ComEd 2013 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

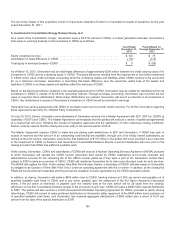

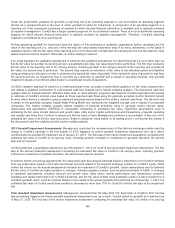

are basedupon certain unobservable inputs, which are consideredLevel 3 inputs, pursuant to applicable accountingguidance.The

intangible assetsare amortizedasadecreasein operatingrevenue withinExelon’s andGeneration’s ConsolidatedStatementsof

OperationsandComprehensiveIncomeover the termoftheunderlyingPPAs.

Exelon Wind. The output oftheacquiredwindturbineshasbeen soldunder PPAcontracts. Theexcess ofthecontractpriceofthe

PPAsover market priceswasrecognizedasintangible assetsat theacquisition date.Generation determinedthat theestimated

acquisition-date fairvalue oftheintangible assetswasapproximately$224million, which is recordedin unamortizedenergy contract

assetswithinExelon’s andGeneration’s ConsolidatedBalanceSheets. Theintangible assetsare amortizedon a straight-line basis

over the periodinwhich theassociatedcontractrevenuesare recognized.

Antelope Valley. Upon completion ofthedevelopment project,all ofthe output will besoldunder a PPAwithPacific Gas&Electric

Company. Theexcess ofthecontractpriceofthePPAover forecastedMPR-basedmarket priceswasrecognizedasan intangible

asset at theacquisition date.Generation determinedthat theestimatedacquisition-date fairvalue oftheintangible asset was

approximately$190million, which is recordedin unamortizedenergy contractassetswithinExelon’s andGeneration’s Consolidated

BalanceSheets. Thefairvalue is amortizedover thelifeofthecontractin relation to the present value oftheunderlyingcash flows

asoftheacquisition date.

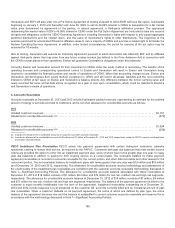

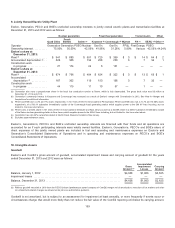

Renewable Energy Credits and Alternative Energy Credits

Exelon’s, Generation’s, ComEd’s and PECO’s other intangible assets, includedinother current assetsandother deferreddebitsand

other assetson theConsolidatedBalanceSheets, includeRECs andAECs. Revenue for RECs that are part ofabundledpower sale

is recognizedwhen thepower is producedanddeliveredto thecustomer.AsofDecember 31,2013,and2012, PECO hadcurrent

AECs of$19million and$17million,respectively, andnoncurrent AECs of$5million and$9million,respectively. AsofDecember 31,

2013,and2012,Generation hadcurrent RECs of$158 million and$61million,respectively, andnoncurrent RECs of$0million and

$45 million,respectively. AsofDecember 31,2013,and2012,ComEd, hadcurrent RECs of$3million and$4million,respectively.

See Note 3—RegulatoryMattersandNote 22—CommitmentsandContingenciesfor additional information on RECs andAECs.

11. Fair Value of Financial Assets and Liabilities

Fair Value of Financial Liabilities Recorded at the Carrying Amount

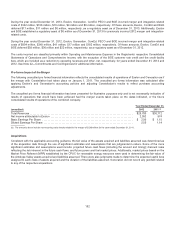

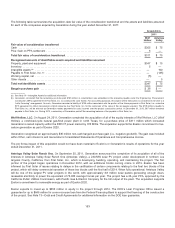

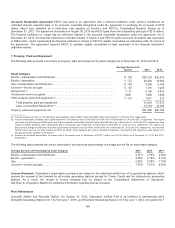

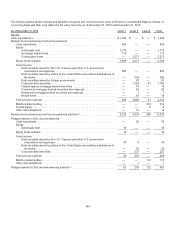

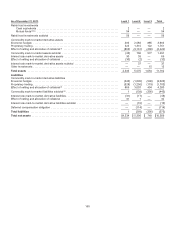

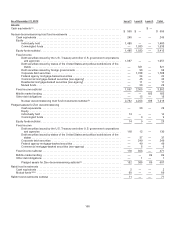

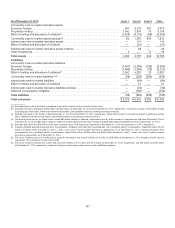

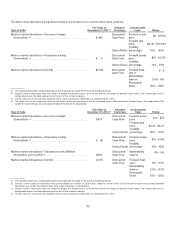

Thefollowingtablespresent thecarryingamountsandfairvaluesofExelon’s short-termliabilities, long-termdebt, SNF obligation,

trust preferredsecurities(long-termdebttofinancingtrustsor junior subordinateddebentures), andpreferredsecuritiesasof

December 31,2013,and2012:

December 31, 2013 December 31, 2012

Carrying

Amount

Fair Value Carrying

Amount

Fair

ValueLevel 1 Level 2 Level 3

Short-termliabilities .......................................... $ 344 $ 3$341$— $ 214$ 214

Long-termdebt(includingamountsdue within one year) ............ 19,132 —18,6721,079 18,745 20,520

Long-termdebttofinancingtrusts ............................... 648 — — 631 648 664

SNF obligation ............................................... 1,021 —79

0—1,020 763

Preferredsecuritiesofsubsidiary ............................... — — — — 87 82

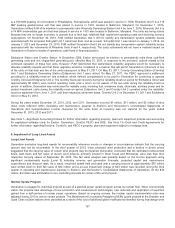

Short-Term Liabilities. Theshort-termliabilitiesincludedinthetablesabove are comprisedofshort-termborrowings (Level 2), short-

termnotespayable relatedto PECO’s accountsreceivable agreement (Level 2), and dividends payable (Level 1). TheRegistrants’

carryingamountsoftheshort-termliabilitiesare representativeoffairvalue becauseoftheshort-termnature oftheseinstruments.

See Note 13—DebtandCreditAgreementsfor additional information on PECO’s accountsreceivable agreement.

Long-Term Debt. Thefairvalue amountsofExelon’s taxable debtsecurities(Level 2)are determinedbyavaluation model that is

basedon a conventional discountedcash flowmethodology andutilizesassumptionsofcurrent market pricingcurves. Inorder to

incorporate thecreditrisk oftheRegistrantsinto thediscount rates, Exelon obtainspricing (i.e., U.S. Treasuryrate pluscredit

spread) basedon tradesofexistingExelon debtsecuritiesaswell asdebtsecuritiesofother issuersinthe electric utilitysector with

similar credit ratings inboththeprimaryandsecondarymarket,across theRegistrants’ debtmaturityspectrum. Thecreditspreads

ofvarioustenorsobtainedfromthis information are addedto the appropriate benchmark U.S. Treasuryratesinorder to determine

thecurrent market yields for thevarioustenors. Theyields are then convertedinto discount ratesofvarioustenorsthat are usedfor

discountingtherespectivecash flows ofthesame tenor for each bondor note.

162