ComEd 2013 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

proprietarytradingpurposes, but this activityaccountsfor onlyasmall portion ofGeneration’s efforts. The tradingportfoliois subject

to a risk management policy that includesstringent risk management limits, includingvolume,stop-loss andvalue-at-risk limits, to

manageexposure to market risk. Additionally, thecorporate risk management group andExelon’s RMC monitor thefinancial risks of

thewholesale andretailpower marketingactivities. See ITEM 7A.QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT

MARKET RISK for additional information.

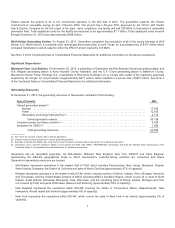

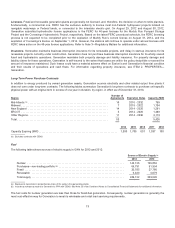

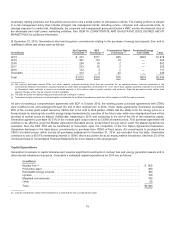

At December 31,2013,Generation’s short andlong-termcommitmentsrelatingto the purchaseofenergy andcapacityfromandto

unaffiliatedutilitiesandotherswere asfollows:

(in millions)

Net Capacity

Purchases (a)

REC

Purchases (b)

Transmission Rights

Purchases (c)

Purchased Energy

from CENG Total

2014 ...................................... $ 412 $117$25$824$1,378

2015 ...................................... 367 110 13 —490

2016 ...................................... 284 76 2—362

2017 ...................................... 223 252—250

2018 ...................................... 112 3 2 —117

Thereafter ................................. 414332 — 449

Total ...................................... $1,812 $334 $76 $824$3,046

(a)Net capacitypurchasesincludePPAsandother capacitycontractsincludingthosethat are accountedfor asoperatingleases. Amountspresentedinthe

commitmentsrepresent Generation’s expectedpaymentsunder these arrangementsat December 31,2013,net of fixedcapacitypaymentsexpectedto bereceived

by Generation under contractsto resell such acquiredcapacityto thirdpartiesunder long-termcapacitysale contracts. Expectedpaymentsincludecertainfixed

capacitycharges which maybereducedon plant availability.

(b) Thetable excludesrenewable energy purchasesthat are contingent in nature.

(c) Transmission rightspurchasesincludeestimatedcommitmentsfor additional transmission rightsthat will berequiredto fulfill firmsalescontracts.

Aspart ofreachingacomprehensiveagreement with EDF inOctober 2010,theexistingpower purchaseagreementswith CENG

were modifiedto beunit-contingent through theendoftheiroriginal termin 2014. Under theseagreementsGeneration purchases

85% ofthenuclear plant output owned by CENG that is not soldto thirdparties. CENG hastheabilityto fix the energy priceona

forwardbasis by enteringinto monthlyenergy hedge transactionsfor a portion ofthefuture sale, while anyunhedgedportionswill be

providedat market pricesbydefault.Additionally, beginningin 2015andcontinuingto theendofthelifeoftherespective plants,

Generation agreedto purchase50.01%ofthenuclear plant output owned by CENG at market prices. This purchaseagreement will

continue to beeffectiveunder theMaster Agreement discussedabove,except that if the put option under theMaster Agreement is

exercised, then theEDF PPAwill be transferredto Generation upon thecompletion ofthePut Option Agreement transaction.

Generation disclosesinthetable abovecommitmentsto purchasefrom CENG at fixedprices. All commitmentsto purchasefrom

CENG at market prices, which include all purchasessubsequent to December 31,2014, are excludedfromthetable.Generation

continuesto owna50.01%membershipinterestinCENG that is accountedfor asan equitymethodinvestment.See Note 25ofthe

CombinedNotesto ConsolidatedFinancial Statementsfor more detailson this arrangement.

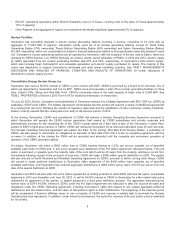

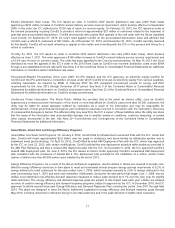

Capital Expenditures

Generation’s business is capital intensiveandrequires significant investmentsinnuclear fuel andenergy generation assetsandin

other internal infrastructure projects. Generation’s estimatedcapital expendituresfor 2014are asfollows:

(in millions)

Nuclear fuel (a)......................................................................... $ 900

Production plant ....................................................................... 900

Renewable energy projects .............................................................. 300

Uprates .............................................................................. 150

Marylandcommitments ................................................................. 100

Other ................................................................................ 50

Total ................................................................................. $2,400

(a)IncludesGeneration’s share oftheinvestment innuclear fuel for theco-ownedSalemplant.

15