ComEd 2013 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

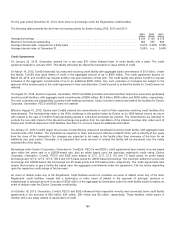

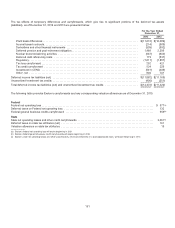

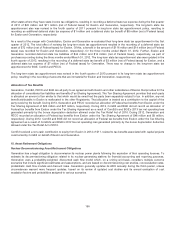

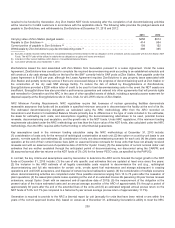

Tabular reconciliation of unrecognized tax benefits

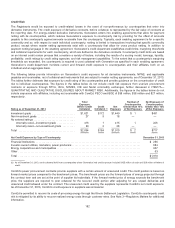

Thefollowingtable providesareconciliation ofExelon’s unrecognizedtaxbenefitsasofDecember 31,2013,2012 and2011:

Unrecognizedtaxbenefitsat January1,2013 .................................................................. $1,024

Increasesbasedon taxpositionsrelatedto 2013 ............................................................... 19

Changetopositionsthat onlyaffecttiming..................................................................... 649

Increasesbasedon taxpositionsprior to 2013 ................................................................. 493

Decreasesbasedon taxpositionsprior to 2013 ................................................................ (6)

Decreasesfromexpiration ofstatute oflimitations .............................................................. (4)

Unrecognizedtaxbenefitsat December 31,2013 ............................................................... $2,175

Unrecognizedtaxbenefitsat January1,2012 .................................................................. $ 807

Merger BalanceTransfer ................................................................................... 195

Increasesbasedon taxpositionsrelatedto 2012 ............................................................... 34

Changetopositionsthat onlyaffecttiming..................................................................... (88)

Increasesbasedon taxpositionsprior to 2012 ................................................................. 91

Decreasesbasedon taxpositionsprior to 2012 ................................................................ (6)

Decreasesrelatedto settlementswithtaxingauthorities ......................................................... (2)

Decreasesfromexpiration ofstatute oflimitations .............................................................. (7)

Unrecognizedtaxbenefitsat December 31,2012 ............................................................... $1,024

Unrecognizedtaxbenefitsat January1,2011 .................................................................. $ 787

Increasesbasedon taxpositionsrelatedto 2011 ............................................................... 5

Changetopositionsthat onlyaffecttiming..................................................................... 21

Decreasesbasedon taxpositionsprior to 2011 ................................................................ (3)

Decreasefromexpiration ofstatute oflimitations ............................................................... (3)

Unrecognizedtaxbenefitsat December 31,2011 ............................................................... $ 807

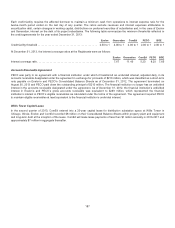

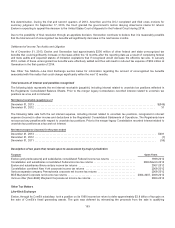

IncludedinExelon’s unrecognizedtaxbenefitsbalanceatDecember 31,2013 and2012 are approximately$1,387 million and$730

million,respectively, oftaxpositionsfor which the ultimate taxbenefitis highlycertain,but for which there is uncertaintyabout the

timingofsuch benefits. Thedisallowanceofsuch positionswouldnot materiallyaffectthe annual effectivetaxrate but would

accelerate thepayment ofcash to,or defer thereceipt ofthecash taxbenefitfrom, thetaxingauthorityto an earlier or later period

respectively.

Unrecognized tax benefits that if recognized would affect the effective tax rate

Exelon andGeneration have$788 million and $768 million,respectively, ofunrecognizedtaxbenefitsat December 31,2013 that,if

recognized, woulddecreasethee

ffectivetaxrate.Exelon andGeneration had$294 million and$263million,respectively, of

unrecognizedtaxbenefitsat December 31,2012 that,ifrecognized, woulddecreasetheeffectivetaxrate.

Reasonably possible that total amount of unrecognized tax benefits could significantly increase or decrease within 12

months after the reporting date

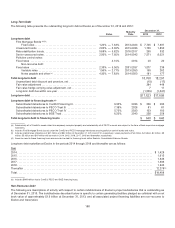

Nuclear Decommissioning Liabilities

AmerGen filedincometaxrefundclaims takingtheposition that nuclear decommissioningliabilitiesassumedaspart ofitsacquisition

ofnuclear power plantsare taken into account indeterminingthetaxbasis intheassetsitacquired. Theadditional basis results

primarilyinreducedcapital gainsor increasedcapital losseson thesale ofassetsin nonqualifieddecommissioningfunds and

increasedtaxdepreciation andamortization deductions. TheIRS disagreeswiththis position andhas disallowedtheclaims. In

November 2008, Generation receivedafinal determination fromthe Appeals division oftheIRS(IRSAppeals) disallowing

AmerGen’s refundclaims. Generation filedacomplaint intheUnitedStatesCourt ofFederal Claims on February20,2009to contest

192