ComEd 2013 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The pro formaimpactofthis acquisition wouldnot havebeen material to Exelon’s or Generation’s resultsofoperationsfor theyear

endedDecember 31,2011.

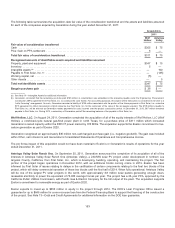

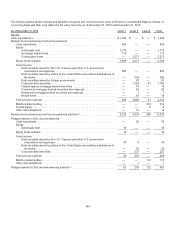

5. Investment in Constellation Energy Nuclear Group, LLC

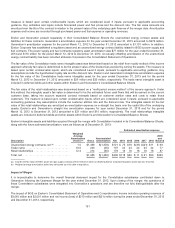

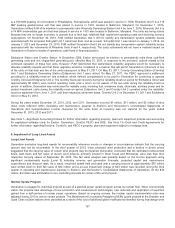

Asaresult oftheConstellation merger,Generation ownsa50.01%interestinCENG, anuclear generation business. Generation’s

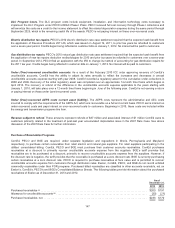

total equityin earnings (losses) on theinvestment inCENG is asfollows:

Year Ended

December 31,

2013

Period March 12,

through December 31,

2012

Equityinvestment income........................................................ $123 $73

Amortization ofbasis differenceinCENG ........................................... (114) (172)

Total equityin earnings (losses)—CENG ............................................ $ 9 $ (99)

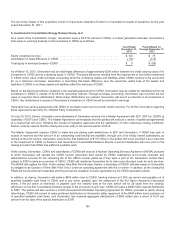

AsofMarch 12,2012,Generation hadan initial basis differenceofapproximately$204million between theinitial carryingvalue ofits

investment inCENG anditsunderlyingequityinCENG. This basis differenceresultedfromtherequirement to recordtheinvestment

inCENG at fairvalue under purchaseaccounting while theunderlyingassetsandliabilitieswithinCENG continue to beaccounted

for on a historical costbasis. Generation is amortizingthis basis differenceover therespectiveuseful livesoftheassetsand

liabilitiesof CENG or asthoseassetsandliabilitiesaffectthe earnings of CENG.

Basedon taxsharingprovisionscontainedinthe operatingagreement for CENG, Generation maybeeligible for distributionsfromits

investment inCENG inexcess ofits50.01%ownershipinterest.Through purchaseaccounting, Generation hasrecordedthefair

value ofexpectedfuture distributions. When thesedistributionsare realized, Generation will recordareduction initsinvestment in

CENG. Any distributionsinexcess ofGeneration’s investment inCENG wouldberecordedin earnings.

Generation hasvariousagreementswith CENG to purchasepower andto providecertainservices. For further information regarding

theseagreementssee Note 25—RelatedPartyTransactions.

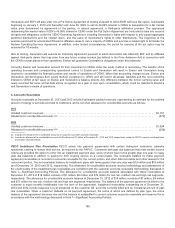

OnJuly29, 2013,Exelon,Generation andsubsidiariesofGeneration enteredinto a Master Agreement with EDF, EDF Inc. (EDFI) (a

subsidiaryof EDF) and CENG. TheMaster Agreement contemplatesthat the partieswill execute a seriesofadditional agreements

at a closingthat will occur followingthereceipt ofregulatoryapprovalsandthesatisfaction ofother customaryclosingconditions.

Exelon currentlyexpectsthat theclosingwill occur earlyinthesecondquarter of2014.

TheMaster Agreement requires CENG to maketwo pre-closingcash distributionsto EDF andGeneration, if CENG hascash in

excess ofreservesandtheamount ofan outstandingcreditfacilityare available,through one ofitswhollyownedsubsidiaries, as

ownersofthejoint venture.Generation receivedthefirstdistribution of$115million inDecember 2013 andrecordeditasareduction

to theInvestment inCENG on Exelon’s andGeneration’s ConsolidatedBalanceSheets. Asecond distribution will occur prior to the

closingprovidedthat CENG hassufficient available cash.

At theclosing, Generation, CENG andsubsidiariesof CENG will execute a Nuclear OperatingServicesAgreement (NOSA)pursuant

to which Generation will operate theCENG nuclear generation fleet owned by CENG subsidiariesandprovidecorporate and

administrativeservicesfor theremaininglifeoftheCENG nuclear plantsasiftheywere a part oftheGeneration nuclear fleet,

subjecttoEDFI’s rightsasamember of CENG. CENG will reimburseGeneration for itsdirectandallocatedcostsfor such services.

TheNOSAwill replacetheSSA.At theclosing, Nine Mile Point Nuclear Station,asubsidiaryof CENG, will alsoassigntoGeneration

itsobligationsasOperator ofNine Mile Point Unit2under an operatingagreement withtheco-owner.Inaddition,at theclosingthe

PSAA will beamendedandextendeduntilthe permanent cessation ofpower generation by theCENG generation plants.

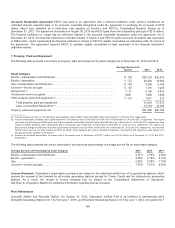

Inaddition,at closing, Generation will makea$400 million loan to CENG, bearinginterestat5.25% per annumandpayable out of

specifiedavailable cash flows of CENG andinanyevent,payable upon thesettlement ofthePut Option Agreement discussed

below, if the put option is exercised, or payable upon thematuritydate ofthe note (which will be20yearsfromtheclosing),

whichever occursfirst. Immediatelyfollowingreceipt ofthe proceeds ofsuch loan, CENG will makea$400 million special distribution

to EDFI. The partieswill alsoexecute a FourthAmendedandRestatedOperatingAgreement for CENG, pursuant to which, among

other things, CENG will committomake preferred distributionsto Generation (after repayment ofthe$400 million loan)quarterlyout

ofspecifiedavailable cash flows, untilGeneration hasreceivedaggregate distributionsof$400 million plusa return of 8.5% per

annumfromthedate ofthespecial distribution to EDFI.

154