ComEd 2013 Annual Report Download - page 121

Download and view the complete annual report

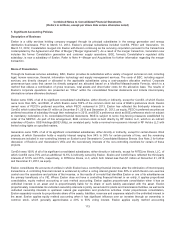

Please find page 121 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.regulatedoperationsthat meet thefollowingcriteria:1)ratesare establishedor approvedbyathird-partyregulator;(2)ratesare

designedto recover the entities’ costofprovidingservicesor products; and(3)there is a reasonable expectation that ratesare set at

levelsthat will recover the entities’ costsfromcustomers. Exelon,ComEd, PECO and BGE account for theirregulatedoperationsin

accordancewithregulatoryandlegislativeguidancefromtheregulatoryauthoritieshavingjurisdiction,principallytheICC, the

PAPUC, andtheMDPSC, inthecasesofComEd, PECO and BGE, respectively, under state public utilitylaws andtheFERCunder

variousFederal laws. Regulatoryassetsandliabilitiesare amortizedandthe relatedexpenseis recognizedintheConsolidated

StatementsofOperationsconsistent withtherecoveryor refundincludedincustomer rates. Exelon believesthat itis probable that

itscurrentlyrecordedregulatoryassetsandliabilitieswill berecoveredandsettled, respectively, infuture rates. However,Exelon,

ComEd, PECO and BGE continue to evaluate theirrespectiveabilitiesto applythe authoritativeguidancefor accountingfor certain

typesofregulation,includingconsideration ofcurrent eventsintheirrespectiveregulatoryandpolitical environments. If aseparable

portion ofComEd’s, PECO’s or BGE’s business wasno longer able to meet thecriteriadiscussedabove,theaffectedentitieswould

berequiredto eliminate fromtheirconsolidatedfinancial statementstheeffectsofregulation for that portion, which couldhavea

material impactontheirresultsofoperationsandfinancial positions. See Note 3—RegulatoryMattersfor additional information.

TheRegistrantstreat theimpactsofafinal rate order receivedafter thebalancesheet date but prior to theissuanceofthefinancial

statementsasa non-recognizedsubsequent event,asthereceipt ofafinal rate order is aseparate and distinctevent that hasfuture

impactson the partiesaffectedbytheorder.

Revenues

Operating Revenues. Operatingrevenuesare recordedasserviceis renderedor energy is deliveredto customers. At theendof

each month, theRegistrantsaccrue an estimate for theunbilledamount ofenergy deliveredor servicesprovidedto customers.

ComEd records itsbestestimatesofthedistribution andtransmission revenue impactsresultingfromchangesin ratesthat ComEd

believesare probable ofapproval by theICC andFERCinaccordancewithitsformula rate mechanisms. BGE records itsbest

estimate ofthe transmission revenue impactresultingfromchangesin ratesthat BGE believesare probable ofapproval by FERCin

accordancewithitsformula rate mechanism. See Note 3—RegulatoryMattersandNote 6—AccountsReceivable for further

information.

RTOs and ISOs. InRTO and ISO marketsthat facilitate thedispatch ofenergy andenergy-relatedproducts, theRegistrants

generallyreport salesandpurchasesconductedon a net hourlybasis ineither revenuesor purchasedpower on theirConsolidated

StatementsofOperations, theclassification of which depends on the net hourlyactivity. Inaddition,capacityrevenue andexpense

classification is basedon the net sale or purchaseposition oftheCompanyinthedifferent RTOs and ISOs.

Option Contracts, Swaps and Commodity Derivatives. Certain option contractsandswap arrangementsthat meet thedefinition

ofderivativeinstrumentsare recordedat fairvalue withsubsequent changesinfairvalue recognizedasrevenue or expense.The

classification ofrevenue or expenseis basedon theintent ofthe transaction.For example,gastransactionsmaybeusedto hedge

thesale ofpower. This will result inthechangeinfairvalue recordedthrough revenue.Asofthemerger date,Exelon and

Generation havecurrentlyelectedto de-designate all oftheircommoditycash flowhedgepositions. AsComEd receivesfull cost

recoveryfor energy procurement andrelatedcostsfromretailcustomers, ComEd records thefairvalue ofitsenergy swap contracts

withunaffiliatedsuppliersaswell asan offsettingregulatoryasset or liabilityon itsConsolidatedBalanceSheets. Refer to Note 3—

RegulatoryMattersandNote 12—DerivativeFinancial Instrumentsfor further information.

Proprietary Trading Activities. Exelon andGeneration account for Generation’s tradingactivitiesunder the provisionsofthe

authoritativeguidancefor accountingfor contractsinvolvedin energy tradingandrisk management activities, which require energy

revenuesandcostsrelatedto energy tradingcontractsto be presentedon a net basis intheincomestatement.Commodity

derivativesusedfor tradingpurposesare accountedfor usingthemark-to-market methodwithunrealizedgainsandlosses

recognizedin operatingrevenues. Refer to Note 12—DerivativeFinancial Instrumentsfor further information.

Income Taxes

DeferredFederal andstate incometaxesare providedon all significant temporary differencesbetween thebookbasis andthetax

basis ofassetsandliabilitiesandfor taxbenefitscarriedforward. Investment taxcreditshavebeen deferredon theRegistrants’

ConsolidatedBalanceSheetsandare recognizedinbookincomeover thelifeofthe relatedproperty. Inaccordancewithapplicable

authoritativeguidance,theRegistrantsaccount for uncertainincometaxpositionsusingabenefitrecognition model withatwo-step

approach; amore-likely-than-not recognition criterion;andameasurement approach that measurestheposition asthe largest

amount oftaxbenefitthat is greater than 50%likelyofbeingrealizedupon ultimate settlement.Ifitis not more-likely-than-not that

115