsinterestinthe entityasan investment andExelon’s percentageshare ofthe

earnings fromthe entityassingle line items initsfinancial statements. Exelon usesthecostmethodifitholds less than 20%ofthe

common stock ofan entity. Under thecostmethod, Exelon reportsitsinvestment at costandrecognizesincome onlyto theextent

Exelon receives dividends or distributions.

For theyear endedDecember 31,2013, BGE recordeda$2million (pre-tax) correctingadjustment to decreaseamortization

expense relatedto regulatoryassetsthat were originallyrecordedduring2012,an adjustment to decreaseincometaxexpenseby

$4 million relatedto therecognition andmeasurement ofregulatoryassetsthat shouldhavebeen recordedin periods prior to 2013,

anda$4 million (pre-tax) correctingadjustment to decrease operatingandmaintenanceexpensefor an overstatement of BGE’s life

insuranceobligation relatedto post-employment benefitsinprior years. For theyear endedDecember 31,2012, BGE recordeda

$2million (pre-tax) correctingadjustment to reduce electric distribution revenue relatedto decouplingof2011 electric distribution

revenue,a$3million (pre-tax) correctingadjustment to increase electric operationsandmaintenanceexpense relatedto

capitalization ofelectric transmission costs, anda$5 million (pre-tax) correctingadjustment to interestexpensetoreflecttheimpacts

ofamendmentsoftaxpositionspreviouslytaken on prior-year consolidatedincometaxreturns. Inaddition,ComEd identifieda

disclosure adjustment withinthe renewable energy creditsandalternative energy creditssection ofthe 2012 Form10-K

Note 8—Intangible Assets which hasbeen revisedinNote 10 ofthis year’s report.Exelon,ComEd and BGE haveconcludedthese

correctingadjustmentsare not material to itsresultsofoperations, cash flows, or financial positionsfor theyearsended

December 31,2013,andDecember 31,2012,or anyprior period.

Theaccompanyingconsolidatedfinancial statementshavebeen preparedinaccordancewithGAAPfor annual financial statements

andinaccordancewiththeinstructionsto Form10-K andRegulation S-X promulgatedbytheSEC.

Each oftheRegistrant’s ConsolidatedFinancial Statementsincludestheaccountsofitssubsidiaries. All intercompanytransactions

havebeen eliminated.

Use of Estimates

The preparation offinancial statementsofeach oftheRegistrantsinconformitywithGAAPrequiresmanagement to makeestimates

andassumptionsthat affecttheamountsreportedinthefinancial statementsandaccompanyingnotes. Areasinwhich significant

estimateshavebeen madeinclude,but are not limitedto,theaccountingfor nuclear decommissioningcostsandother AROs,

pension andother postretirement benefits, the application ofpurchaseaccounting, inventoryreserves, allowancefor uncollectible

accounts, goodwill andasset impairments, derivativeinstruments, unamortizedenergy contracts, fixedasset depreciation,

environmental costsandother loss contingencies, taxesandunbilledenergy revenues. Actual resultscould differ fromthose

estimates.

Reclassifications

Certainprior year amountsinExelon’s ConsolidatedStatementsofOperations, ConsolidatedStatementsofCash Flows, and

ConsolidatedBalanceSheetshavebeen reclassifiedbetween line items for comparative purposesandcorrection ofprior period

classification errorsidentifiedin 2013.Thereclassifications did not affectanyoftheRegistrants’ net incomeorcash flows from

operatingactivities.

In 2013,Exelon and BGE correctedthe presentation ofinterestexpense relatedto BGE’s financingtrustof$12 million and

$16million,respectively, to be presentedasInterestexpensetoaffiliates, net on theirStatementsofOperationsandComprehensive

Incomefor theyear endedDecember 31,2012.Exelon and BGE alsoreclassifiedthe relatedAccruedexpensesof$4million to

Payablesto affiliateson itsDecember 31,2012 BalanceSheet. Similar adjustmentsare alsoreflectedinNote 22 –RelatedParty

Transactions. Exelon andGeneration alsocorrectedamounts disclosedwithinNote 22 –RelatedPartyTransactionsto increase

Purchasedpower andfuel fromaffiliatesby$114million andto increasePayablesto affiliatesby$20 million.In 2013,Generation

correctedthe presentation ofinterestexpense relatedto certaindebtof $75 million to be presentedasInterestexpensetoaffiliates,

net on itsStatement ofOperationsandComprehensiveIncomefor theyear endedDecember 31,2012 andwithinNote 22 –Related

PartyTransactions.

Accounting for the Effects of Regulation

Exelon,ComEd, PECO and BGE applythe authoritativeguidancefor accountingfor certaintypesofregulation, which requires

ComEd, PECO and BGE to recordintheirconsolidatedfinancial statementstheeffectsofcost-basedrate regulation for entitieswith

114