ComEd 2013 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

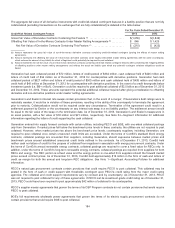

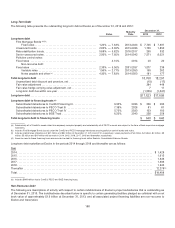

Generation

Intercompany

Eliminations Exelon

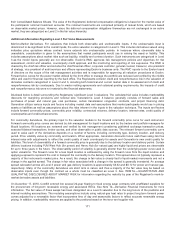

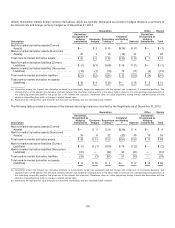

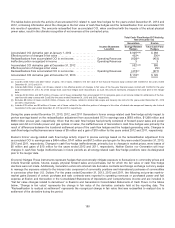

Year Ended December 31, 2013

Operating

Revenues

Purchased

Power

and Fuel Total

Operating

Revenues (a) Total

Changeinfairvalue ............................................. $285 $180$ 465 $ (6) $ 459

Reclassification to realizedat settlement ............................ (65) 1043913 52

Net mark-to-market gains ..................................... $220 $284 $ 504$7 $511

Generation

Intercompany

Eliminations Exelon

Year Ended December 31, 2012

Operating

Revenues

Purchased

Power

and Fuel Total

Operating

Revenues (a) Total

Changeinfairvalue ............................................. $(362)$215$(147) $ (94) $(241)

Reclassification to realizedat settlement ............................ 429238 667 101 768

Net mark-to-market gains ..................................... $ 67 $453$520 $7 $527

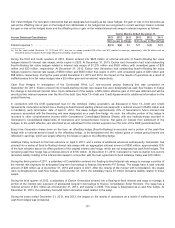

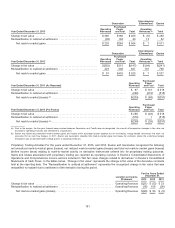

Year Ended December 31, 2011 (As Reported)

Operating

Revenues

Purchased

Power

and Fuel Total

Changeinfairvalue .................................................................. $ 87 $131 $218

Reclassification to realizedat settlement ................................................. (296) (219) (515)

Net mark-to-market (losses) (b) ...................................................... $(209) $ (88) $(297)

Year Ended December 31, 2011 (Pro Forma)

Operating

Revenues

Purchased

Power

and Fuel Total

Changeinfairvalue .................................................................. $258 $ (40)$218

Reclassification to realizedat settlement ................................................. (516) 1(515)

Net mark-to-market (losses) (b) ...................................................... $(258) $ (39) $(297)

(a)Prior to themerger,thefive-year financial swap contractbetween Generation andComEd wasde-designated. Asaresult,all prospectivechangesinfairvalue are

recordedto operatingrevenuesandeliminatedinconsolidation.

(b) Exelon has historicallypresentedmark-to-market gainsandlosseswithin purchasedpower expensefor all non-trading, energy-relatedderivativesthat were not

accountedfor ascash flowhedges. In 2011,Exelon andGeneration classifiedthemark-to-market gainsandlossesfor contracts, where theunderlyinghedged

transaction wasan expectedsale to hedgepower,to operatingrevenues.

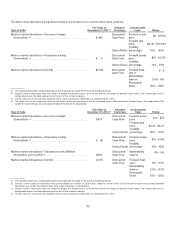

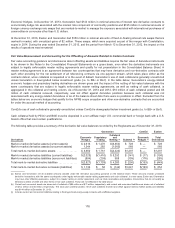

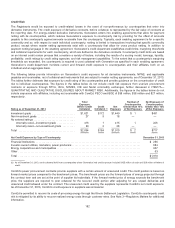

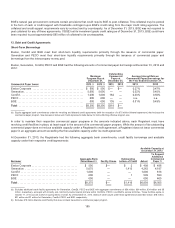

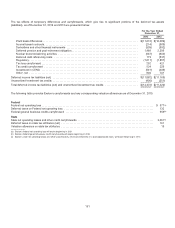

Proprietary Trading Activities For theyearsendedDecember 31,2013,and2012,Exelon andGeneration recognizedthefollowing

net unrealizedmark-to-market gains(losses), net realizedmark-to-market gains(losses) andtotal net mark-to-market gains(losses)

(before incometaxes) relatingto mark-to-market activityon derivativeinstrumentsenteredinto for proprietarytradingpurposes.

Gainsandlossesassociatedwithproprietarytradingare reportedasoperatingrevenue inExelon’s ConsolidatedStatementsof

OperationsandComprehensiveIncomeandare includedin“Net fairvalue changesrelatedto derivatives” inExelon’s Consolidated

StatementsofCash Flows. Inthetablesbelow, “Changeinfairvalue”representsthechangeinfairvalue ofthederivativecontracts

heldat the reportingdate.The“Reclassification to realizedat settlement”representstherecognizedchangeinfairvalue that was

reclassifiedto realizeddue to settlement ofthederivativeduringthe period.

Location on Income

Statement

For the Years Ended

December 31,

2013 2012 2011

Changeinfairvalue ........................................................ OperatingRevenue $(21)$(12)$23

Reclassification to realizedat settlement ....................................... OperatingRevenue (18) 108(26)

Net mark-to-market gains(losses) ......................................... OperatingRevenue $(39) $ 96 $ (3)

181