ComEd 2013 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

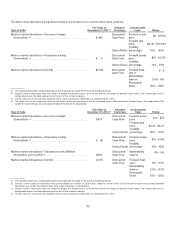

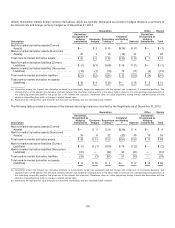

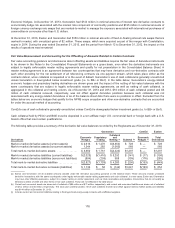

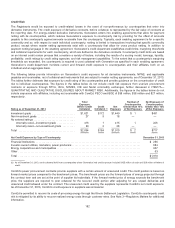

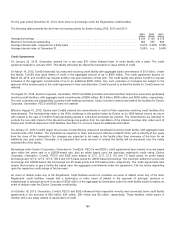

Thefollowingtable providesasummaryofthederivativefairvalue balancesrecordedbytheRegistrantsasofDecember 31,2012:

Generation ComEd Exelon

Derivatives

Economic

Hedges (a)

Proprietary

Trading

Collateral

and

Netting (b) Subtotal (c)

Economic

Hedges (a)(d)

Intercompany

Eliminations (a)

Total

Derivatives

Mark-to-market derivativeassets(current

assets) .................................. $2,883$2,469 $(4,418) $ 934$— $— $934

Mark-to-market derivativeassetswithaffiliate

(current assets) 226— —226— (226) —

Mark-to-market derivativeassets(noncurrent

assets) .................................. 1,792724(1,638) 878 — — 878

Total mark-to-market derivativeassets .......... $4,901 $3,193$(6,056) $2,038$— $(226) $1,812

Mark-to-market derivativeliabilities(current

liabilities) ................................. $(2,419) $(2,432) $ 4,519$(332)$(18) $— $(350)

Mark-to-market derivativeliabilitywithaffiliate

(current liabilities) — — — — (226) 226—

Mark-to-market derivativeliabilities(noncurrent

liabilities) ................................. (1,080) (689) 1,568 (201) (49) — (250)

Total mark-to-market derivativeliabilities......... $(3,499) $(3,121)$6,087 $ (533)$(293)$226$(600)

Total mark-to-market derivative net assets

(liabilities) ................................ $1,402 $72$31 $1,505$(293)$— $1,212

(a)Includescurrent andnoncurrent assetsfor Generation andcurrent andnoncurrent liabilitiesfor ComEd of$226million relatedto thefairvalue ofthefive-year

financial swap contractbetween Generation andComEd, asdescribedabove.For Generation,excludes$28million ofnoncurrent liabilityrelatingto an interest rate

swap inconnection witha loan agreement to fundAntelope Valleyas discussedabove.

(b) Exelon andGeneration net all available amountsallowedunder thederivativeaccountingguidanceonthebalancesheet.Theseamountsinclude unrealized

derivative transactionswiththesamecounterpartyunder legallyenforceable master nettingagreementsandcash collateral.InsomecasesExelon andGeneration

mayhaveother offsettingexposures, subjecttoamaster nettingor similar agreement,such astradereceivablesandpayables, transactionsthat do not qualify as

derivatives, andlettersofcredit.These are not reflectedinthetable above.

(c) Current andnoncurrent assetsare shown net ofcollateral of$113 million and$201 million,respectively, andcurrent andnoncurrent liabilitiesare shown net of

collateral of$(214) million and$(131)million,respectively. The total cash collateral received, net ofcash collateral postedandoffset againstmark-to-market assets

andliabilitieswas$(31)million at December 31,2012.

(d) Includescurrent andnoncurrent liabilitiesrelatingto floating-to-fixedenergy swap contractswithunaffiliatedsuppliers.

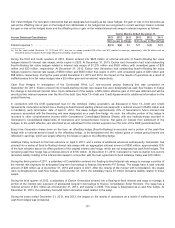

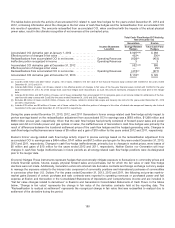

Cash Flow Hedges. As discussedpreviously, effectiveprior to themerger withConstellation,Generation de-designatedall ofits

cash flowhedgesrelatingto commoditypricerisk. Becausetheunderlyingforecastedtransactionsremain at least reasonably

possible,thefairvalue oftheeffective portion ofthesecash flowhedgeswasfrozen inaccumulated OCI andisreclassifiedto results

ofoperationswhen theforecastedpurchaseorsale ofthe energy commodityoccurs, or becomesprobable ofnot occurring.

Generation began recordingprospectivechangesinthefairvalue oftheseinstrumentsthrough current earnings fromthedate ofde-

designation.Approximately$195 million ofthese net pre-taxunrealizedgainswithinaccumulated OCI are expectedto be

reclassifiedfromaccumulated OCI duringthenexttwelvemonths by Generation.Generation expectsthesettlement ofthemajority

ofitscash flowhedgeswill occur during2013 through 2014.

Exelon discontinueshedgeaccountingwhen itdeterminesthat thederivativeis no longer effectiveinoffsettingchangesinthecash

flows ofahedgeditemor when itis no longer probable that theforecastedtransaction will occur.For theyear ended2012,the

amount reclassifiedinto earnings asaresult ofthediscontinuanceofcash flowhedgeswas immaterial.

179