ComEd 2013 Annual Report Download - page 14

Download and view the complete annual report

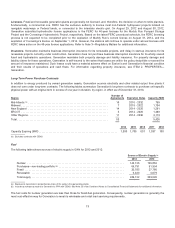

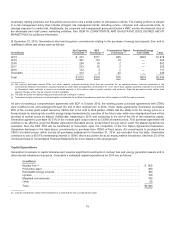

Please find page 14 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•ERCOT representsoperationswithinElectric ReliabilityCouncilofTexas, coveringmostofthestate ofTexas(approximately

12%ofcapacity).

•Other Regionsisan aggregate ofregionsnot consideredindividually significant (approximately6%ofcapacity).

Nuclear Facilities

Generation hasownershipinterestsin eleven nuclear generatingstationscurrentlyinservice,consistingof19unitswithan

aggregate of17,263MW ofcapacity. Generation whollyownsall ofitsnuclear generatingstations, except for QuadCities

GeneratingStation (75% ownership), Peach BottomGeneratingStation (50%ownership)andSalemGeneratingStation (Salem)

(42.59% ownership), which are consolidatedon Exelon’s financial statementsrelativetoitsproportionate ownershipinterestineach

unit.Generation’s nuclear generatingstationsare all operatedbyGeneration,withtheexception ofthetwounitsat Salem, which are

operated by PSEG Nuclear, LLC (PSEG Nuclear), an indirect,whollyownedsubsidiaryof PSEG. In 2013 and2012,electric supply

(inGWh) generatedfromthenuclear generatingfacilitieswas 57% and53%, respectively, ofGeneration’s total electric supply,

which alsoincludesfossil, hydroelectric andrenewable generation andelectric supplypurchasedfor resale.Themajorityofthis

output was dispatchedto support Generation’s wholesale andretailpower marketingactivities. See ITEM 7. MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS for further discussion of

Generation’s electric supplysources.

Constellation Energy Nuclear Group, Inc.

Generation alsoownsa50.01%interestinCENG, ajoint venture with EDF. CENG is governedbyaboardoften directors, fiveof

which are appointedbyGeneration and fiveby EDF. CENG ownsandoperatesa total of fivenuclear generatingfacilitieson three

sites, Calvert Cliffs, Ginna andNi

ne Mile Point. CENG’s ownershipshare inthe total capacityoftheseunitsis3,998 MW. See

ITEM 2.PROPERTIES ofExelon’s 2013 Form10-K for additional information on thesesites.

OnJuly29, 2013,Exelon,Generation andsubsidiariesofGeneration enteredinto a Master Agreement with EDF, EDF Inc. (EDFI) (a

subsidiaryof EDF) and CENG. TheMaster Agreement contemplatesthat the partieswill execute a seriesofadditional agreements

at a closingthat will occur followingthereceipt ofregulatoryapprovalsandthesatisfaction ofother customaryclosingconditions.

Exelon currentlyexpectsthat theclosingwill occur earlyinthesecondquarter of2014.

At theclosing, Generation, CENG andsubsidiariesof CENG will execute a Nuclear OperatingServicesAgreement pursuant to

which Generation will operate theCENG nuclear generation fleet owned by CENG subsidiariesandprovidecorporate and

administrativeservicesfor theremaininglifeoftheCENG nuclear plantsasiftheywere a part oftheGeneration nuclear fleet,

subjecttoEDFI’s rightsasamember of CENG. CENG will reimburseGeneration for itsdirectandallocatedcostsfor such services.

TheNuclear OperatingServicesAgreement will replacetheSSA.At theclosing, Nine Mile Point Nuclear Station,asubsidiaryof

CENG, will alsoassigntoGeneration itsobligationsasOperator ofNine Mile Point Unit2under an operatingagreement withthe

co-owner.Inaddition,at theclosingthePSAA will beamendedandextendeduntilthecomplete andpermanent cessation of

operation oftheCENG generation plants.

At closing, Generation will makea$400 million loan to CENG bearinginterestat5.25% per annum, payable out ofspecified

available cash flows of CENG and, inanyevent,payable upon settlement ofthePut Option Agreement discussedbelow, if the put

option is exercised, or payable upon thematuritydate ofthe note (which will be20yearsfromtheclosing), whichever occursfirst.

Immediatelyfollowingreceipt ofthe proceeds ofsuch loan, CENG will makea$400 million special distribution to EDFI. The parties

will alsoexecute a FourthAmendedandRestatedOperatingAgreement for CENG, pursuant to which, amongother things, CENG

will committomake preferred distributionsto Generation (after repayment ofthe$400 million loan)quarterlyout ofspecified

available cash flows, untilGeneration hasreceivedaggregate distributionsof$400 million plusa return of 8.5% per annumfromthe

date ofthespecial distribution to EDFI.

Generation and EDFI will also enter into a Put Option Agreement at closingpursuant to which EDFI will havethe option,exercisable

beginningin 2016andthereafter untilJune 30,2022,to sell its 49.99% interestinCENG to Generation for a fairmarket value price

determinedbyagreement ofthe parties, or absent agreement,athirdpartyarbitration process. The appraisersdeterminingfair

market value of EDF’s 49.99% interestinCENG under thePut Option Agreement are instructedto takeinto account all rightsand

obligationsunder theCENG OperatingAgreement,includingGeneration’s rightswithrespecttoanyunpaid aggregate preferred

distributionsandthe relatedreturn,andthevalue ofGeneration’s rightsto other distributions. Thebeginningoftheexercise period

will beacceleratedifExelon’s affiliatesceasetoownamajorityof CENG andexercise a relatedright to terminate theNuclear

OperatingServicesAgreement.Inaddition,under limitedcircumstances, the periodfor exerciseofthe put option maybeextended

for 18months.

8