ComEd 2013 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Accounting for Electric Transmission and Distribution Property Repairs

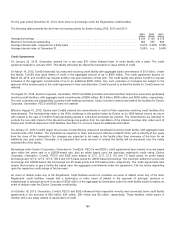

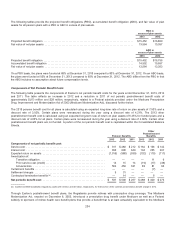

OnAugust19, 2011,theIRS issuedRevenue Procedure 2011-43 providingasafeharbor methodoftaxaccountingfor repaircosts

associatedwithelectric transmission and distribution property. ComEd and PECO adoptedthesafeharbor intheRevenue

Procedure for the 2011 and2010 taxyears, respectively. For theyear endedDecember 31,2011,theadoption ofthesafeharbor

resultedina$35million reduction to incometaxexpenseatPECO, while Generation incurredadditional incometaxexpenseinthe

amount of$28million due to a decreaseinitsdomestic production activitiesdeduction, which are reflectedintheeffectiveincome

taxrate reconciliation aboveinthe plant basis differencesanddomestic production activitiesdeduction lines, respectively. For

Exelon,theadoption hadaminimal effectonconsolidatedearnings. Inaddition,theadoption ofthesafeharbor resultedinacash

taxbenefitatExelon,ComEd and PECO intheamount ofapproximately$300 million,$250million, $95 million respectively, partially

offset by acash taxdetriment at Generation intheamount of$28million relatedto a decreaseddomestic production activities

deduction.

BGE adoptedthesafeharbor for theshort period2012 pre-merger taxyear.For theyear endedDecember 31,2012,theadoption of

thesafeharbor resultedinacash taxbenefitatBGE intheamount of$27million.

See Note 3—RegulatoryMattersfor discussion oftheregulatorytreatment prescribedinthe 2010 electric distribution rate case

settlement for PECO’s cash taxbenefitresultingfromthe application ofthemethodchangetoyearsprior to 2010.

Accounting for Gas Distribution Property Repairs

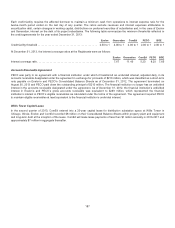

InSeptember 2012, PECO filedan application withtheIRSto changeitsmethodofaccountingfor gas distribution repairsfor the

2011 taxyear.Thechangetothenewlyadoptedmethodfor the 2011 taxyear and2012 resultedinataxbenefitof$26million at

Exelon,of which $29million intaxbenefitis recordedat PECO, partiallyoffset by an expenserecordedat Generation to reflecta

reduction initsdomestic production activitiesdeduction. BGE changeditsmethodofaccountingfor gas distribution repairsfor the

2008taxyear.TheIRSisexpectedto issue industryguidanceinthe near future.Exelon, PECO and BGE will then determine the

financial statement impactsofthegas distribution repaircostsaccountingmethodchangesafter guidanceis issued.

Accounting for Final Tangible Property Regulations

OnSeptember 19, 2013,theTreasuryDepartment andtheIRSpublishedfinal regulationsregardingthetaxtreatment ofcosts

incurredto acquire,produce,or improve tangible property. TheRegistrantshaveassessedthefinancial impactofthis guidanceand

do not expectittohaveamaterial impact.Anychangesinmethodofaccountingrequiredto conformto thefinal regulationswill be

madefor theRegistrant’s 2014taxable year.

2011 Illinois State Tax Rate Legislation

TheTaxpayer AccountabilityandBudget Stabilization Act, (SB 2505), enactedinto lawinIllinois on January13,2011,increasesthe

corporate taxrate inIllinois from7.3%to 9.5% for taxyears2011—2014, providesfor a reduction inthe rate from 9.5% to 7.75% for

taxyears2015—2024andfurther reducesthe rate from 7.75% to 7.3%for taxyears2025andthereafter.Pursuant to the rate

change,Exelon re-evaluateditsdeferredstate incometaxesduringthefirstquarter of2011.Illinois’ corporate incometaxrate

changesresultedinachargetostate deferredtaxes(net ofFederal taxes) duringthefirstquarter of2011 of$7million,$11 million

and$4million for Exelon,Generation andComEd, respectively. Exelon’s andComEd’s chargeis net ofaregulatoryasset of

$15million.

In 2011,theincometaxrate changeincreasedExelon’s Illinois incometaxprovision (net ofFederal taxes) by approximately

$7 million,of which $12 million and$5million ofadditional taxrelatesto Exelon Corporate andGeneration,respectively, anda

$10 million benefitfor ComEd. The 2011 taxbenefitatComEd reflectstheimpactofa 2011 taxnet operatingloss generated

primarilybythebonusdepreciation deduction allowedunder theTaxReliefActof2010 andthe electric transmission and distribution

propertyrepairsdeduction discussedbelow.

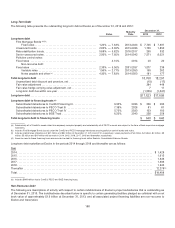

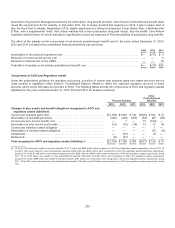

Long-Term State Tax Apportionment

Exelon andGeneration periodicallyrevieweventsthat may significantlyimpacthowincomeis apportionedamongthestatesand,

therefore,thecalculation ofExelon’s andGeneration’s deferredstate incometaxes. In 2011 asaresult ofthe 2011 Illinois State Tax

Rate Legislation discussedabove,Exelon andGeneration re-evaluatedtheir long-termstate taxapportionment for Illinois andall

195