ComEd 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TheHealthCare ReformActsinclude a provision that imposesan excisetaxon certainhigh-cost plansbeginningin 2018, whereby

premiums paid over a prescribedthresholdwill betaxedat a 40%rate.Although theexcisetaxdoesnot gointo effect until 2018,

accountingguidancerequiresExelon to incorporate theestimatedimpactoftheexcisetaxinitsannual actuarial valuation.The

application ofthelegislation is still unclear andExelon continuesto monitor theDepartment ofLabor andIRSfor additional

guidance. Effectivein 2002,Constellation amendeditsother postretirement benefit plansfor all subsidiariesother than Nine Mile

Point by cappingretiree medical coveragefor future retireeswhowere under theageof55on January1,2002 at 2002 levels.

Therefore,theexcisetaxisnot expectedto haveamaterial impactonthelegacy Constellation other postretirement benefit plans.

However,certainkeyassumptionsare requiredto estimate theimpactoftheexcisetaxon theother postretirement obligation for

legacy Exelon plans, includingprojectedinflation rates(basedon theCPI) andwhether pre-andpost-65 retiree populationscan be

aggregatedindeterminingthe premiumvaluesofhealthcare benefits. Exelon reflecteditsbestestimate oftheexpectedimpactinits

annual actuarial valuation.

Health Care Cost Trend Rate. Assumedhealthcare cost trendrateshaveasignificant effectonthecostsreportedfor Exelon’s

other postretirement benefit plans. Accountingguidancerequiresthat annual healthcare costestimatesbedevelopedusingpast

andpresent healthcare cost trends (bothfor Exelon andacross thebroader economy), aswell asexpectationsofhealthcare cost

escalation,changesinhealthcare utilization anddeliverypatterns, technological advancesandchangesinthehealthstatusofplan

participants. Therefore,the trendrate assumption is subjecttosignificant uncertainty, particularlywhen consideringpotential impacts

ofthe 2010 HealthCare ReformActs. Exelon assumedan initial healthcare cost trendrate of 6.50%for 2013,decreasingto an

ultimate healthcare cost trendrate of5.00%in 2017.

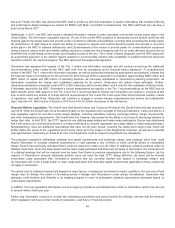

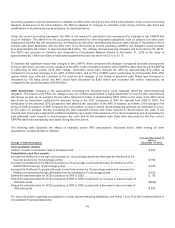

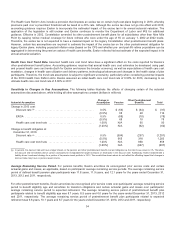

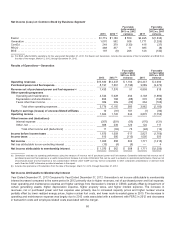

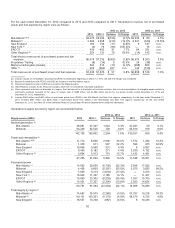

Sensitivity to Changes in Key Assumptions. Thefollowingtablesillustrate theeffectsofchangingcertainoftheactuarial

assumptions discussedabove, while holdingall other assumptionsconstant (dollarsinmillions):

Actuarial Assumption

Change in

Assumption Pension

Other Postretirement

Benefits Total

Changein 2013 cost:

Discount rate (a)........................................... 0.5% $ (63)$(34) $ (97)

(0.5%) 68 48 116

EROA.................................................. 0.5% (68) (10) (78)

(0.5%) 68 10 78

Healthcare cost trendrate ................................. 1.00%N/A9090

(1.00%) N/A(62)(62)

Changeinbenefitobligation at

December 31,2013:

Discount rate (a)........................................... 0.5% (904) (297) (1,201)

(0.5%) 965 3181,283

Healthcare cost trendrate ................................. 1.00%N/A858 858

(1.00%) N/A(607) (607)

(a)Ingeneral,thediscount rate will have a larger impactonthe pension andother postretirement benefitcostandobligation asthe rate movescloser to 0%. Therefore,

thediscount rate sensitivitiesabovecannot necessarilybeextrapolatedfor larger increasesor decreasesinthediscount rate.Additionally, Exelon implementeda

liability-driven investment strategy for a portion ofitspension asset portfolioin 2010.Thesensitivitiesshownabovedo not reflecttheoffsettingimpactthat changesin

discount ratesmayhave on pension asset returns.

Average Remaining Service Period. For pension benefits, Exelon amortizesitsunrecognizedprior servicecostsandcertain

actuarial gainsandlosses, asapplicable,basedon participants’ averageremainingservice periods. Theaverageremainingservice

periodofdefinedbenefit pension plan participantswas11.8 years, 11.9 years, and12.1yearsfor theyearsendedDecember 31,

2013,2012 and2011,respectively.

For other postretirement benefits, Exelon amortizesitsunrecognizedprior servicecostsover participants’ averageremainingservice

periodto benefiteligibilityageandamortizesitstransition obligationsandcertainactuarial gainsandlossesover participants’

averageremainingservice periodto expectedretirement.Theaverageremainingservice periodofpostretirement benefit plan

participantsrelatedto benefiteligibilityagewas 8.7 years, 8.9 yearsand 6.6 yearsfor theyearsendedDecember 31,2013,2012

and2011,respectively. Theaverageremainingservice periodofpostretirement benefit plan participantsrelatedto expected

retirement was 9.8 years, 10.1yearsand 8.7 yearsfor theyearsendedDecember 31,2013,2012 and2011,respectively.

54