ComEd 2013 Annual Report Download - page 227

Download and view the complete annual report

Please find page 227 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

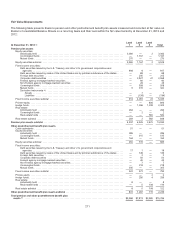

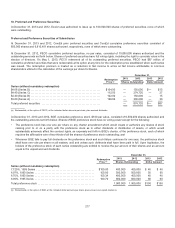

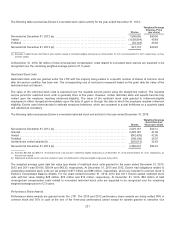

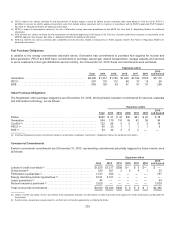

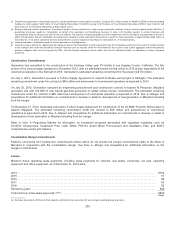

Thefollowingtable summarizesExelon’s nonvestedstock option activityfor theyear endedDecember 31,2013:

Shares

Weighted Average

Exercise Price

(per share)

Nonvestedat December 31,2012 (a).................................................... 1,960,665 $40.56

Vested ............................................................................. (1,058,804) 40.89

Forfeited ........................................................................... (54,743)39.36

Nonvestedat December 31,2013 (a).................................................... 847,118$40.22

(a) Excludes1,348,913 and2,647,536ofstock options issuedto retirement-eligible employeesasofDecember 31,2013 andDecember 31,2012,respectively, asthey

are fullyvested.

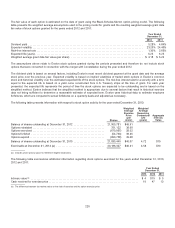

At December 31,2013,$2million oftotal unrecognizedcompensation costsrelatedto nonvestedstock optionsare expectedto be

recognizedover theremainingweighted-average periodof1.6 years.

Restricted Stock Units

Restrictedstock unitsare grantedunder theLTIP withthemajoritybeingsettledinaspecific number ofsharesofcommon stock

after theservicecondition hasbeen met.Thecorrespondingcostofservicesismeasuredbasedon thegrant date fairvalue ofthe

restrictedstock unitissued.

Thevalue oftherestrictedstock unitsisexpensedover therequisite service periodusingthestraight-line method. Therequisite

service periodfor restrictedstock unitsisgenerallythree to fiveyears. However,certainrestrictedstock unitawards becomefully

vestedupon theemployee reachingretirement-eligibility. Thevalue oftherestrictedstock unitsgrantedto retirement-eligible

employeesiseither recognized immediatelyupon thedate ofgrant or through thedate at which theemployee reachesretirement

eligibility. Exelon uses historical data to estimate employee forfeitures, which are comparedto actual forfeitureson a quarterlybasis

andadjustedasnecessary.

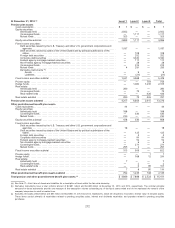

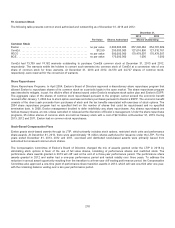

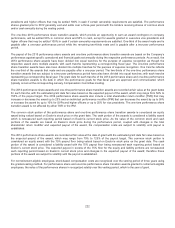

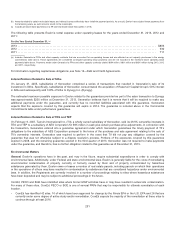

Thefollowingtable summarizesExelon’s nonvestedrestrictedstock unitactivityfor theyear endedDecember 31,2013:

Shares

Weighted Average

Grant Date Fair

Value (per share)

Nonvestedat December 31,2012 (a).................................................... 2,029,161$42.12

Granted ............................................................................ 2,828,187 31.06

Vested ............................................................................. (842,439) 42.90

Forfeited ........................................................................... (108,199) 36.37

Undistributedvestedawards(b) ........................................................ (520,013)32.62

Nonvestedat December 31,2013 (a).................................................... 3,386,697 $34.10

(a) Excludes931,628and 686,121 ofrestrictedstock units issuedto retirement-eligible employeesasofDecember 31,2013 andDecember 31,2012,respectively, as

theyare fullyvested.

(b) Representsrestrictedstock unitsthat vestedbut were not distributedto retirement-eligible employeesduring2013.

Theweightedaveragegrant date fairvalue (per share)ofrestrictedstock unitsgrantedfor theyearsendedDecember 31,2013,

2012 and2011 was$31.06, $39.94 and$43.33,respectively. At December 31,2013 and2012,Exelon hadobligationsrelatedto

outstandingrestrictedstock unitsnot yet settledof $77 million and $58 million,respectively, which are includedincommon stock in

Exelon’s ConsolidatedBalanceSheets. For theyearsendedDecember 31,2013,2012 and2011,Exelon settledrestrictedstock

unitswithfairvalue totaling$28million,$25million and$19million,respectively. At December 31,2013, $64 million oftotal

unrecognizedcompensation costsrelatedto nonvestedrestrictedstock unitsare expectedto berecognizedover theremaining

weighted-average periodof2.5 years.

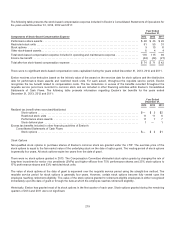

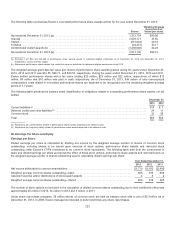

Performance Share Awards

Performanceshare awards are grantedunder theLTIP. The 2013 and2012 performanceshare awards are beingsettled50%in

common stock and50%incash at theendofthethree-year performance periodexcept for awards grantedto executivevice

221